Small business lender Lendio announced today that it has raised $20.5 million in new funding. The round was led by Napier Park’s Financial Partners Group, and included participation by:

- Blumberg Capital

- Highway 12 Ventures

- North Hill Ventures

- Pivot Investment Partners

- Runa Capital

- Tribeca Venture Partners

The new investment takes Lendio’s total funding to more than $30 million. As part of the agreement, Dan Kittredge from Napier Park and Chris Gottschalk of Blumberg Capital will join Lendio’s board of directors. Lendio plans to use the capital to expand its partnership program, help grow its team of loan advisors, and fuel continued innovation of the platform.

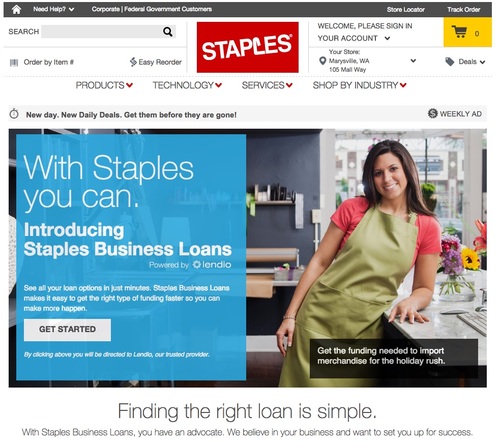

Kittredge praised Lendio’s recent growth and partnerships with companies like Staples in explaining his firm’s commitment to the company. “Lendio’s leadership team has proven its ability to drive innovation and deliver an incredible platform that helps both small business owners and small business lenders alike,” he said.

Lendio believes that a big reason why small businesses get turned down when applying for loans is a matter of proper matchmaking. Whether the small business is pursuing the wrong type of loan product, or has found the right loan but at the wrong bank or credit union, the result is the same. Lendio’s platform makes it easier for qualified borrowers to find the loan that best suits their needs from the financial institution best able (and willing) to service it. Businesses are able to make these loan inquiries without penalty to their credit rating due to Lendio’s “soft pull” of personal and business credit data.

“Our focus is to provide three essential benefits for the business owner – offer a wide variety of loan options, speed up the process, and reduce the time and effort it requires to get funded, and provide a white-glove, trusted experience, Lendio CEO Brock Blake said.

Above (Left to right): Trent Miskin (CTO) and Brock Blake (CEO) presenting at FinovateSpring 2011.

For banks and credit unions the reward is lower customer acquisition costs, more qualified leads, and a significantly larger potential market for new customers.

Lendio demoed its technology at FinovateSpring 2011. The company was founded in 2005 and is headquartered in Salt Lake City, Utah.