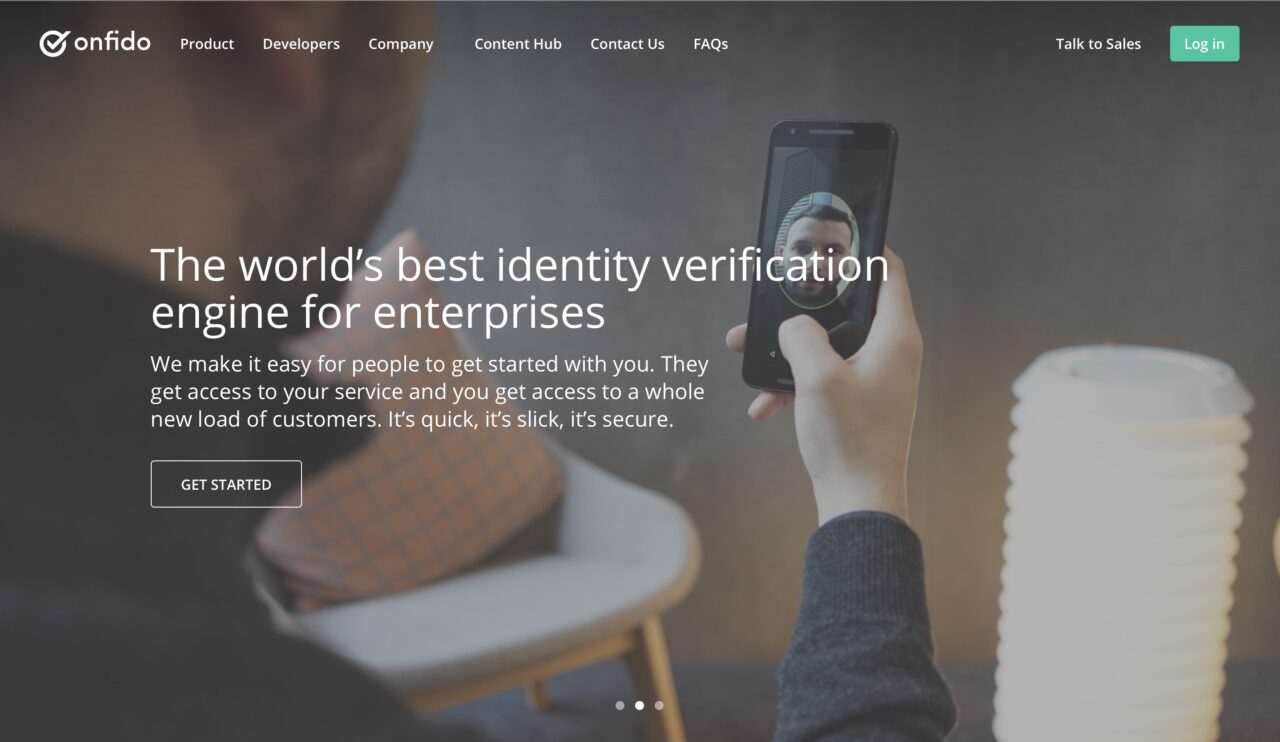

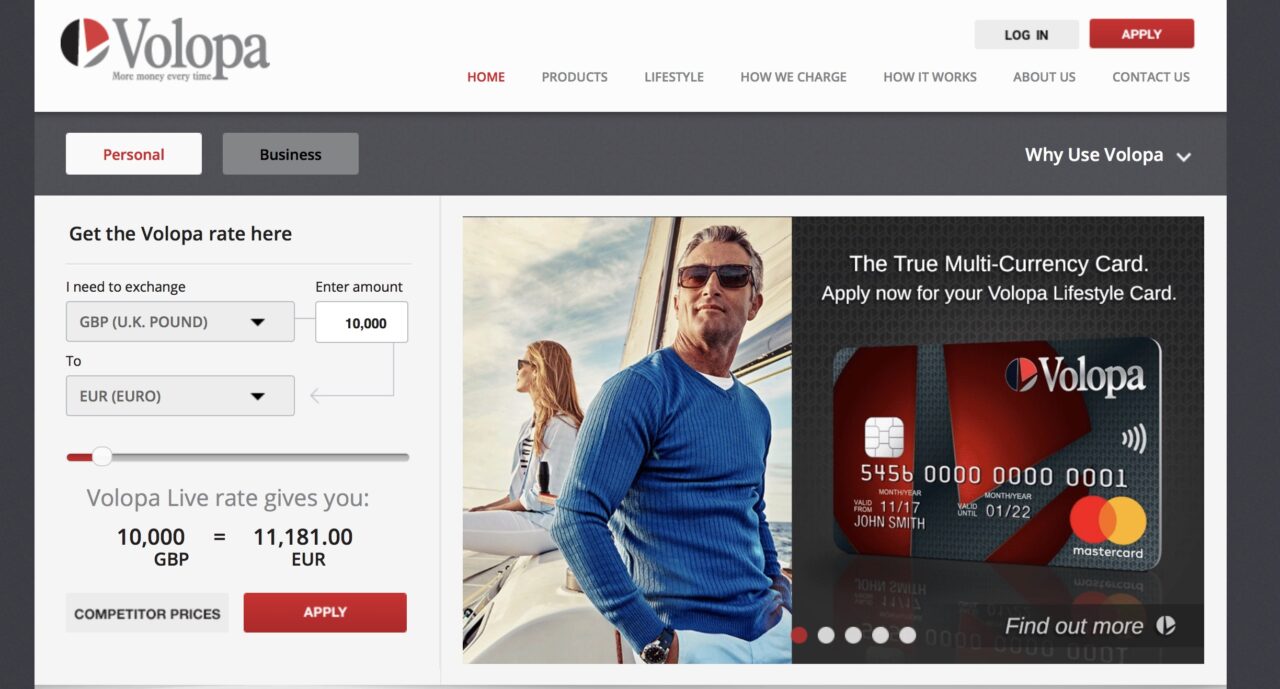

Identity verification specialist Onfido will help FX and international payments solutions provider Volopa enhance its customer onboarding process with secure and scalable KYC functionality. Volopa sought out Onfido’s machine learning-based technology in order to help it meet growing demand for its multi-currency prepaid card business.

