An investment of $460 million in Swedish e-commerce payments innovator Klarna takes the company’s valuation to $5.5 billion, and makes it the largest private fintech firm in Europe. The funding will help fuel Klarna’s international growth, especially in the United States, where it has been gaining new customers at a rate of six million a year.

Dragoneer Investment Group led the round. Commonwealth Bank of Australia, HMI Capital LLC, Merian Chrysalis Investment Company Limited, Första AP-Fonden (AP1), IPGL, IVP, and funds and accounts managed by BlackRock also participated. Combined with the financing from a round this spring, the investment gives Klarna more than $1.2 billion in total capital.

For company CEO and co-founder Sebastian Siemiatkowski, the funding comes at a moment of great opportunity for fintechs like Klarna that are innovating in the area of consumer finance. “This is a decisive time in the history of retail banking,” he said. “Finally, transparency, technology and creativity will serve the consumer, and there will be no more room for unimaginative products, non-transparent terms of use or lack of genuine care of ones customers.”

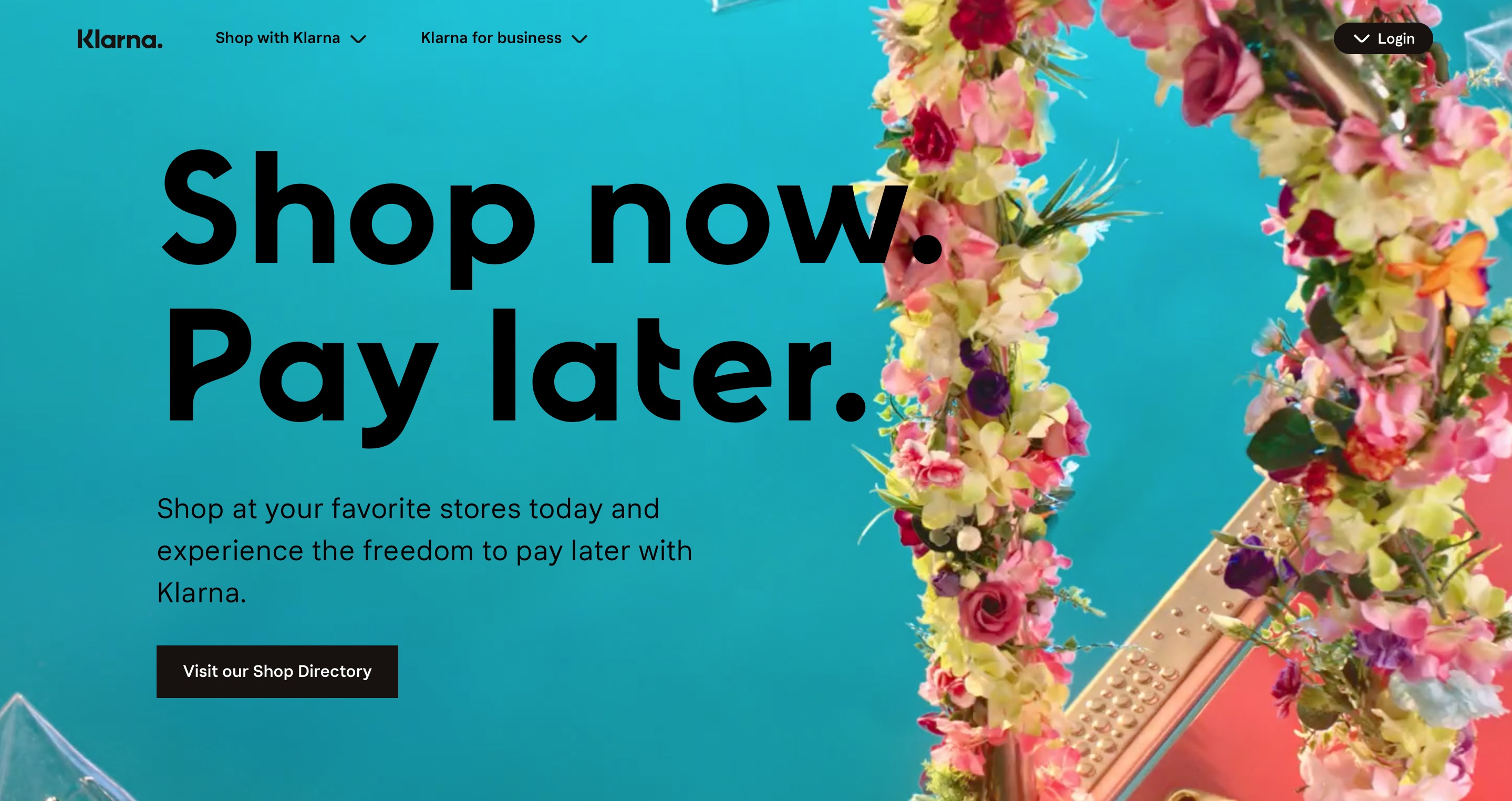

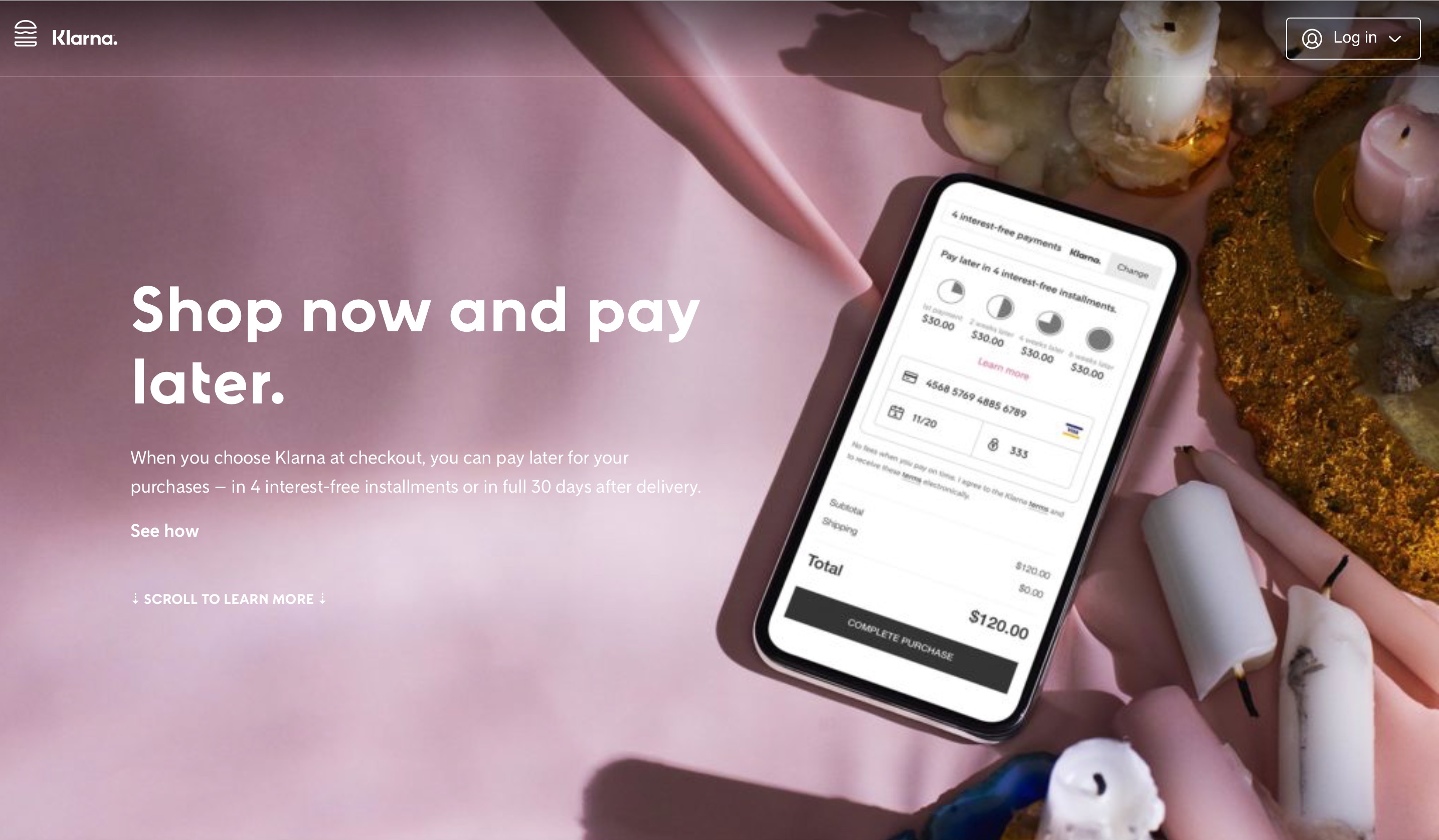

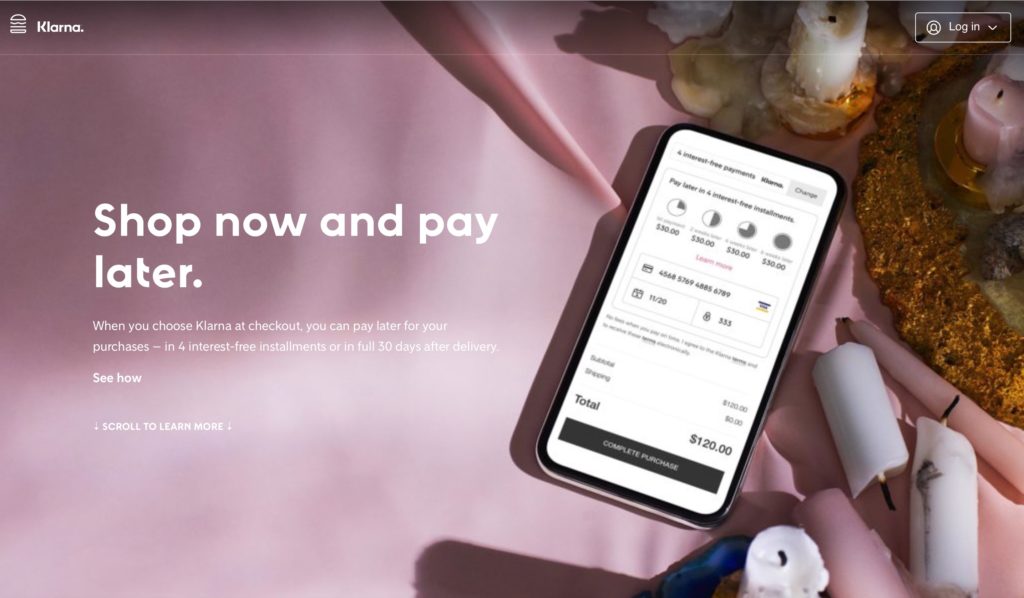

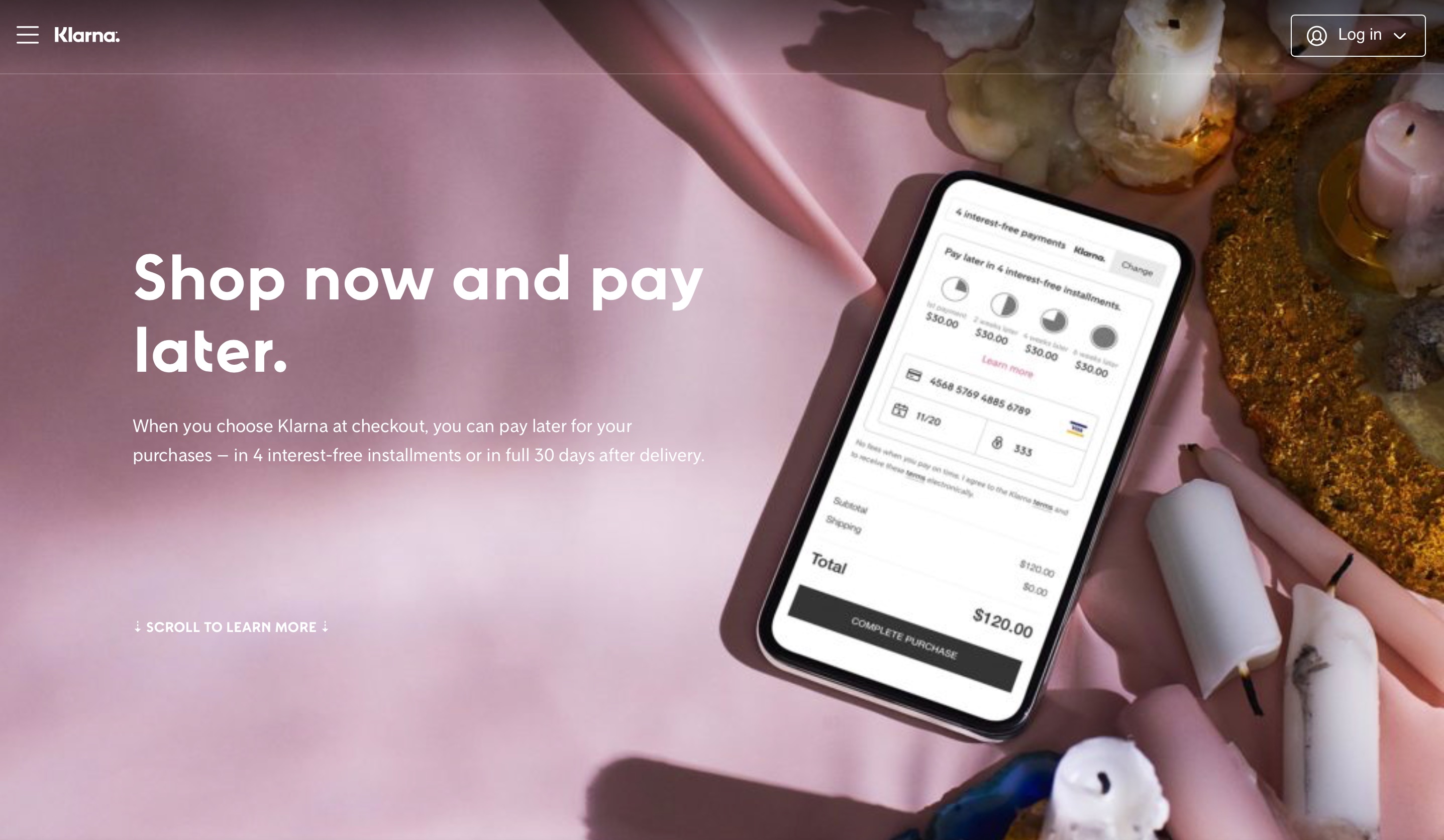

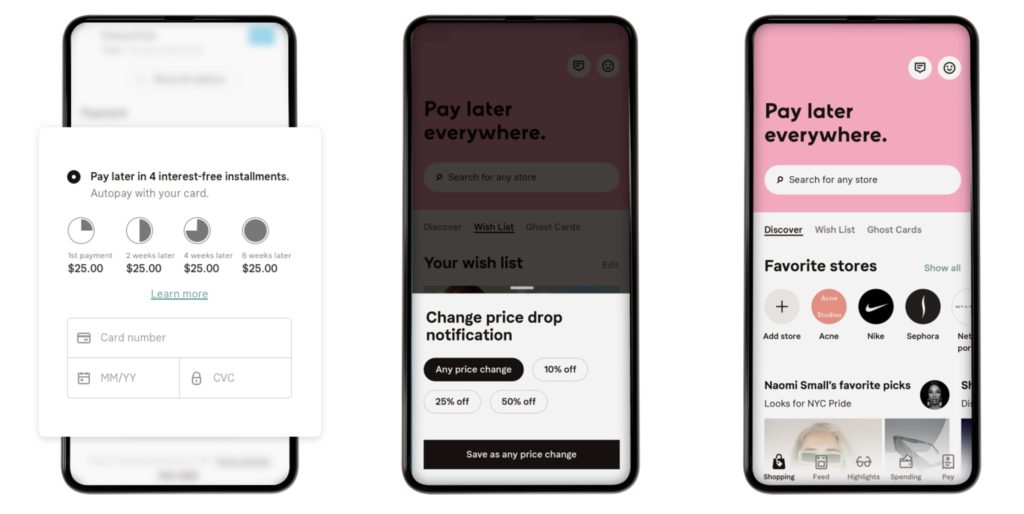

Klarna’s Shop Now Pay Later approach to e-commerce enables consumers to pay for purchases at leading, brick and mortar retailers as well as with online merchants, with a variety of interest-free, no-fee financing offerings. These include a four installment payment option that charged every other week to the customer’s credit or debit card, and 30-day payment period that begins once the item is shipped or received.

Klarna has more than 60 million shoppers using its offerings, and 130,000 retailer partners around the world. Richard Watts of Merian Chrysalis Investment Company credited Klarna with providing its merchant partners with “considerable improvement in customer engagement and sales.” In fact, Klarna reports that merchants that are offering its four installment payment plan have experienced a 68% increase in average order value, a 44% increase in conversion v.s. cards, and a 21% higher purchase frequency.

“Klarna is one of Europe’s great fintech success stories and the company continues to develop truly innovative payment solutions,” Watts said.

The funding news for Klarna arrives amid a flurry of new service offerings, such as making its Shop Now Pay Later option available in-store, as well. It has also been a big year for products, from the launch of its global customer authentication platform to unveiling of its open banking platform. 2019 has also been a busy year in terms of partnerships: Klarna joined global fashion retailer ASOS in an expansion to the U.S., teamed up with U.K. fashion brand Superdry, and partnered with Canadian e-commerce and in-store point-of-sale financing company PayBright.

Founded in 2005 and headquartered in Stockholm, Sweden, Klarna demonstrated its platform at FinovateSpring 2012.