Currency and foreign exchange solutions company Kantox boosted its total funding to just over $35 million today after closing a $5.7 million (€5 million) debt financing round.

The investment is the second debt financing deal Kantox has received from Silicon Valley Bank following a round of an undisclosed amount in December of 2017.

Kantox CEO and co-founder Philippe Gelis said that the company has a “very strong” relationship with the bank. He added, “This investment will contribute to our ongoing growth trajectory as we continue to bring more technology to the FX market.”

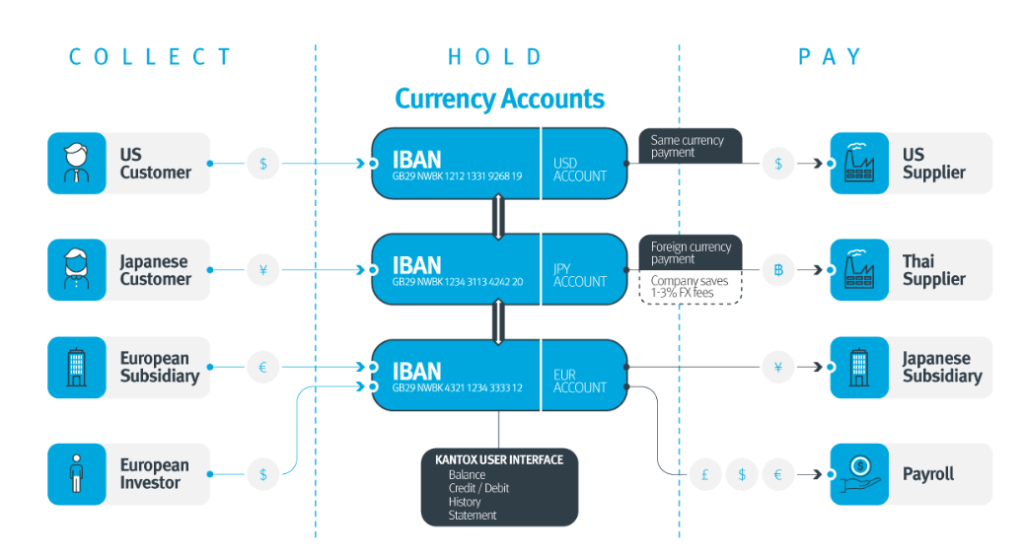

Founded in 2011, Kantox offers a low-cost way for businesses dealing with a variety of foreign currencies. The tool allows treasury managers to collect, hold, and pay in 29 different currencies.

Kantox also offers a host of other FX tools, including a product to help businesses price their goods dynamically, based on market changes; a service that provides companies with mid-market rates for spots and forwards in over 130 currencies and hundreds of currency pairs; and a suite of FX risk management tools. Dynamic Hedging, one of the risk management tools Kantox launched in 2016, helps companies monitor currency risk in real time.

Gelis demoed Kantox Peer FX at FinovateEurope 2013 in London. The company’s 3,500+ clients have leveraged Kantox’s foreign exchange management solutions to trade $9.7 billion in 143 countries.