SEO-friendly e-commerce platform 3dcart will leverage technology from Payoneer to “transform” its cross-border paymenst process to merchants around the world. Through the new partnership, 3dcart will rely on the Payoneer platform’s cross-border functionality, prompt payment processing, and flexible payouts to send payments to more than 200 countries in more than 150 currencies.

“Our mission is to empower businesses to grow globally by enabling them to easily and digitally send payments to their payees all over the world,” Scott Galit, Payoneer CEO, explained, “without having to worry about the complexities and regulations of executing cross-border payments. We look forward to working with 3dcart to open up new global opportunities for their business,” Galit said.

Florida-based 3dcart provides order management software, built-in blogging, email marketing tools, more than 100 mobile-ready themes and 24×7 technical support to help retailers and internet marketers drive online traffic and sales to their stores. In choosing Payoneer, the company said it wanted a solution that would make it easier for their merchants to accept payments globally and called Payoneer “an ideal choice.”

“We’re excited to include Payoneer as an integrated payment method in the 3dcart platform, especially because we have sellers all over the world,” 3dcart COO Jimmy Rodriguez said. “Our clients need a reliable, flexible means of accepting international payments, and Payoneer aligns perfectly with that.”

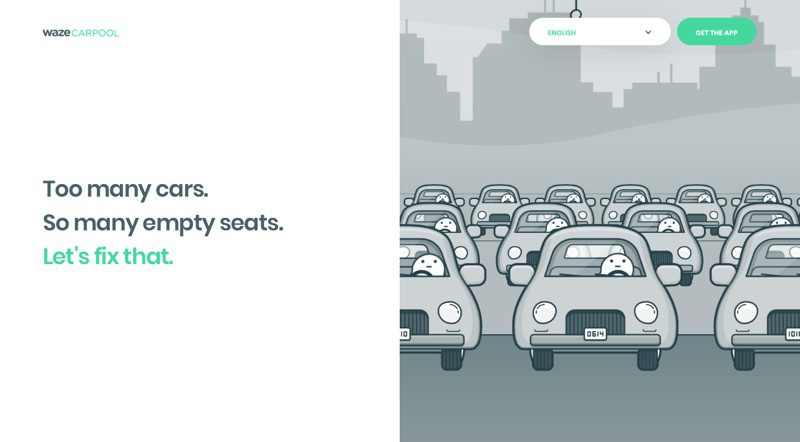

Founded in 2005 and headquartered in New York City, Payoneer began the year with news that it would power local payments for social navigation specialist Waze’s Carpool service. The company, with more than four million users of its solutions, picked up an investment from China Broadband Capital back in December. Last fall, Payoneer was named to the Inc. 5,000 roster of fastest growing private companies in the U.S. In addition to the businesses that use Payoneer’s cross-border payments platform, companies like Airbnb, Amazon, Getty Images, and Google also take advantage of Payoneer’s mass payout services.

Payoneer demonstrated its Commercial Account at FinovateAsia 2013. The account enables businesses and individuals around the world to receive funds from a global network of corporate companies. Account holders can access funds via low cost withdrawals to bank accounts, prepaid debit with instant spending and ATM access, as well as through a transfer to local eWallets in certain locations.