It’s no secret that saving money is more difficult than spending it. That’s why, since the dawn of fintech, startups and FIs alike have been working on solutions to get users to keep money in the bank. Changes in these solutions have been subtle but persistent over the decade-plus time that companies have had to refine them.

Missed the other five savings categories? Check them out:

For the next week, we’re going to take a look at six different categorizations of savings technology. We’re kicking the series off by focusing on PFM platforms that use a goals-based approach. Don’t cringe! While PFM and basic budgeting technologies may seem like dinosaurs, they have outlasted many other fintech innovations because they have a stickiness that keeps customers coming back.

Goals-based PFM

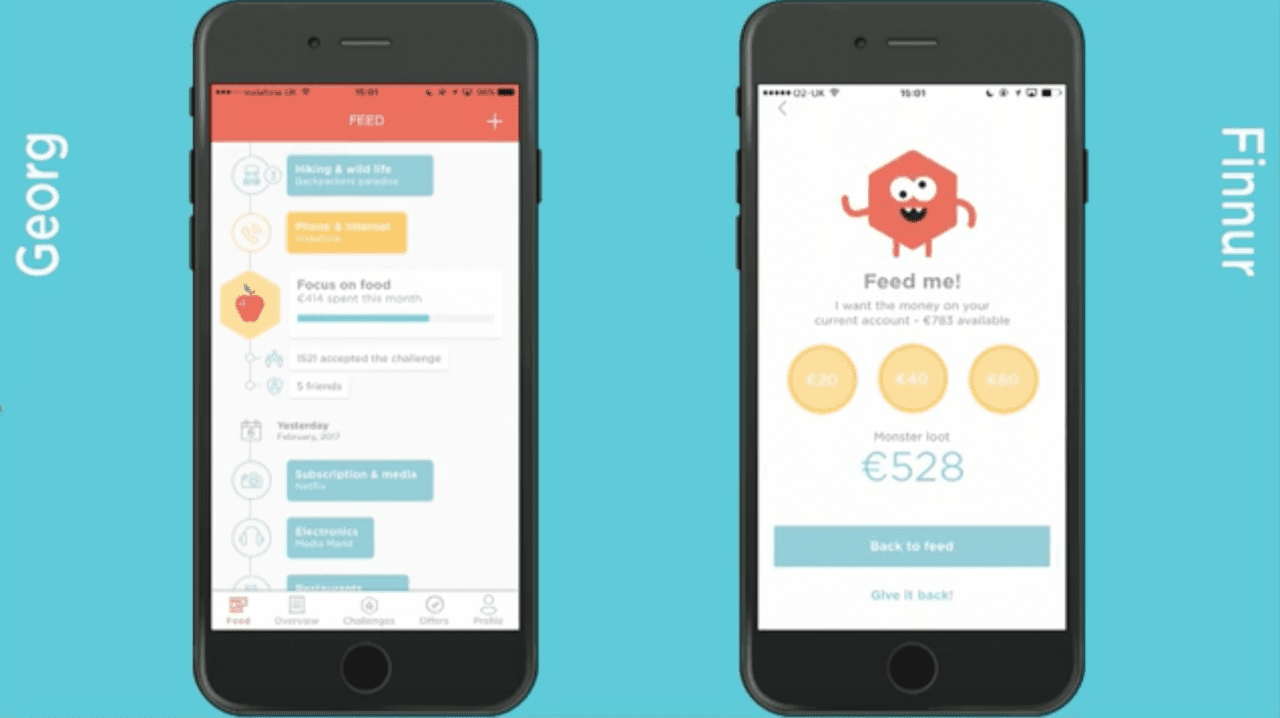

This category contains companies that have expanded beyond simple discretionary income budgeting to offer some type of goal-saving feature. Two good examples are Meniga, which launched Personal Finance Challenges at FinovateEurope 2017, and Qapital, which employs an If This, Then That (IFTTT) approach to saving. Qapital debuted at FinovateSpring 2014.

