3E Software’s Teslar offers a fully integrated system to track loans. Its lending and credit management tools offer multiple services to track commercial debt.

Company facts:

- Self-funded

- 100% employee owned

- Five-year annual average revenue growth rate of 150%+

- Average customer ROI totals 200%

3E’s Teslar toolbox integrates with all of a bank’s systems to present commercial loan officers with portfolio and performance data. What is unique about Teslar’s platform, according to CEO Joe Ehrhardt, is that it aggregates multiple tools to offer a cradle-to-grave approach to assist with all phases of loan management.

Teslar’s capabilities are highly configurable and suitable for small community banks, as well as large regional banks.

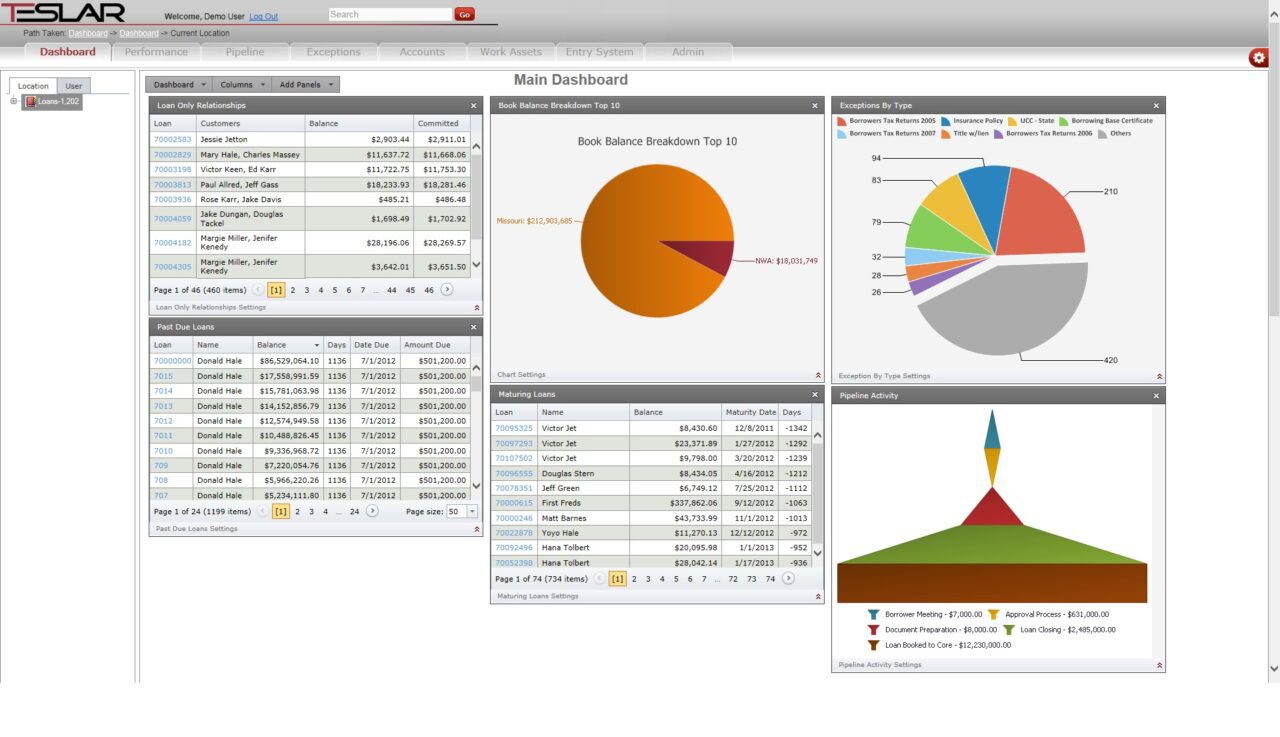

Dashboards

Teslar’s dashboards offer a customized overview of loan-related stats and facts pertaining to specific concerns. Banks can configure dashboards at the branch level and even the user level by using filters. And managers can use it to compare various teams of loan officers.

Upon logging in, the lender sees the main dashboard (below) which outlines maturing loans, past-due loans, exceptions, and covenants. This overview highlights important factors for that day. Users simply click through graphs for details and borrower contact information.

Teslar’s Main Dashboard (above)

