With bitcoin and cryptocurrencies enjoying renewed interest, it’s worth noting that many fintech fans encountered their first bitcoin-related businesses through Finovate conferences.

Here’s a look at some of the companies that have brought their bitcoin and crypto-powered innovations to the Finovate stage.

OpenCoin – FinovateSpring 2013 – The company now well-known as Ripple was introduced to Finovate audiences back in 2013. At FinovateSpring that year, Chris Larsen – CEO of a startup called OpenCoin – introduced its virtual currency and distributed open source payment network. Founded in 2012 and headquartered in San Francisco, California, Ripple currently has more than 300 financial institutions who leverage its RippleNet blockchain network to power real-time payments.

KlickEx – FinovateAsia 2013 – New Zealand-based KlickEx unveiled its asset-backed and algorithmic cryptocurrency for institutional and retail users at FinovateAsia in 2013. The company, founded in 2009, recently announced a partnership with the National Reserve Bank of Tonga to launch a new national payment system.

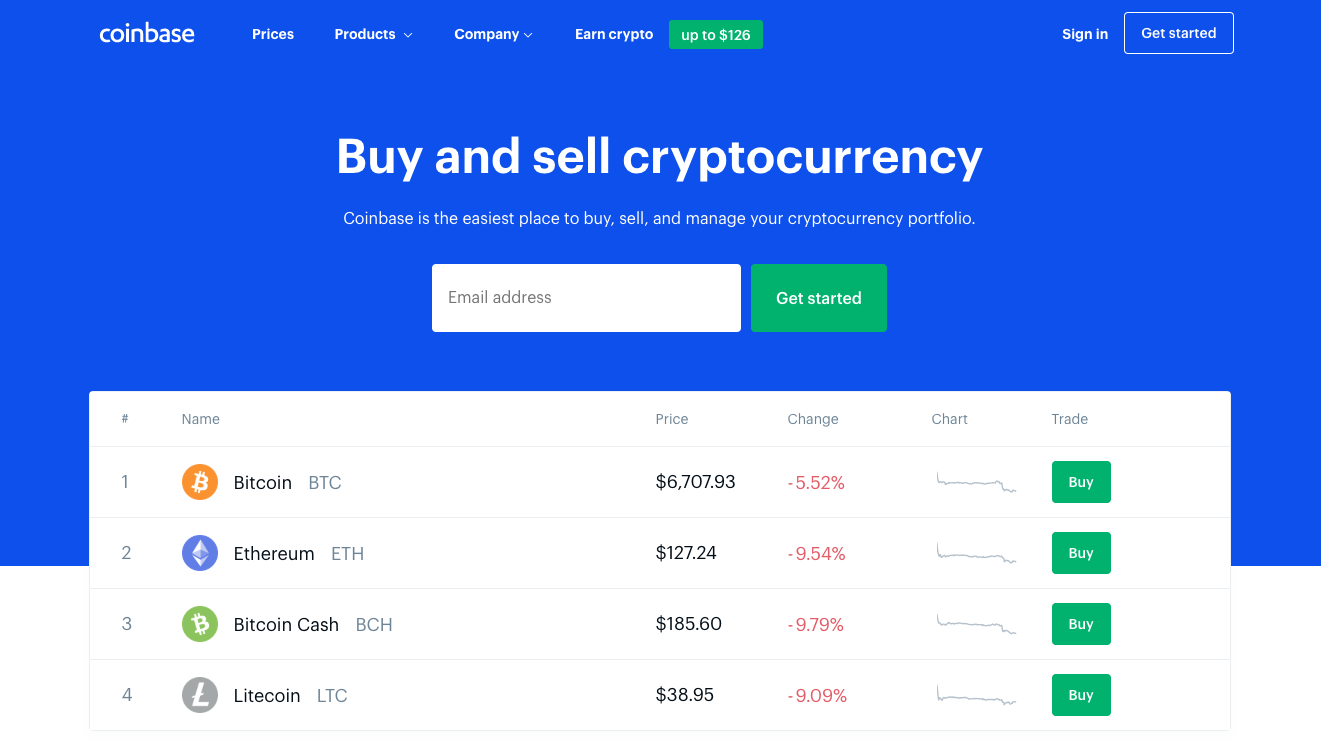

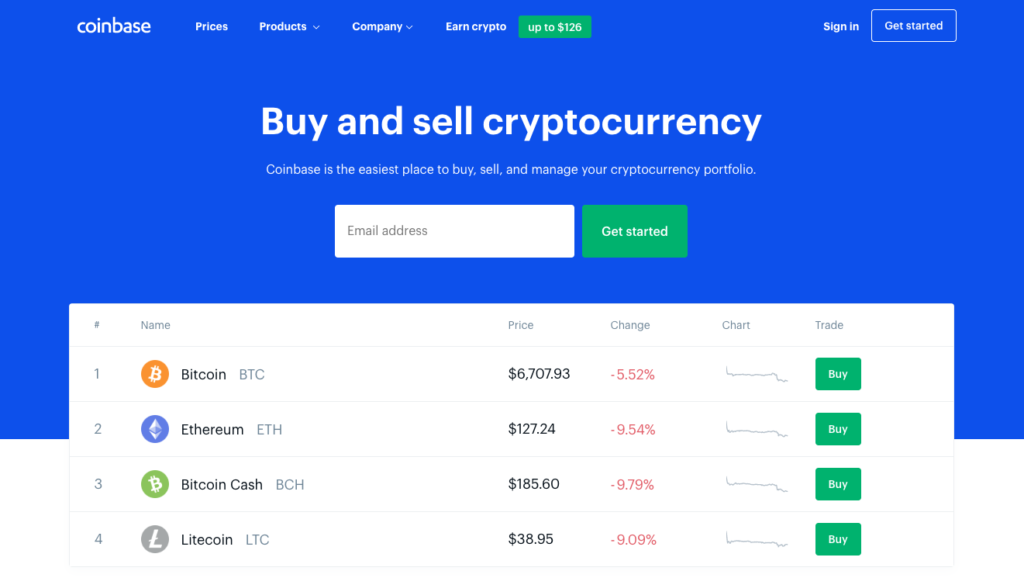

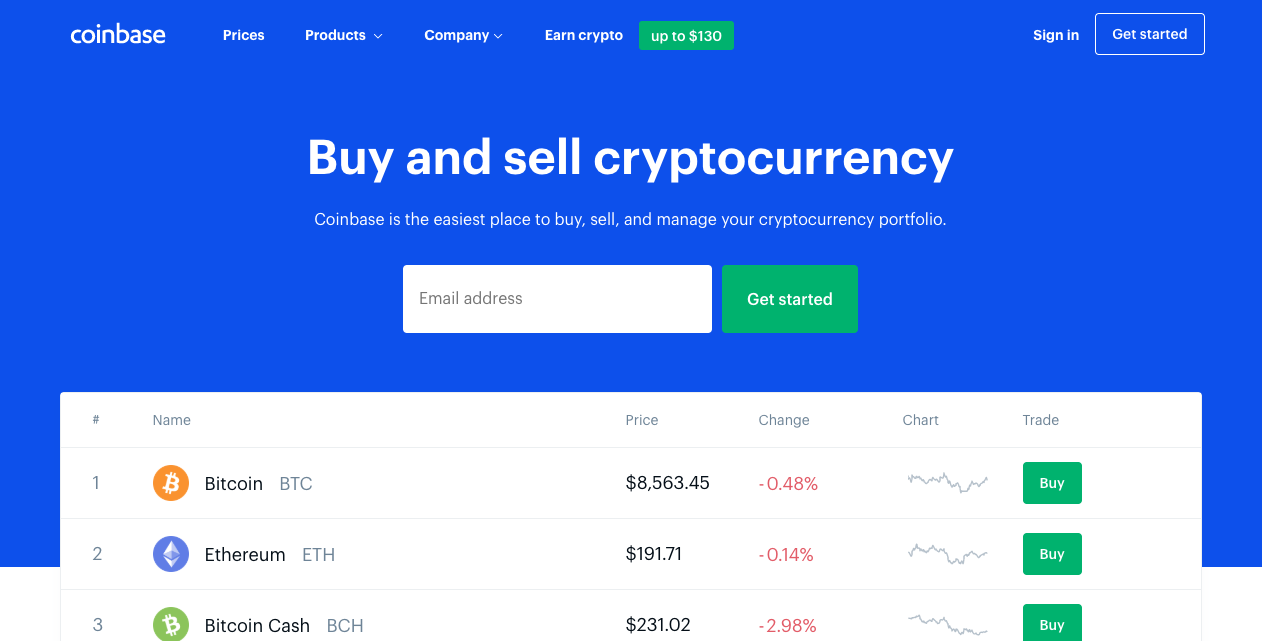

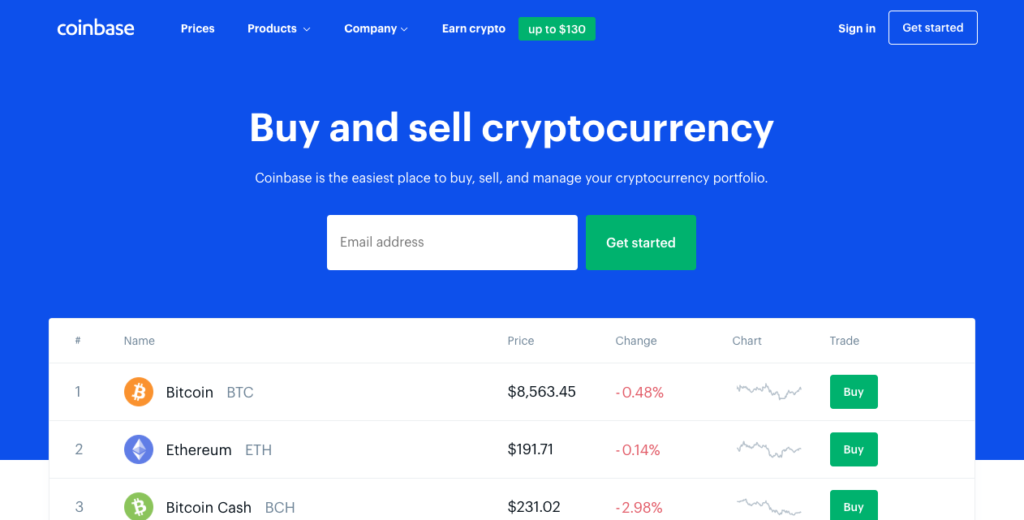

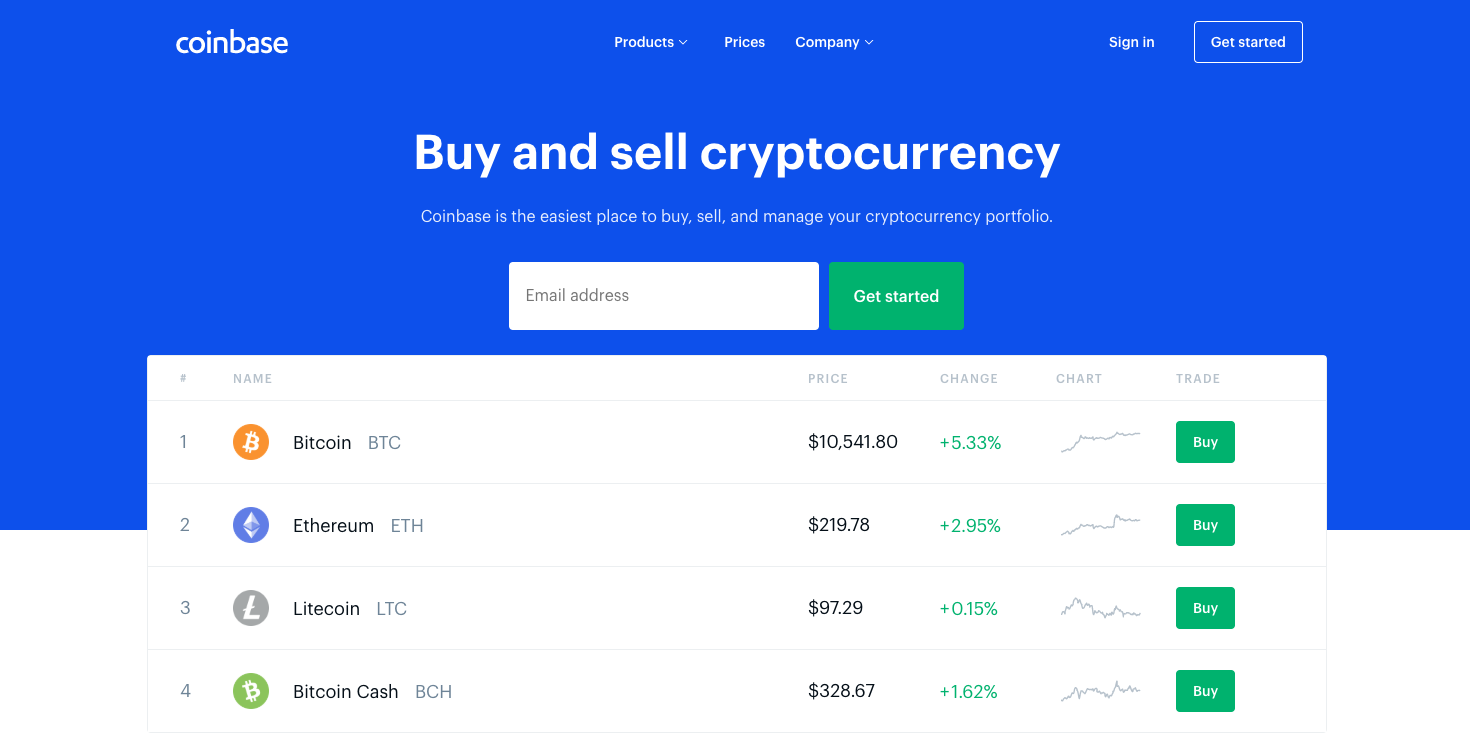

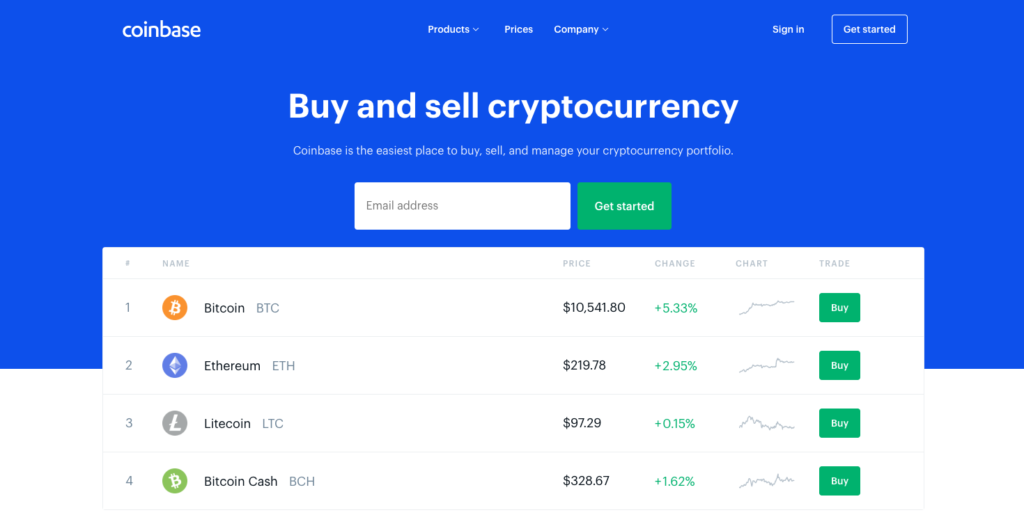

Coinbase – FinovateSpring 2014 – Among the bigger names in bitcoin and cryptocurrency to have demonstrated their technology at Finovate conferences is San Francisco, California-based Coinbase. Debuting at Finovate with its Instant Exchange in 2014, Coinbase has grown into one of the biggest players in the cryptocurrency market with more than 35 million verified users and more than $320 billion in total volume traded on its platform.

