After going public earlier this year, Cardlytics has come out with its Q1 financial results, and a major new client. The data-driven marketing company has sealed a deal with JPMorgan Chase.

“We are pleased to announce the signing of an agreement for a national launch with JPMorgan Chase,” said Lynne Laube, COO and co-founder of Cardlytics. “The addition of Chase to the Cardlytics Purchase Intelligence platform will further strengthen our ability to provide powerful, actionable insights for our marketer clients and then act on these insights at scale.”

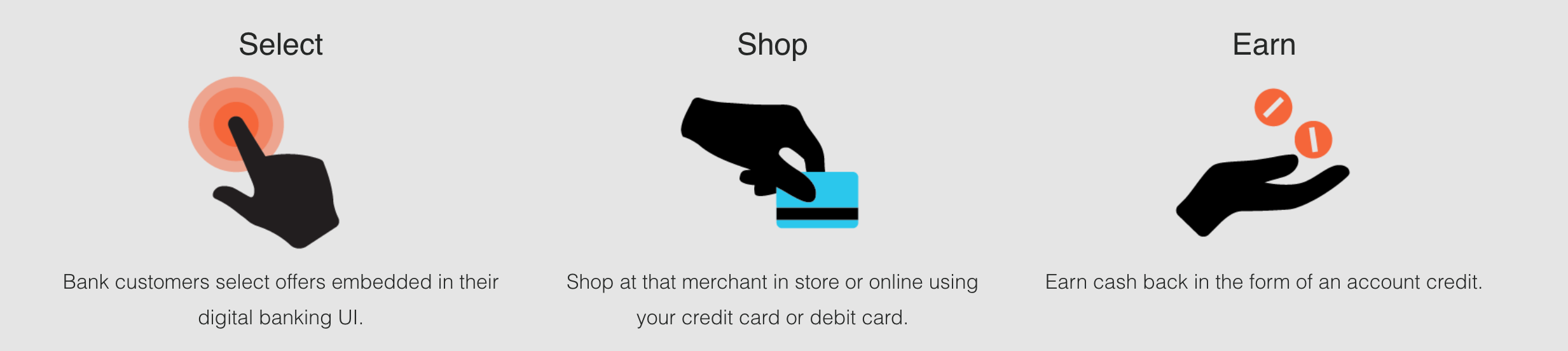

Cardlytics’ Purchase Intelligence platform is a loyalty program that banks implement with their existing debit or credit cards. Customers receive personalized offers and cash-back savings based on their transactions. This increases average consumer spend, boosts merchant loyalty, and drives more engagement within the bank’s online and mobile banking.

Chase joins a host of other banks and financial services companies already leveraging Purchase Intelligence, including PNC, Regions, SunTrust, Bank of America, Fiserv, FIS, and Digital Insight. David Evans, CFO of Cardlytics, said, “With the announcement that Chase will be coming onto our platform, we are very excited about the longer-term prospects for the business.”

Cardlytics’ primary offering is Cardlytics Direct, a native bank advertising channel that enables marketers to reach consumers through online and mobile banking channels. The service has more than 2,000 bank clients in the U.S. and appeals to bank customers by offering cash back on select purchases. In fact, Cardlytics has paid more than $230 million in consumer rewards to date.

At FinovateFall 2013, Cardlytics demoed its geolocation application, a solution that sends bank customers ads and offers based on their location. Making its public debut on the NASDAQ in February, the company has put forth strong growth for shareholders. In the first quarter of this year, Cardlytics’ total revenue was $32.7 million, an 22% YoY increase, and its direct revenue was $32.1 million, a 31% YoY increase.