On Finovate.com

- Microsoft Marketing Vet Jeremy Korst Joins Avalara as New CMO.

Around the web

- New York-based BizFi reaches $2 billion in originations.

- LTP: Trulioo CEO Stephen Ufford writes about the problem of gift card fraud.

- Boku extends partnership with Microsoft to support carrier billing to France.

- Exostar teams up with Taulia to bring supply chain finance to the aerospace and defense industry.

- Avoka, SocietyOne, and SuiteBox named finalists for Fintech Business Awards.

- HBR: Narrative Science CEO Stuart Frankel writes about talking chatbots.

- Quantopian recognized by Boston Globe as a “Company to Watch in 2017.”

- Let’s Talk Payments features Kontomatik’s successful 2016.

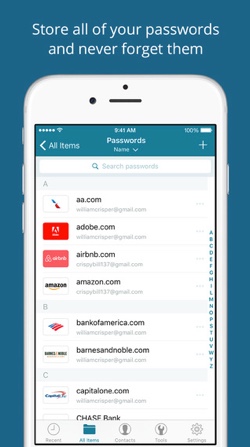

- Dashlane to support Intel Software Guard Extensions to help protect your passwords with hardware-enhanced security.

- OurCrowd marks 4 years, $320m raised, 100 startups, 9 exits.

This post will be updated throughout the day as news and developments emerge. You can also follow all the alumni news headlines on the Finovate Twitter account.

“The app combines the same convenience and functionality of the previous version,”

“The app combines the same convenience and functionality of the previous version,”