Digital banking solutions company Meniga has brought in $8 million (€7.5 million) today in a round led by by new investor Industrifonden with participation from previous investors Frumtak Investment Fund, Velocity Capital Private Equity, and Kjolfesta. This boosts the London-based company’s capital to almost $23 million. Meniga plans to use the funds to strengthen its R&D efforts and bolster its sales team to meet current demand.

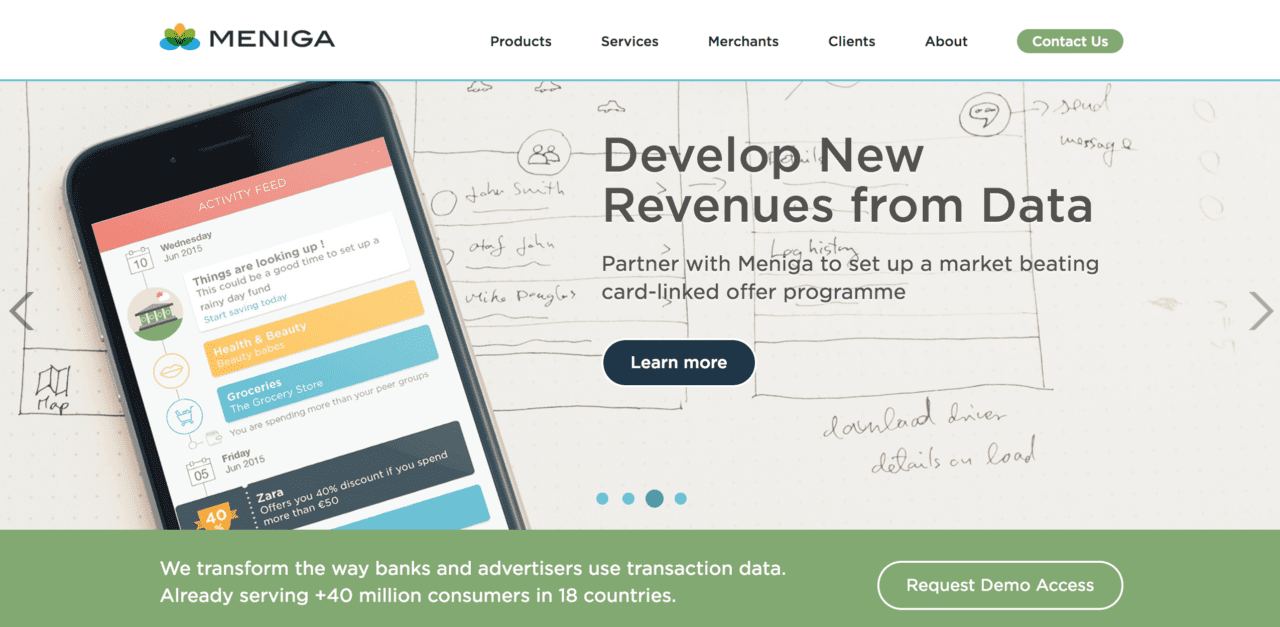

Founded in Iceland in 2009, Meniga helps banks in 18 markets leverage their customer data to market and up-sell products and services to the banks’ 40 million end customers. The company’s clients include Santander, Intesa, ING Direct, Commerzbank and mBank. In addition to its focus on harnessing banking data, Meniga’s latest challenge is helping banks comply with PSD2 regulations.

Meniga CEO Georg Lúðvíksson and Chief Product Owner Finnur Magnusson debuted Meniga Challenges at FinovateEurope 2016 earlier this year. The API offers a variety of ways to help users with different savings personalities save for goals or simply compete with their friends to spend less. We featured Meniga’s Challenges in our recent overview of the savings technology horizon last month.