The following is a guest post from Scott Raspa, Head of Marketing, Hydrogen.

The European fintech scene has experienced tremendous growth over the last few years. One of the key drivers of this growth is open banking. This is causing financial institutions and fintechs to partner together to provide more innovative, user-friendly solutions for consumers throughout Europe.

European consumers are receptive to the idea of non-financial players offering financial products, according to EY’s Global FinTech Adoption Index 2019. The survey finds that fintech adoption throughout Europe, especially in countries such as the Netherlands, U.K., Germany, Sweden, and Switzerland, are well above the global average of 64%, and aren’t showing signs of slowing down any time soon.

Below is a list of the top 50 fintech companies in Europe, based on their valuations.

| Ranking | Company | Funding | Valuation | Country |

| 1 | Adyen | $266M | $22B | Netherlands |

| 2 | Nexi | Public | $8.2B | Italy |

| 3 | Klarna | $1.4B | $5.5B | Sweden |

| 4 | Checkout | $380M | $5.5B | U.K. |

| 5 | Revolut | $917M | $5.5B | U.K. |

| 6 | Transferwise | $1.1B | $5B | U.K. |

| 7 | Greensill | $1.7B | $3.5B | U.K. |

| 8 | N26 | $782.8M | $3.5B | Germany |

| 9 | Oaknorth | $1B | $2.8B | U.K. |

| 10 | IZettle | €273.2M | $2.2B | Sweden |

| 11 | MetroBank | Public | $1.92B | U.K. |

| 12 | Wefox | $268.5M | $1.65B | Germany |

| 13 | Funding Circle | $746.4M | $1.5B | U.K. |

| 14 | Monzo | £384.7M | $1.24B | U.K. |

| 15 | Rapyd | $170M | $1.2B | U.K. |

| 16 | Ledger | $88M | $1.2B | France |

| 17 | Avaloq | CHF350M | $1.1B | Switzerland |

| 18 | Deposit Solutions | $198.9M | $1.1B | Germany |

| 19 | Ivalua | $134.4M | <$1.0B | France |

| 20 | Sumup | $425.6M | $1.0B | U.K. |

| 21 | Radius Payment | £150M | $1.0B | U.K. |

| 22 | Numbrs | $78.8M | $1.0B | Switzerland |

| 23 | Monese | $80.4M | $1.0B | U.K. |

| 24 | Worldremit | $407.7M | <$900M | U.K. |

| 25 | Ebury | $123.5M | >$900M | U.K. |

| 26 | Oodle Car Finance | £160M | >$850M | U.K. |

| 27 | Qonto | $151.5M | >$770M | France |

| 28 | Starling Bank | £363M | >$600M | U.K. |

| 29 | Atom Bank | £429M | $590M | U.K. |

| 30 | Raisin | $206M | <$550M | Germany |

| 31 | Tradeplus24 | $103.5M | >$550M | Switzerland |

| 32 | Kreditech | $347.5M | <$500M | Germany |

| 33 | Pleo | $78.8M | $500M | Denmark |

| 34 | Smava | $188.7M | $500M | Germany |

| 35 | Tink | $205.5M | >$500M | Sweden |

| 36 | Pagantis | €76.2M | >$400M | Spain |

| 37 | Gocardless | $122.3M | >$400M | U.K. |

| 38 | Wynd | $123.5M | >$400M | France |

| 39 | Moneyfarm | $127.3M | >$400M | U.K. |

| 40 | Soldo | $83.2M | >$400M | U.K. |

| 41 | Ratesetter | £43M | $360M | U.K. |

| 42 | solarisBank | €155.1M | $360M | Germany |

| 43 | Bitstamp | $12.4M | $350M | U.K. |

| 44 | Tinubu Square | €79.3M | >$350M | France |

| 45 | Nutmeg | $153.6M | $318M | U.K. |

| 46 | Banking Circle | N/A | $300M | Denmark |

| 47 | BIMA | $170.6M | $300M | Sweden |

| 48 | LendInvest | $1.3B | >$300M | U.K. |

| 49 | PayFit | $101.1M | >$280M | France |

| 50 | Curve | $74.2M | $250M | U.K. |

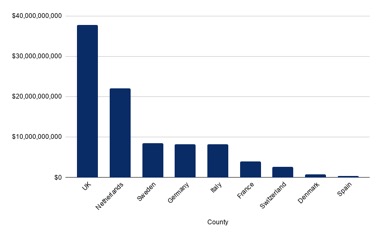

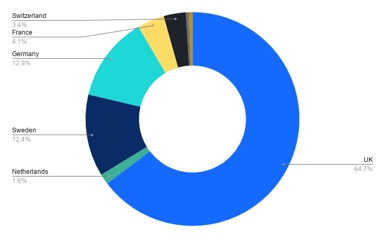

These companies have raised over $16.8B (€14.3B) in venture capital funding and are valued, collectively, at over $92B (€78B).

The U.K. fintechs are valued at nearly $40B (€34B). The Netherlands are second, all thanks to Ayden, the most valuable fintech in Europe.

The U.K. has also invested the most money, nearly $11B (€9.4B), almost 65% of the funding of these top 50 fintech companies. After the U.K., Germany and Sweden have invested the most with 12.9% ($2.1B / €1.78B) and 12.4% ($2.0B / €1.7B) of the overall funding, respectively.

Fintech Enablement in Europe

Here at Hydrogen we work with companies all over the world. Our award-winning fintech enablement platform enables organizations to quickly and easily build fintech products and components. Whether you want to offer a PFM app in France, a challenger bank in the U.K., or issue cards in Germany, Hydrogen is here to help. Hydrogen has pre-built integrations, workflows, business logic, and UI already built in and available in white labeled/no-code modules or through our robust API.

It’s free to get started, so start building with Hydrogen today!

*Note: Funding information was provided by Crunchbase.com and the Euro, Pound, and US Dollar conversions were based off of today’s conversion rate. Also, total funding amounts didn’t include public companies or companies where we couldn’t identify the funding received.