“A key strength of Volopa is our ability to deliver client-branded cards which presents a unique advantage for Volopa in the marketplace where we are seeing strong demand for this proposition,” Jay Wissema, Director at Volopa said. He called the partnership, “another step forward in the company’s focus to maximize customer delight and deliver exceptional products at lower cost for our customers.”

An operator of consumer and corporate multi-currency prepaid card programs, Volopa enables businesses to offer their own Volopa-powered, branded cards. Cardholders can store value and transact in as many as 14 different local currencies without additional conversion or FX charges and fees, and can use accompanying mobile and web apps to manage and control their card use. These apps can be used to transfer funds between cards, top up cards instantly, view transactions in real time, and more.

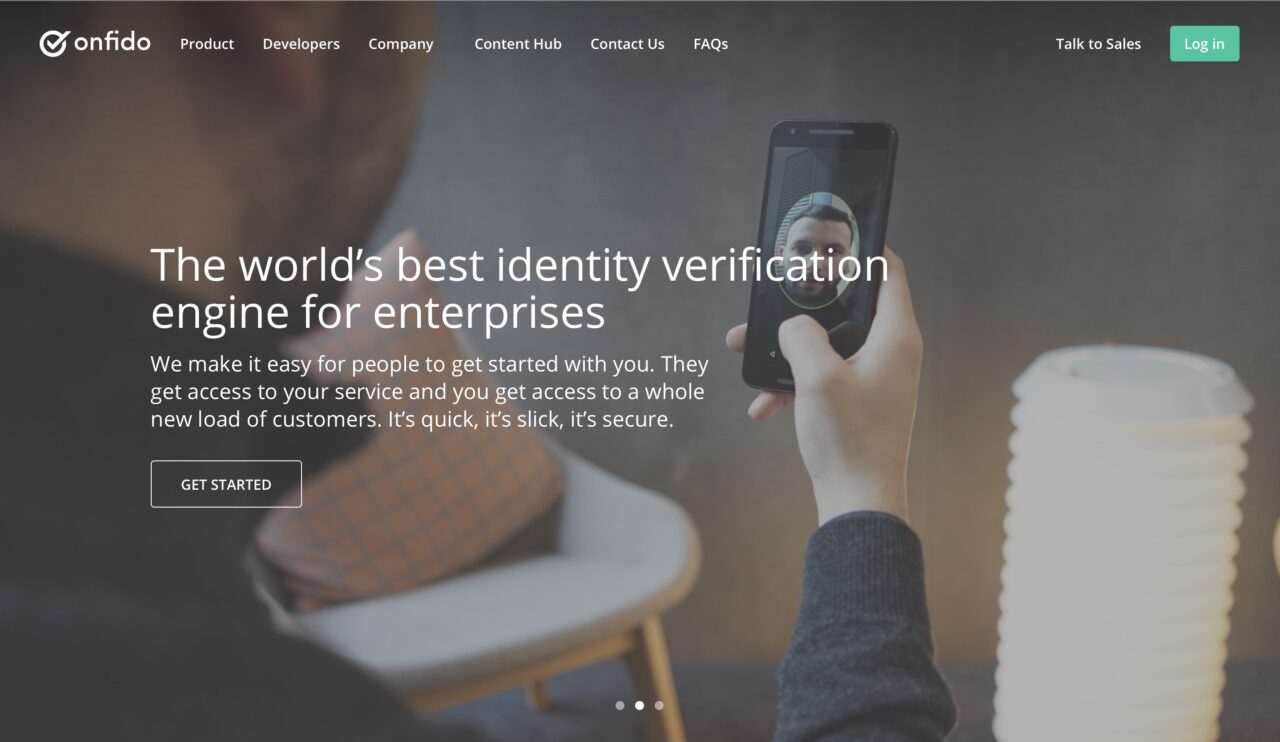

Onfido will enable Volopa to onboard new customers in less than five minutes. To use the technology, Volopa customers simply take a selfie and a photo of their physical ID. Onfido verifies the authenticity of the identity document, compares the selfie with the photograph in the identity document, and cross references the customer’s identity against international watchlists.

“We are proud to be supporting Volopa as they grow,” Onfido CEO Husayn Kassai said. “Balancing security against scale is a challenge for many businesses, but our machine learning technology means we’re able to help Volopa deliver both. We’re excited by their vision of putting people in control of their transactions and look forward to developing our partnership with Volopa.”

Founded in 2012 and based in London, U.K., Onfido demonstrated the Facial Check with Video feature of its identity verification SDK at FinovateEurope 2018 earlier this year. Facial Check with Video provides additional security during the onboarding process, leveraging liveness detection to defend against spoofing attempts.

Last month, Onfido announced that it was partnering with TransferGo, helping the international remittance firm speed its onboarding process. Also in August, the company teamed up with Claim Technology to support claims handlers and their customers. Onfido will provide identify verification for India’s largest ride sharing company, Zoomcar, courtesy of a deal announced in July, the same month the company reported that it would provide identity verification technology for LendInvest’s Buy-to-Let digital applications.

Onfido has raised more than $60 million in funding, and includes Idinvest Partners, Wellington Partners, and Crane Venture Partners among its investors. See the company’s latest technology later this month at FinovateFall in New York.