- Meniga

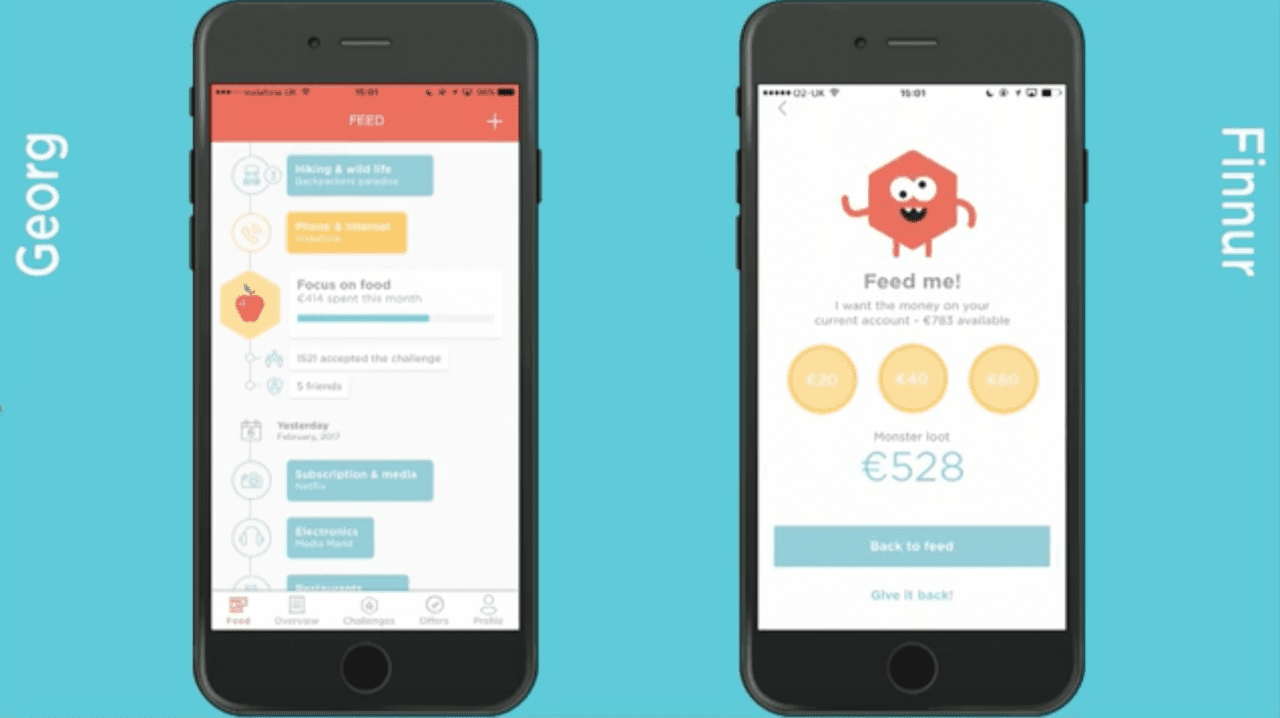

When U.K.-based Meniga launched Meniga Challenges at FinovateEurope 2017, the company’s CEO Georg Lúðvíksson referred to the new technology as “a new concept that is designed to motivate people with vastly different personality traits to become more financially fit.” The app-based challenges use behavioral psychology to motivate users to spend less and save more. In one instance, the app may appeal to the user’s competitive side by using social pressure to get them to spend less than their friends on groceries (pictured below on left). In another scenario, a cute Money Monster may appear at random intervals to get users to feed the monster by setting aside a bit of their cash (pictured below on right).

