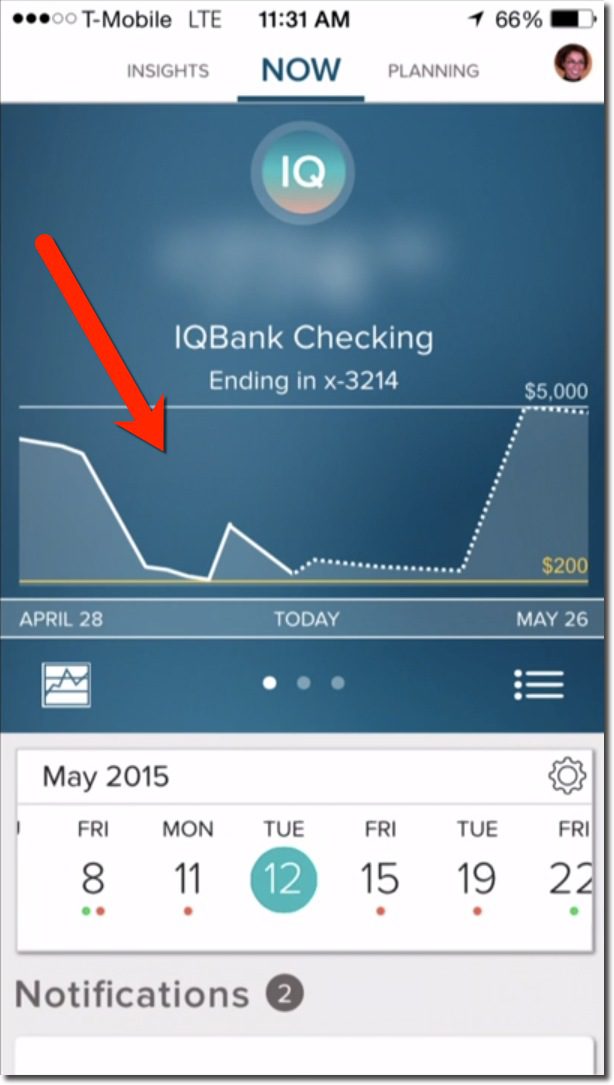

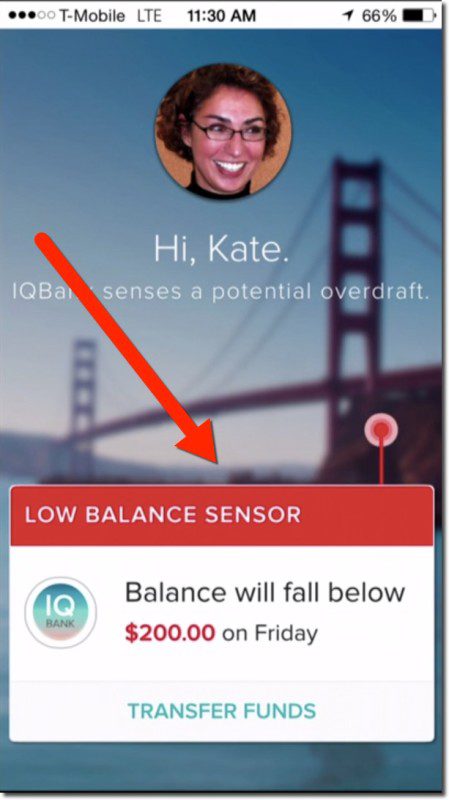

For several years I’ve used the forward-looking balance feature from Simple’s “Safe to Spend” and Key Bank’s MyControlBanking as a great example of where banking/PFM is headed (see notes 1, 2, 3). But this seemingly vital PFM feature has not been adopted by other major players.

For several years I’ve used the forward-looking balance feature from Simple’s “Safe to Spend” and Key Bank’s MyControlBanking as a great example of where banking/PFM is headed (see notes 1, 2, 3). But this seemingly vital PFM feature has not been adopted by other major players.

My hypothesis is that banks are (rightly) afraid of the cost (customer service, litigation, fines, CFPB backlash) if it doesn’t work perfectly. The false positive problem is especially daunting (note 3). You tell customers they are good to go and then Monday morning you bounce two of their checks collecting $70 in OD fees.

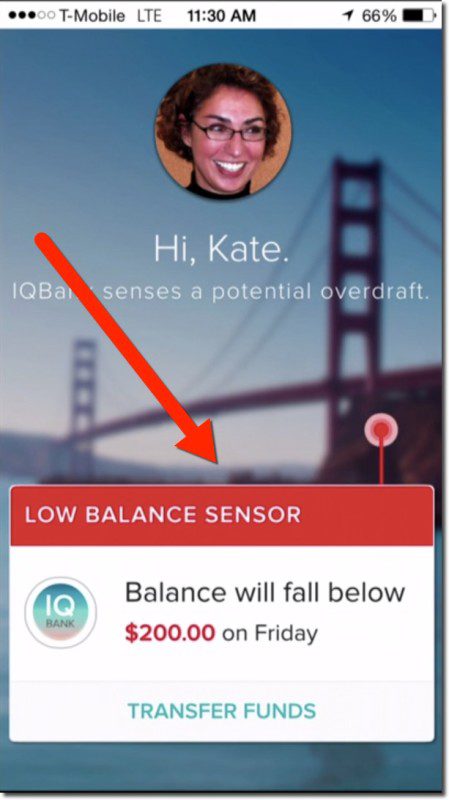

Enter Yodlee’s version of the forward-looking balance summary, Sense. The service made its industry debut at FinovateSpring last month (video here and below). With 15 years’ experience providing mega-banks with data aggregation and PFM services, it may have the necessary credibility to power forward-looking banking features for its client banks.

Bottom line: Regardless of where the algorithms are sourced, I hope banks come to their senses soon, and offer seamless money-management guidance.

——-

Yodlee Sense demo at FinovateSpring 2015 (13 May)

——–

Notes:

1. U.K.’s stealthy banking startup Mongo appears to be working on a similar function.

2. Simple was acquired by BBVA Compass in 2014 for $117 million.

3. Moven provides a compelling alternative-spending feedback/prediction system which is less likely to produce false positives. The neo-bank startup constantly compares your spending velocity with historical trends, to provide a real-time green-light/red-light indicator when you are headed towards overspending (see its FinovateSpring Best of Show 2015 demo here). For extra credit, the Moven app makes it easy to lock away the extra cash saved in the lower spending months.