FinovateSpring is less than one month away. Our annual spring conference returns to the City National Civic building near the campus of San Jose State University for a first look at the financial technologies of 2015. If you’ve been thinking about joining us the 12/13 of March for two days of live demos and professional networking, now is a great time to pick up your ticket and save your spot.

Today’s Sneak Peek preview brings you another handful of companies that will be presenting their technologies live on stage at FinovateSpring 2015 next month. In this edition, we introduce you to:

Check out the previous three installments of our Sneak Peek series below. And stayed tuned for Sneak Peek #5 next week.

- Sneak Peek Part 1: Alpha Payments Cloud, CUneXus, DRAFT, FundAmerica, SayPay, StockViews, and TrueAccord

- Sneak Peek Part 2: Bento for Business, DoubleNet Pay, Karmic Labs, SizeUp, Stratos, TickerTags, and Trulioo

- Sneak Peek Part 3: 3E Software, Corezoid, Malauzai Software, PayActiv, PsychSignal, Someone With Group, and Trizic

Transform the way your business makes international payments with Currency Cloud’s Payment Engine featuring an enhanced API for maximum efficiency.

Transform the way your business makes international payments with Currency Cloud’s Payment Engine featuring an enhanced API for maximum efficiency.

Features:

- Reach new customers

- Benefit from real-time wholesale rates

- Leverage a fast, secure payment network

Why it’s great

Powering global payments—Currency Cloud has built a technology-based payment engine that simplifies international payments and offers an easy integration for businesses of all sizes.

Presenters

Todd Latham, Vice President of Marketing

Todd Latham, Vice President of Marketing

Latham has extensive experience in the technology and financial service sectors, and he is fascinated at how technology is transforming people’s lives for the better.

LinkedIn

Rachel Nienaber, Vice President of Engineering

Rachel Nienaber, Vice President of Engineering

Nienaber is fluent in Ruby and Java, carrying 10+ years of experience in bespoke development projects. She is also responsible for ongoing technology development.

LinkedIn

Accepting payments just got easier. Introducing Dream Payments, a next-generation mobile payment platform accepting all forms of payment.

Accepting payments just got easier. Introducing Dream Payments, a next-generation mobile payment platform accepting all forms of payment.

Features:

- Sell anywhere; accept all payments

- Save time; grow your business

- Create customer experiences

- Safe and secure transactions

Why it’s great

Sell anywhere, anytime, in any format. Dream Payments enables merchants to accept payments anywhere, anytime, using mobile commerce solutions. Dream Payments are the future of mobile commerce.

Presenters

Christian Ali, Vice President, Business Development

Christian Ali, Vice President, Business Development

Ali has been a trusted advisor to the North American payments industry for nearly 20 years and currently serves as vice president of business development at Dream Payments.

LinkedIn

Anant Tailor, COO

Anant Tailor, COO

Tailor is the chief operating officer at Dream Payments where he is responsible for the daily operations of the company including product management; go to market strategy; and all customer engagements.

LinkedIn

Hip Pocket engages your mobile and website visitors by using social influence and personalized consultation to generate new, qualified mortgage leads.

Hip Pocket engages your mobile and website visitors by using social influence and personalized consultation to generate new, qualified mortgage leads.

Features:

- Unique peer-group comparisons

- Real-time integration and personalization savings estimates

- Results and call-to-action are customized to each user’s situation

Why it’s great

Hip Pocket allows your institution to provide an engaging, intuitive user experience that marries the emotional and logical decision-making processes.

Presenters

Mark Zmarzly, Founder, CEO

Mark Zmarzly, Founder, CEO

Zmarzly is a passionate innovator and thought-leader in the financial industry. He has delivered multiple TEDx talks and has presented for the ABA; BAI; and for JD Power & Associates.

LinkedIn

Todd Cramer, Head of Digital Experience and Design

Todd Cramer, Head of Digital Experience and Design

Cramer holds an MBA and has more than five years of experience in branding, user experience and eCommerce for a $5B bank enterprise.

LinkedIn

The INETCO analytics software application provides financial institutions with the game-changing knowledge of where, when, and how customers interact with their channels.

The INETCO analytics software application provides financial institutions with the game-changing knowledge of where, when, and how customers interact with their channels.

