Budapest, Hungary-based Dorsum launched a new wealth management mobile app this week. The investment software provider’s new My Wealth mobile app helps customers better understand and review their portfolio holdings, as well as make new investments with just a few taps. The app leverages gamification and an education marketplace toolkit to ensure that customers remain well-informed about basic investment concepts and principles. My Wealth also features a self-learning chatbot as well as the ability to request a human financial advisor to take over the conversation, giving users the benefits of both AI and human advisory.

Imre Rokob, Director of Business Development at Dorsum noted that innovations like the My Wealth app are driven largely by a combination of a shift in investing preferences and the arrival of non-financial participants in the investment arena. “Present-day investors want to manage their portfolios on the go while staying in control in an efficient and intuitive way,” Rokob explained. “I’m very proud that our continuous effort to revolutionize our B2B software offerings has resulted in a digital innovation offering a unique wealth management mobile application with the right balance between intelligent automation and a human approach.”

My Wealth not only helps bridge the gap between AI and human financial advice. The technology also helps investors bridge the gap between their actual and optimal investment portfolios. When this occurs, the app provides customers with a list of potential investments the user could make that would help bring the actual portfolio more in line with the optimal portfolio. Users can receive personalized notifications and news on the app, as well as set up a meeting for a call or chat with an advisor. The solution works for both iOS and Android, and can be readily integrated into any wealth management platform or system. While designed for customers, financial advisors can use the app to keep in touch with clients and to send personalized notes and advice, as well.

“Our exceptional solution merges with the traditional advisory and the digital advisory process into a hybrid model,” Dorsum CEO Robert Ko said. “Our software meets the digital expectations of the younger generations, ready to fight with robo disruptors and boost performance of personal financial advisors.”

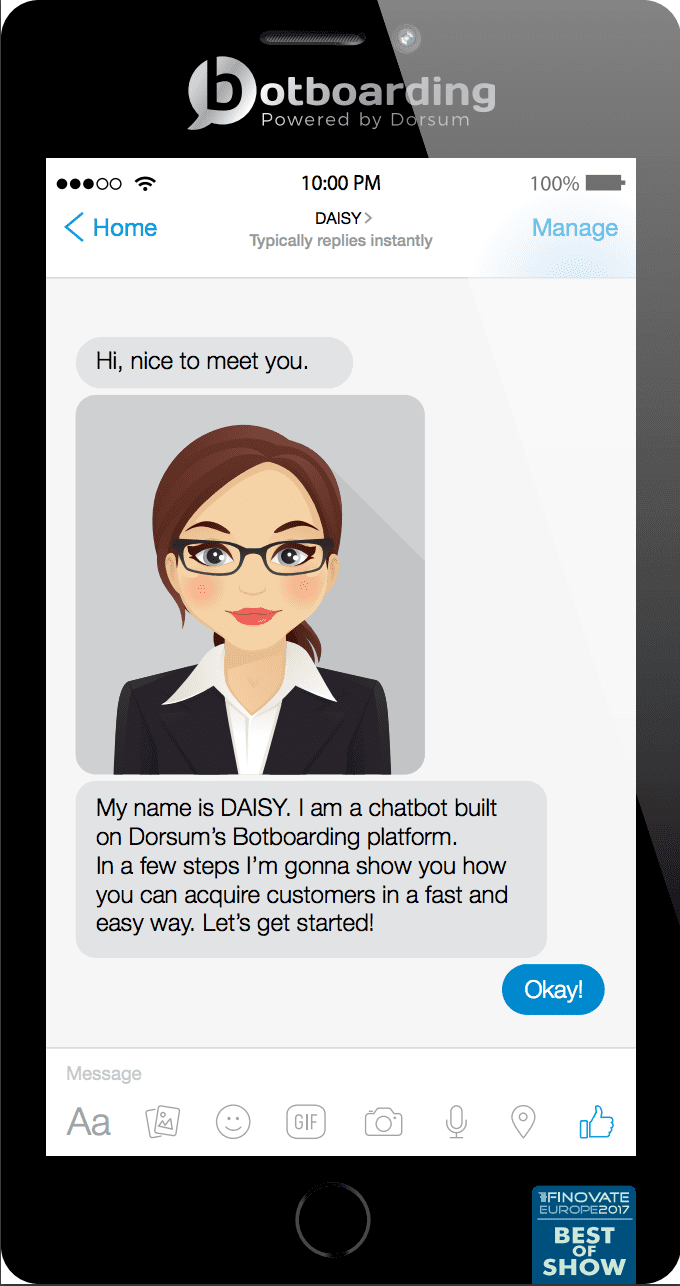

Dorsum demonstrated its Botboarding platform at the inaugural FinovateMiddleEast 2018 conference earlier this year. The technology, which won the company a Best of Show award last year at FinovateEurope 2017, creates customer onboarding chatbots that combine natural language communication with traditional data collection and user profiling.

In addition to its Botboarding platform, Dorsum offers a client acquisition tool that supports client engagement with vivid presentations and a portfolio calculator that provides instant financial planning simulations, as well as its wealth management platform. With subsidiaries in Romania and Bulgaria, Dorsum includes Raiffeisen Bank International, Erste Bank, and Generali among its clients.

Presenters

Presenters Agnes Bati, International Project Assistant

Agnes Bati, International Project Assistant

You can’t spell the name Daisy without AI, which is good because it’s the premise behind

You can’t spell the name Daisy without AI, which is good because it’s the premise behind

We interviewed Róbert Kő (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

We interviewed Róbert Kő (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

CREALOGIX

CREALOGIX Dorsum

Dorsum ebankIT

ebankIT

Horizn

Horizn ICAR

ICAR ITSector

ITSector Mitek

Mitek

Swaper

Swaper Trustly

Trustly Wealthify

Wealthify Xignite

Xignite

eToro

eToro Memento

Memento