AlphaPoint – FinovateEurope 2015 – With more than $350 million in monthly trading volume and 20 digital currency exchanges operating in 15 countries, AlphaPoint is a leading fintech exchange platform provider for digital currencies. The company demoed version two of its digital currency exchange platform at FinovateEurope in 2015.

CoinJar – FinovateEurope 2015 – Australia’s largest and longest-operating bitcoin company, CoinJar demonstrated its platform at FinovateEurope 2015. The Best of Show-winning firm was the first in its market to offer a bitcoin debit card that enabled cardholders to use the cryptocurrency for everyday purchases.

Bitbond – FinovateEurope 2015 – Berlin, Germany’s Bitbond offers a global P2P bitcoin lending platform that enables anyone with an Internet connection to both get loans as well as invest their savings for interest. The company demonstrated its AutoInvest functionality, which facilitates and automates fund allocation in a portfolio, at FinovateEurope 2015.

itBit – FinovateSpring 2015 – New York-based itBit demonstrated its bitcoin trading platform at FinovateSpring in 2015. The company’s technology enables both institutional and retail investors to buy and sell bitcoin. Rebranded as Paxos in the fall of 2016, the company has since highlighted its work in private blockchains and distributed ledger technology.

Blockstack.io – FinovateFall 2015 – Best of Show winning Blockstack.io offers a hosted and licensed enterprise blockchain platform that enables financial services companies and others to build applications on their own private blockchain. The San Francisco, California-based company, founded in 2015, was acquired by Digital Asset Holdings for an undisclosed sum before the end of the year.

ArcBit – FinovateFall 2015 – With a pledge to leverage bitcoin and blockchain technology to bring banking to the underbanked, ArcBit, which made its Finovate debut at FinovateFall in 2015, offers a mobile wallet specifically designed to give bitcoin owners full control over their cryptoholdings.

Coinalytics – FinDEVr San Francisco 2015 – Our developers conference, FinDEVr is one way that many bitcoin and crytocurrency innovators were able to bring their innovations to the public. Coinanalytics, which offers an end-to-end intelligence platform for the bitcoin industry, is an example of the kind of company developing solutions to make bitcoin a better opportunity for payments, financial services, and IoT.

BlockCypher – FinDEVr Silicon Valley 2015 – Another alum of our developer’s conference, BlockCypher offers companies a cloud-optimized, enterprise-grade blockchain platform that enables them to build reliable blockchain apps. Headquartered in Redwood City, California, the company was founded in 2014.

Gem – FinDEVr Silicon Valley 2015 – Founded in 2014 and based in Venice, California, Gem demonstrated its API which provides a comprehensive security solution for bitcoin apps – without taking control over funds. With a few lines of code, Gem enables developers to provide an interface to their bitcoin apps that gives users better funding options.

Ledger – FinovateEurope 2016 – Headquartered in Paris, France and founded in 2015, Ledger designs trusted hardware solutions for bitcoin and blockchain apps. The company’s solutions, including the Nano X and Nano S, provide cryptocurrency owners with a secure, portable way to take and manage their digital assets wherever they are.

Stratumn – FinDEVr New York 2016 – Enterprise blockchain technology company Stratumn provides firms with the infrastructure and tools they need to to build, deploy, and run blockchain. The company presented the high performance, proof-of-existence engine of its development platform at our developer’s conference in 2016. Jerome Lefebvre took over as CEO of the company from co-founder Richard Caetano in the fall of 2019.

Plutus.it – FinovateEurope 2018 – London-based Plutus demonstrated its Tap & Pay and Debit Card solutions that enable consumers to pay with bitcoin or Ethereum at any contactless point of sale. Founded in 2016, the company currently supports more than 26,000 Plutus accounts and credits its users for acquiring more than $100,000 in rewards via its Pluton Rewards program.

Amber Labs – Finovate MiddleEast 2019 – Best of Show winner Amber Labs is a bitcoin exchange, wallet, and micro-investment app in one. Headquartered in Brisbane, Queensland, Australia, and founded in 2017, Amber Labs offers a mobile first, automated investment platform for retail customers looking to buy and sell bitcoin.

Photo by Thought Catalog from Pexels