Features:

- View transaction data on-demand, across all banking channels

- Reduce failed customer interactions and resolve issues faster

- Adopt data-driven strategies that improve customer engagement

Why it’s great

INETCO Analytics will accelerate your omnichannel strategy with powerful, on-demand insights into customer behavior.

Presenters

Marc Borbas, VP Product Marketing

Marc Borbas, VP Product Marketing

With 12+ years of experience working with financial technology startups, Borbas drives the product strategy for INETCO’s real-time transaction-monitoring and customer-analytics solutions.

LinkedIn

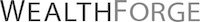

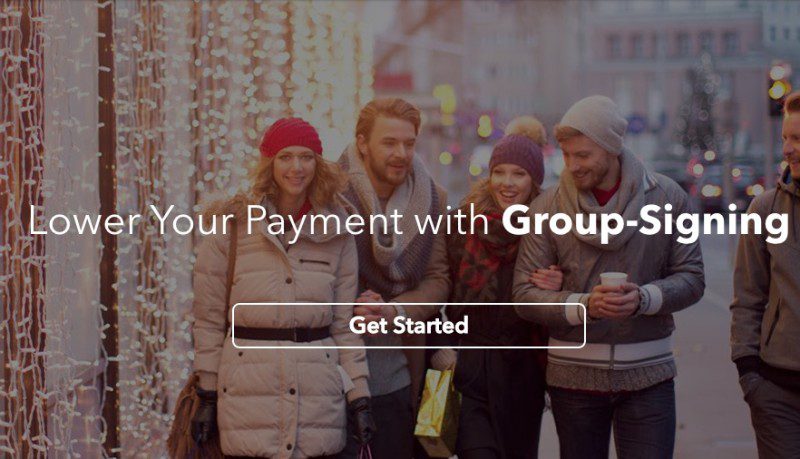

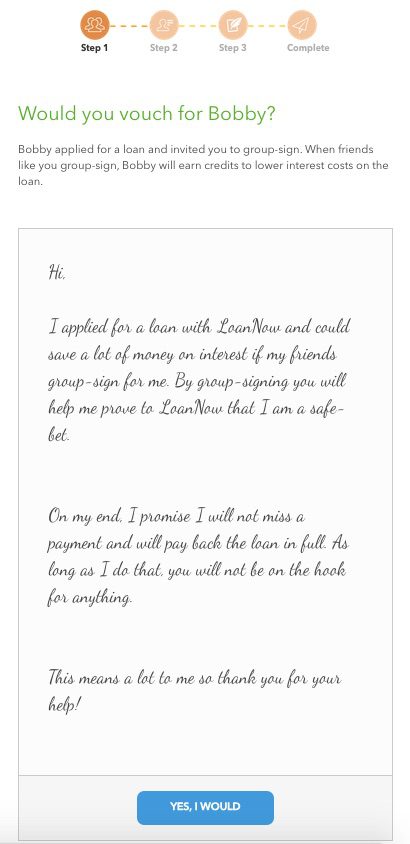

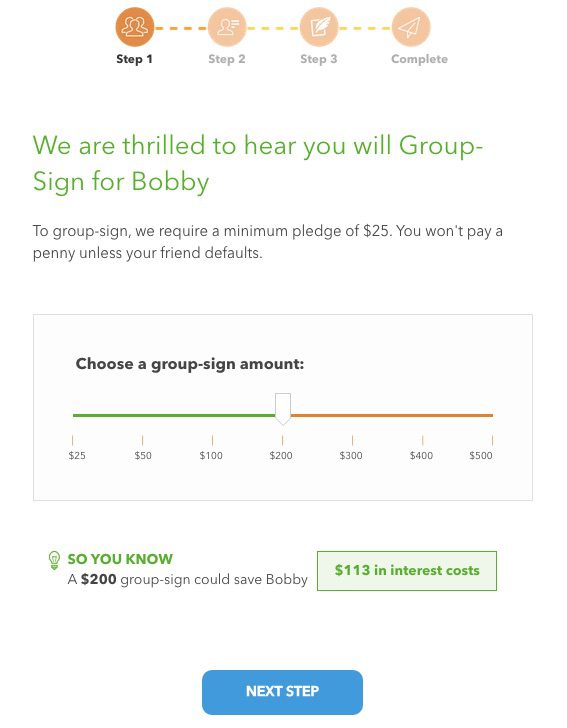

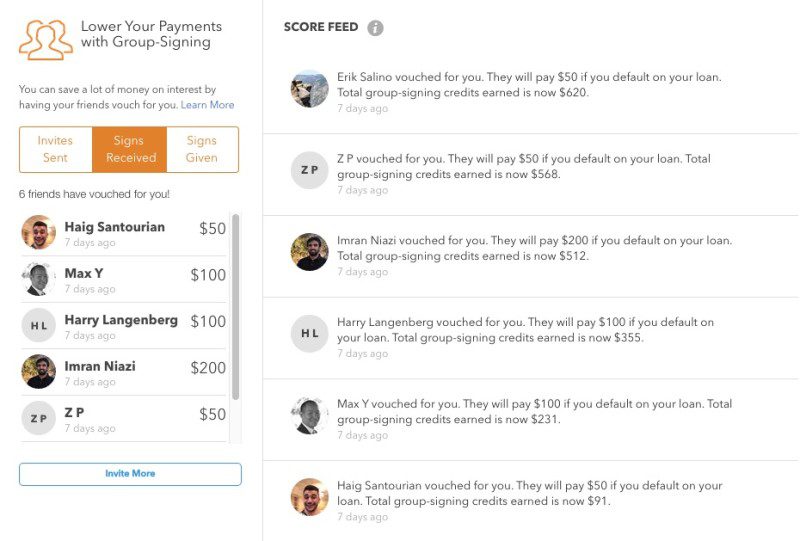

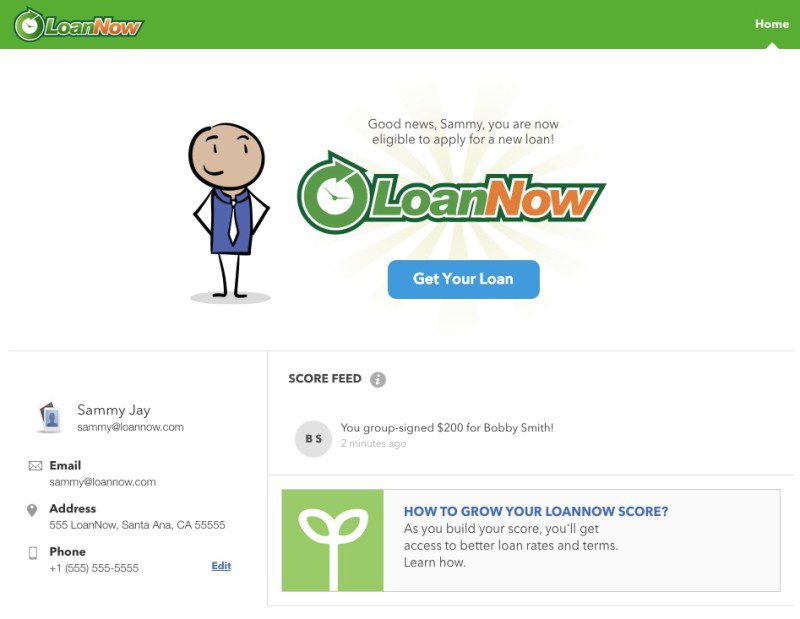

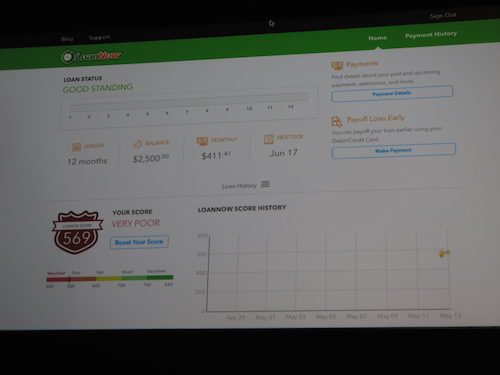

As a responsible lender, LoanNow’s motivational lending platform helps deep subprime borrowers secure affordable credit, then actively reduce APR within the loan term.

As a responsible lender, LoanNow’s motivational lending platform helps deep subprime borrowers secure affordable credit, then actively reduce APR within the loan term.

