From Big Tech to Big Retail, banks and other traditional financial services providers are facing a unique and potentially existential challenge These companies are leveraging their technology-first platforms, powerful brands, and history of innovation to draw customers away from relying on banks for a growing amount of their financial and banking needs.

We caught up with Richard Steggall, CEO of Urban FT, to talk about the world that banks find themselves in today and what they need to do in order to better engage their customers and ward off the challenge from Big Tech and Big Retail.

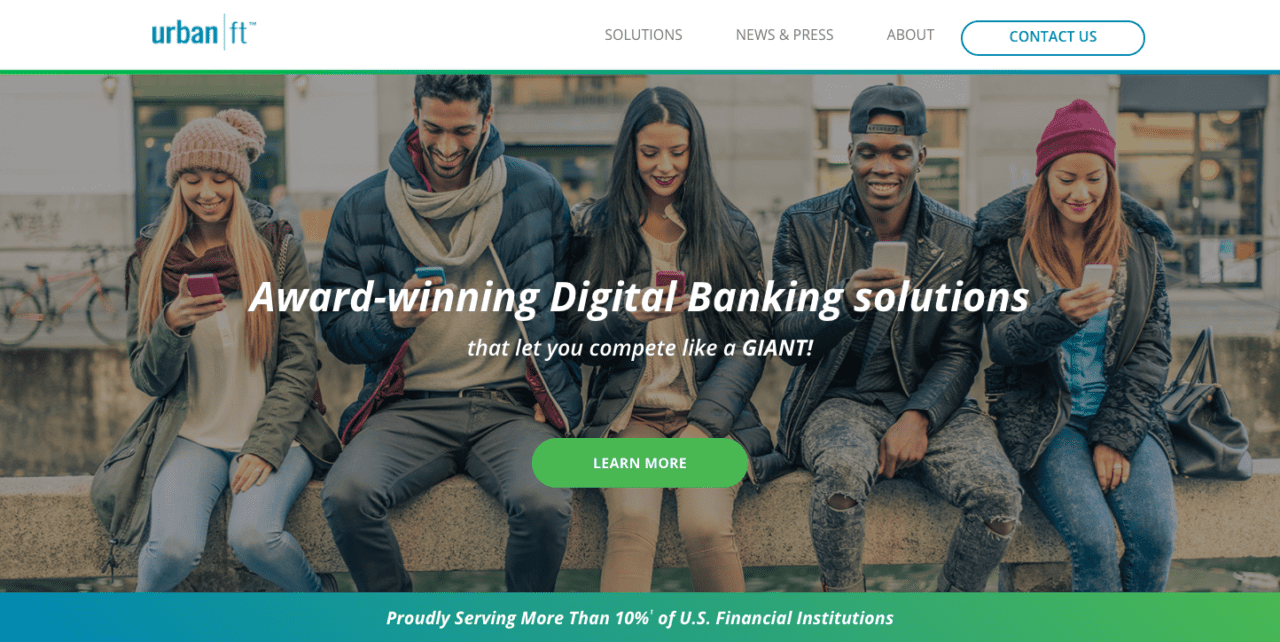

A Finovate alum for more than six years, Urban FT offers a white-label, B2B digital banking platform and includes financial institutions, brokerages, insurance companies and non-traditional FSOs among its customers.

How big is the threat that banks – smaller banks in particular – face from Big Tech companies?

Richard Steggall: When it comes to the threat regional banks and credit unions face from big tech, we’re seeing a true David versus Goliath moment play out. There is unprecedented pressure mounting for small FIs to digitize – fast – and for the majority of FIs, the pace is much faster than what their capabilities and resources allow. As FIs continue to fall behind the tech curve in delivering on the convenience consumers demand, they’re losing customers in the payments arena to the ‘Fantastic Four’ in payments (Paypal, Stripe, Square and Adyen). And in the long term, FIs risk leaving the door wide open for tech giants like Apple, Amazon and Google to become our bankers.

According to a recent report from McKinsey, in order for regional banks and credit unions to preserve their market share, they must find a way to digitally transform the end-to-end “customer journey” by the end of 2022. No matter how large of a budget an FI has, that certainly does not leave much time for the digital overhaul that’s needed to achieve this lofty goal. As the same report outlines, transaction banking trails nearly a decade behind the technology industry when it comes to practices in customer-management and sales. These delays make a successful digital transformation of the customer journey a decidedly formidable – but certainly not unfeasible – vision for small FIs.

How can banks leverage their strengths to better compete with tech giants that are entering the banking services space?

Steggall: As I mentioned, the financial services industry is in the midst of a David vs. Goliath scenario. With big tech continuing to invade financial services – such as the November 2020 relaunch of Google Pay – some are prematurely saying that small FIs will soon become casualties of war. But, in reality, we’re still in the early battles and there’s no clear frontrunner yet. While regional banks and credit unions may not boast the tech savvy of fintech giants nor deep pockets of large bank conglomerates, they have a potentially more powerful weapon: the hearts of customers.

Reinforced by close community ties and unmatched trust, small FIs are ideally positioned to deliver personalized, innovative user experiences (UXs) that unlock meaningful, local economic development value rather than line the pockets of predatory big tech elites. This area is their strength and they need to home in and capitalize on it.

