Financial services company Fiserv has agreed to acquire U.K.-based Monitise for 2.9 pence per share, which equates to $89 million.

The acquisition comes after a storied history for Monitise, which was valued at $2.6 billion at its peak in 2014 and had formed successful partnerships with IBM, Santander, Telefonica, Virgin Money, and others. In 2015, however, the company changed its business model because of increased competition from tech giants such as Alphabet and Apple who offered mobile payment services for free. After the pivot, Monitise wasn’t able to recover and ended up putting itself up for sale in 2015.

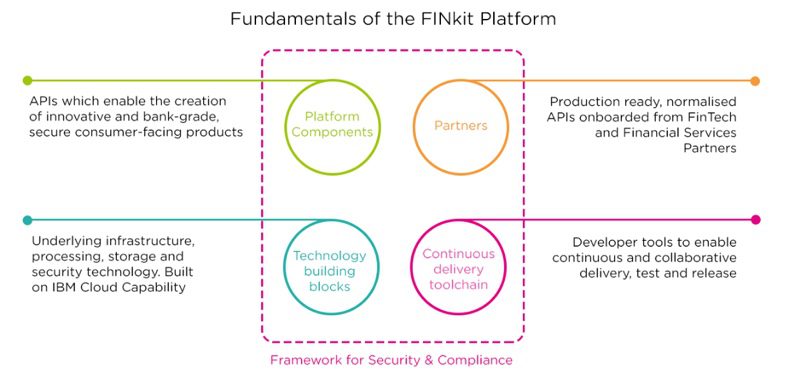

Founded in 2003, Monitise demoed its mobile banking platform on a Nokia flip phone at FinovateFall 2007, the same year it went public on the London stock exchange. In 2009, Monitise’s mobile payments partner, Metavante, was acquired by Fiserv rival FIS. Most recently, Monitise launched FINkit, a cloud-based platform, in 2016 to foster collaboration between banks and fintechs. BehavioSec, Currencycloud, and Envestnet | Yodlee were among the founding FINkit members.

Fiserv anticipates the acquisition, which is subject to shareholder approval, to “accelerate the Fiserv digital strategy and the development of a next-generation digital banking platform for leading financial institutions worldwide.” The Wisconsin-based company will foster Monitise’s FINkit program to help its bank clients accelerate adoption of fintech services.

Jeffery Yabuki, Fiserv President and CEO said, “Monitise has been a global pioneer and innovator in digital banking for more than a decade.” He added, “Combining its talented associates and advanced technologies with leading digital solutions from Fiserv will expand our clients’ ability to provide differentiated experiences to their customers.”

Founded in 1984, Fiserv most recently presented at FinDEVr New York 2017, where the company’s Sr. Product Manager, Jon Zimmermann, and VP of Electronic Payments, Paul Diegelman, addressed the audience in a presentation titled Payments Processing: Bank-Grade Standards, Now Available to Anyone. Yesterday, the company announced that it will help banks and credit unions join the Zelle P2P payment network via its Turnkey Service for Zelle.