Digital financial solutions company additiv has scored $25.5 million (CHF21 million) this week. The investment, which comes from BZ Bank and Patinex, marks the company’s first round of funding.

The investment will help additiv meet demand for its products across Europe and Asia. In the press release, the company’s founder and CEO, Michael Stemmle said, “This funding will finance our international expansion and help strengthen our management team. It will also fuel our production of cutting-edge SaaS/cloud-based products that ensure our clients are ahead of the curve. It really is crunch time for the sector and this funding allows us to be at our best when our clients need us most.”

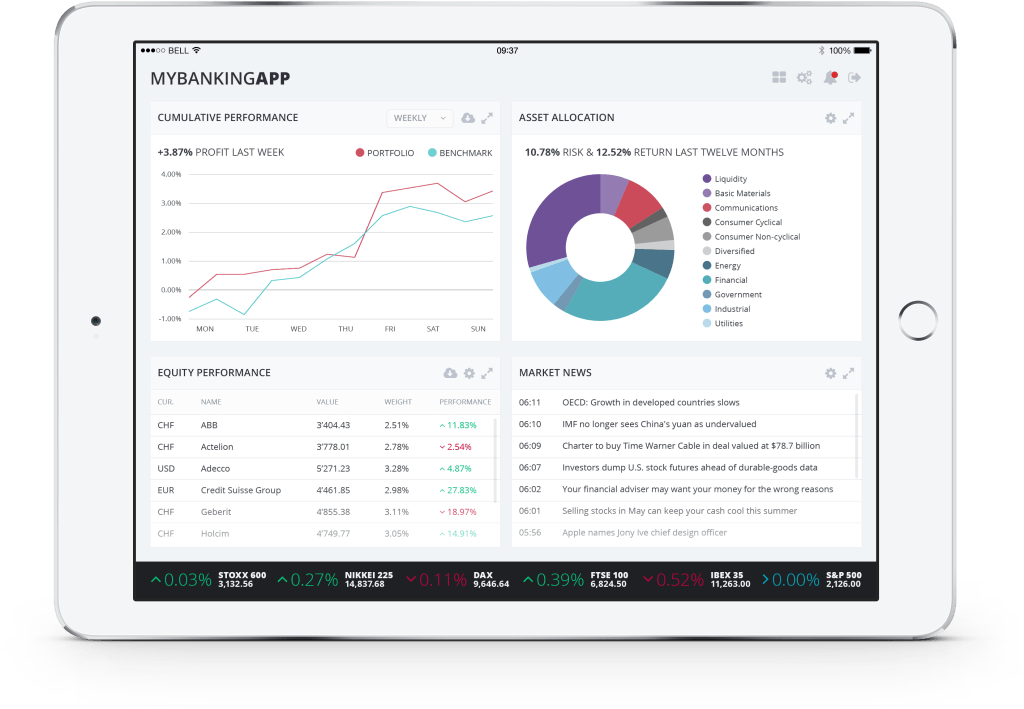

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance, demoed how Descartes Finance built a digital private banking platform on top of additiv’s digital finance suite. The technology enables self-directed investors to implement portfolios based on allocation and optimization methods.

Founded in 1998, additiv offers a digital financial suite, robo advisor and advisor services, as well as digital mortgage tools. At FinovateEurope 2016, the company’s CEO and founder, Michael Stemmle, along with Adriano Lucatelli and Marc Sauter from Descartes Finance, demoed how Descartes Finance built a digital private banking platform on top of additiv’s digital finance suite. The technology enables self-directed investors to implement portfolios based on allocation and optimization methods.

additiv’s Digital Finance Suite (DFS) recently began powering Natwest’s new robo-advice offering, which launched for the U.K. savings and investment market. This comes after the company piloted similar projects with Coutts, a private bank, and RBS Group. We featured the company earlier this year in our roundup of top business-to-business wealth tech players.