Meniga offers multiple approaches to appeal to diverse users

- Qapital

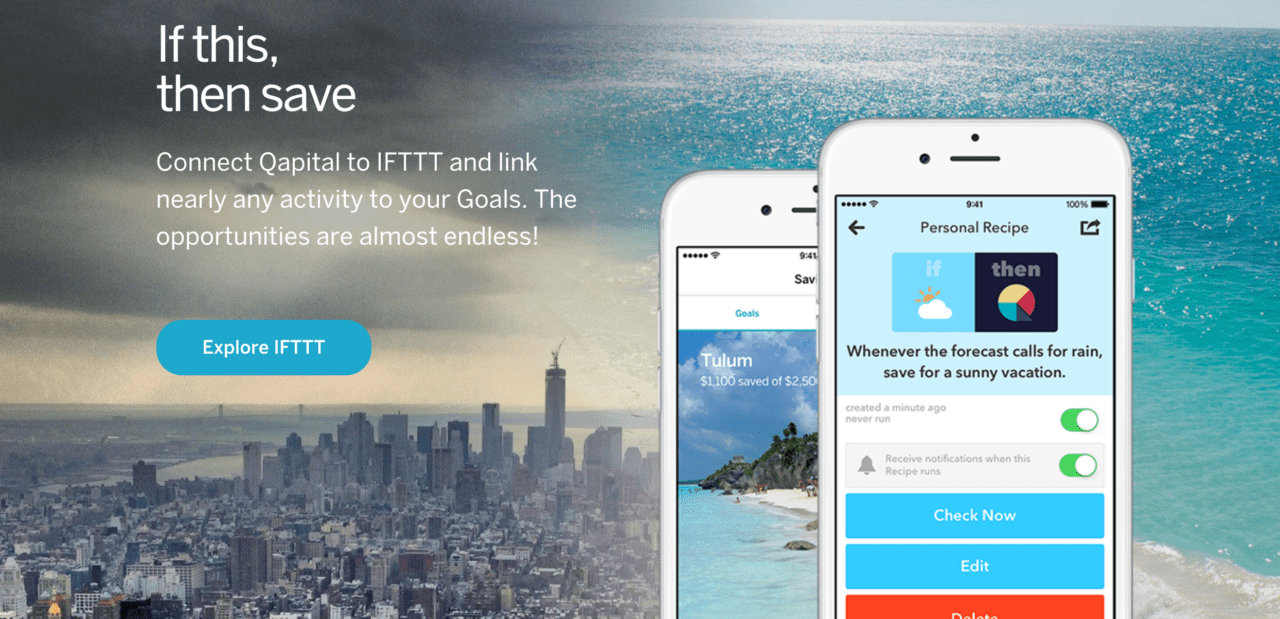

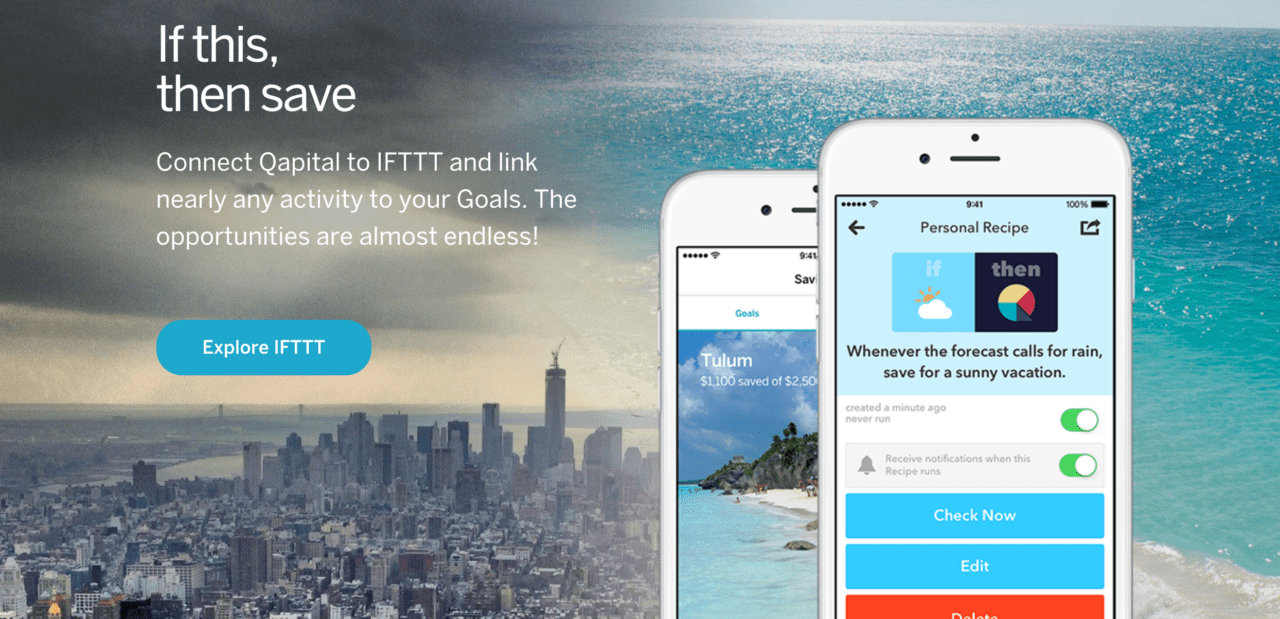

Qapital appeals to Millennials by using an IFTTT approach to saving, which allows users to set up IFTTT rules that set aside money when specified triggers occur. The company has more than 200 prompts, or channels, that pull information from third party apps. These prompts range from user-controlled ones, such as “set aside $5 every time I publish a post on Instagram with the hashtag #blessed”; to more unpredictable events, such as, “save $10 every time the weather calls for snow”; and even, “save $3 every time an astronaut enters orbit.”

Qapital’s IFTTT savings feature

Additionally, Qapital offers a savings feature that rounds up users’ daily purchases to the nearest dollar and deposits the change into their savings account. The Sweden-based company also supplies more traditional savings tools such as savings automation and goal-oriented transfers.

That’s a look at savings technology within PFM and how it applies to advice and goals. Stay tuned over the course of the week– we’ll examine the next five categories and investigate the companies that are pushing forward to encourage users to save.