Moreover, they can benefit from the chinks in the armor of their competitors, as big tech’s approach to financial services is far from flawless. According to a recent Ponemon study, 86% of consumers are “very concerned” about how tech companies are using their personal information. Moreover, in good news for FIs, consumers still overwhelmingly trust banks more with their data than other industries, according to a report from nCipher Security.

This is the opportune moment for small FIs to cut in, striking a balance of innovation and ethics in digitizing. While big tech hoards consumer data to bolster other revenue streams like advertising, FIs can “wow” customers by using ethically sourced data to drive responsible personalization and superior UXs that safeguard privacy.

How do banks make the best of their newly-created digital experiences in a post-COVID world in which human-to-human interaction is again possible, if not preferred?

Steggall: While regional banks and credit unions have a leg up in trust and transparency, they also need to understand where their own weaknesses and risks lie. This exposure is largely in the 3Ds: data, digitization and deployment (of technology).

Customer data is truly the holy grail because it allows FIs to better serve consumers no matter where they lie on the financial spectrum. For example, if an FI knows a customer has college-aged children, there is a strong opportunity to be the thought leader on student lending. But there’s a fine line; in an environment where consumers feel surveilled, catchphrases like “convenience”, “personalization” and “user experiences” may lose their appeal.

By upholding the old adage “with great power comes great responsibility”, FIs can rise above big tech and continue to learn about their customers in organic ways that don’t find them creeping in on online activity. Rather, the purpose of technology deployment is to infuse ethically enhanced human touchpoints in all processes, such as allowing customers to provide pertinent financial information voluntarily that might help an FI build a profile.

Given that banks will never out-tech the tech titans, what is the most constructive way for financial institutions to understand and invest in technology, especially digital technology?

Steggall: In terms of digitization and technology deployment, one of the most pressing issues facing small FIs is the disjointed manner in which they’ve been innovating. To date, most small FIs have contracted with various third-party fintech vendors to complement their traditional commercial offerings with piecemeal digital tools and services, including remote deposits, remote credit card processing and wealth management dashboards.

While FIs need to rapidly adopt fintech and digitize their service offering to keep pace with consumer demands, digital transformation has largely been happening within a temporary, makeshift model. Though this ‘band-aid’ approach to innovation has bought FIs some time, it hasn’t healed the fundamental problem that’s restraining digitization. Rather, this framework has inadvertently staggered an infinite and vast maze of third-party fintech platforms – all using different forms of connectivity and technology languages. Sometimes, tools are not even directly connected to the banking core. Moreover, the countless agreements require ongoing vendor due diligence, contract reviews and audits. This cumbersome approach to fintech has overwhelmed some FIs with a complex labyrinth, deepening the innovation gap for regional banks and credit unions, in particular.

Small FIs must break free of this constrictive fintech investment model and focus on centralizing the digital ecosystem so they can become more malleable, agile, and nimble in responding to surging digital demands. Rather than let the labyrinth get more twisted, a fintech banking core can serve to connect core banking functions with digital technology. In the long term, an effective fintech core will help FIs better scale and maximize the investments they make in technology.

What role does Urban FT play in helping banks and other businesses close the technology gap?

Steggall: At Urban FT, our mission is succinct but powerful: “Dream Big, Deliver Exceptional.” We’re focused on empowering FIs – especially local and regional banks and credit unions – to better scale continuous innovation so they can gain a competitive advantage and protect their market share from the likes of big tech. We see ourselves as the bridge between FIs and fintech innovation.

As an example of our commitment to help close the technology gap, our X-35 FinTech Core is an API-first, developer-friendly and cloud-based technology hub that operates alongside and in tandem with an FI’s banking core or payment processor. Essentially, it consolidates any existing tools and all fintech solutions an FI wants to deploy. By placing all solutions within one centralized platform, the full digital ecosystem becomes accessible as part of a singular vendor relationship that’s governed by one contractual relationship. X-35 has been designed to enable FIs of any size to rapidly and continuously launch to market truly innovative products. And now they can do this without the prohibitive expenses they were previously faced with.

Urban FT helps advance innovation once thought of as impossible for small FIs, providing both the foundation and the plumbing so that our clients can deliver tomorrow’s fintech innovations today.

Are there factors that tend to make a given company’s digitization initiative more likely to succeed than not? Do the success stories have a similar theme?

Steggall: While digital transformation certainly needs to be a priority for FIs of all sizes, innovation for the sake of innovating is not the answer. In today’s fast-paced marketplace, consumers are signaling desires for more human touchpoints and sometimes this touch can get lost in the midst of technology adoption – especially when resources are limited.

To create long-term value, small FIs should continue their humanized, high-touch approach to banking. This means deeply understanding the most pressing pain points their customers and potential customers are facing. Being a problem-solver will help FIs reach broader audiences, attract more customers, launch more services and clear more transactions. For example, at least 6% of the population – over 14.1 million adults – are unbanked in the United States. By exploring how to serve the unbanked and underbanked, FIs can tap into new segments of their communities and connect them with tailored services that improve their financial health.

In particular, a successful digital transformation requires an FI to think carefully about how two very different operating models – one current and one future state – should be integrated and operate in tandem under the same roof. Broadly speaking, there are three models for this integration: full integration, a digital center of excellence, and a separate digital department. For most small FIs, a fully integrated model is not scalable whereas a separate digital department does not engage enough of the organization. We see the most success when the digital center of excellence is set up, building a bridge to fintech innovation.

Photo by Mikhail Nilov from Pexels