Features:

- Repayment-motivation algorithm incentivizes good financial behavior

- Active reduction in APR during loan for positive behaviors

- LoanNow to debut new features to lower the cost of credit

Why it’s great

LoanNow allows people to be more than a credit score and to actively reduce their cost of credit through positive financial behavior and loan management.

Presenters

Harry Langenberg, CEO, Co-founder

Harry Langenberg, CEO, Co-founder

Since graduating from the Wharton Business School, Langenberg has been a pioneer in bringing innovation to consumer finance. He’s founded Optima Tax Relief, SuperMoney, and Debtmerica.

LinkedIn

Miron Lulic, President, COO, Co-Founder

Miron Lulic, President, COO, Co-Founder

Lulic has spent his entire career at high-growth technology-driven companies. At LoanNow, Lulic leads product management, design, and marketing while also overseeing all other operations.

LinkedIn

Zahur Peracha, CTO

Zahur Peracha, CTO

After more than a decade of building and launching new products for Silicon Valley startups and Amazon.com, Zahur now leads all technology at LoanNow.

LinkedIn

WealthForge has launched the Invest Button, transforming the way private capital is raised by making the entire process faster, cheaper, and more compliant than ever before.

WealthForge has launched the Invest Button, transforming the way private capital is raised by making the entire process faster, cheaper, and more compliant than ever before.

Features:

- Simple, turnkey technology

- Straight-through processing

- Reduced transaction risk

Why it’s great

The WealthForge solution makes private placement transactions more efficient. The entire process has been reduced from months to weeks, costing nickels on the dollar, from risky to fully compliant.

Presenters

Arthur Weissman, Head of Sales and Marketing

Arthur Weissman, Head of Sales and Marketing

Weissman is an industry expert in helping to lead the move of private investing from offline to online. Weissman heads sales and marketing helping to make raising private capital faster and more efficient.

LinkedIn

Mat Dellorso, Co-Founder, President

Mat Dellorso, Co-Founder, President

Dellorso is a leading innovator in venture finance and has worked directly with FINRA and the SEC to establish regulations for online private investing.

LinkedIn

A global financial technology leader, Yodlee’s cloud-based platform powers dynamic innovation and solutions for digital financial services.

A global financial technology leader, Yodlee’s cloud-based platform powers dynamic innovation and solutions for digital financial services.

Features:

- Provides actionable financial advice

- Makes personalized recommendations

- Leverages Yodlee’s advanced data network

Why it’s great

Yodlee capitalizes on its unique data network and key data-driven insights to fundamentally change the digital banking experience.

Presenters

John Bird, VP, Product Marketing and Alliances

John Bird, VP, Product Marketing and Alliances

Bird, as VP of product marketing and alliances at Yodlee, is responsible for the marketing of the Yodlee platform to financial institutions and startup financial technology companies.

LinkedIn

Katy Gibson, VP Product Applications

Katy Gibson, VP Product Applications

Gibson, as VP of product applications at Yodlee, is responsible for the creation and execution of product strategy for Yodlee’s suite of financial management applications.

LinkedIn

Todd Latham, Vice President of Marketing

Todd Latham, Vice President of Marketing Rachel Nienaber, Vice President of Engineering

Rachel Nienaber, Vice President of Engineering

Christian Ali, Vice President, Business Development

Christian Ali, Vice President, Business Development Anant Tailor, COO

Anant Tailor, COO

Mark Zmarzly, Founder, CEO

Mark Zmarzly, Founder, CEO Todd Cramer, Head of Digital Experience and Design

Todd Cramer, Head of Digital Experience and Design Marc Borbas, VP Product Marketing

Marc Borbas, VP Product Marketing

Harry Langenberg, CEO, Co-founder

Harry Langenberg, CEO, Co-founder Miron Lulic, President, COO, Co-Founder

Miron Lulic, President, COO, Co-Founder Zahur Peracha, CTO

Zahur Peracha, CTO Arthur Weissman, Head of Sales and Marketing

Arthur Weissman, Head of Sales and Marketing Mat Dellorso, Co-Founder, President

Mat Dellorso, Co-Founder, President

John Bird, VP, Product Marketing and Alliances

John Bird, VP, Product Marketing and Alliances Katy Gibson, VP Product Applications

Katy Gibson, VP Product Applications