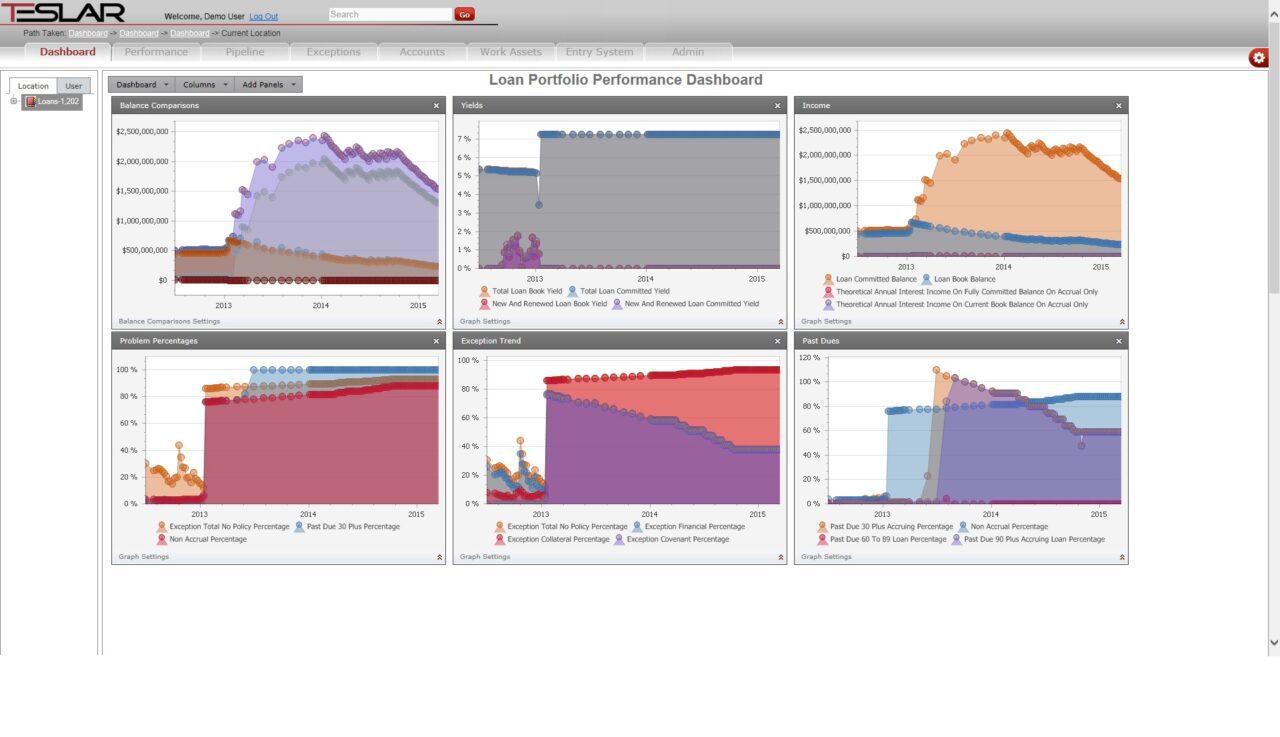

The Loan Portfolio Performance Dashboard (below) graphs six aspects of a loan portfolio:

- Balance comparison

- Yields

- Income

- Problem percentages

- Exception trends

- Past dues

Similar to the main dashboard, users can customize each graph.

Teslar’s Loan Portfolio Performance Dashboard (above)

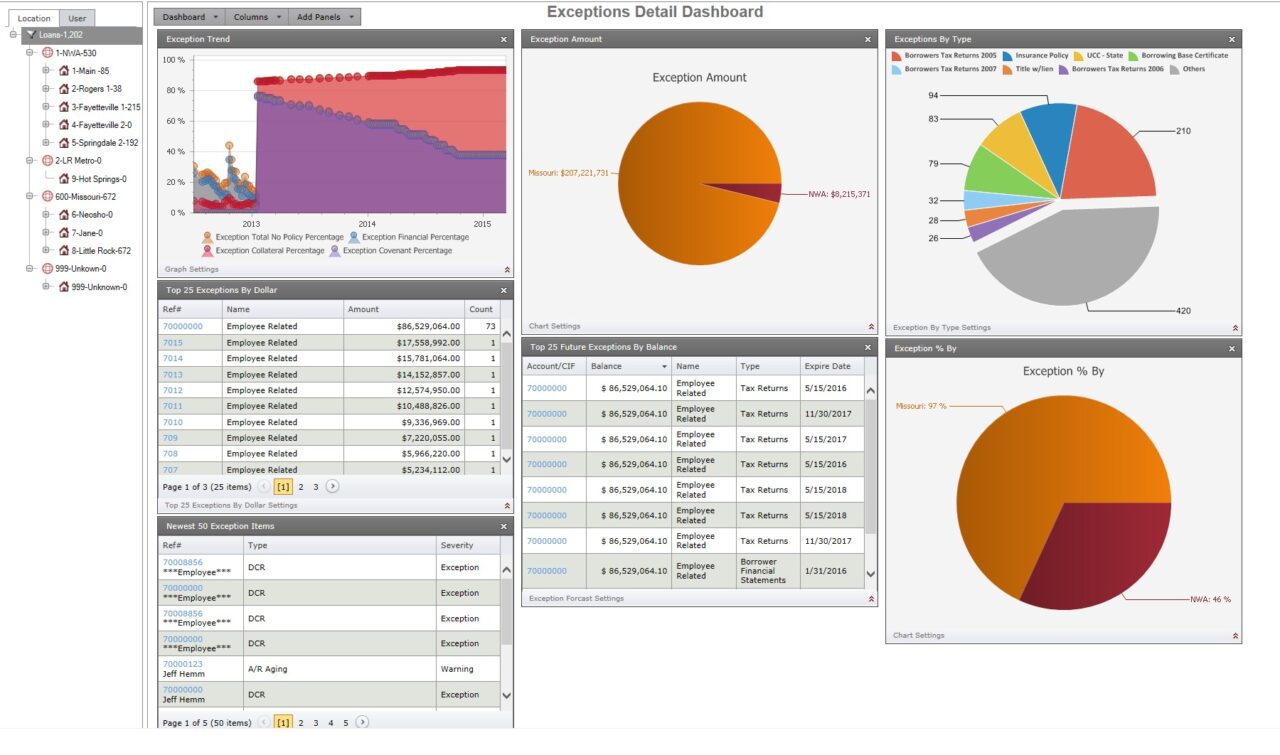

Exception tracking

Teslar supports five different types of exceptions: collateral, credit, policy, financial, and covenant (see section below). Its reporting system minimizes the need for data entry and helps quality-control groups find irregularities faster.

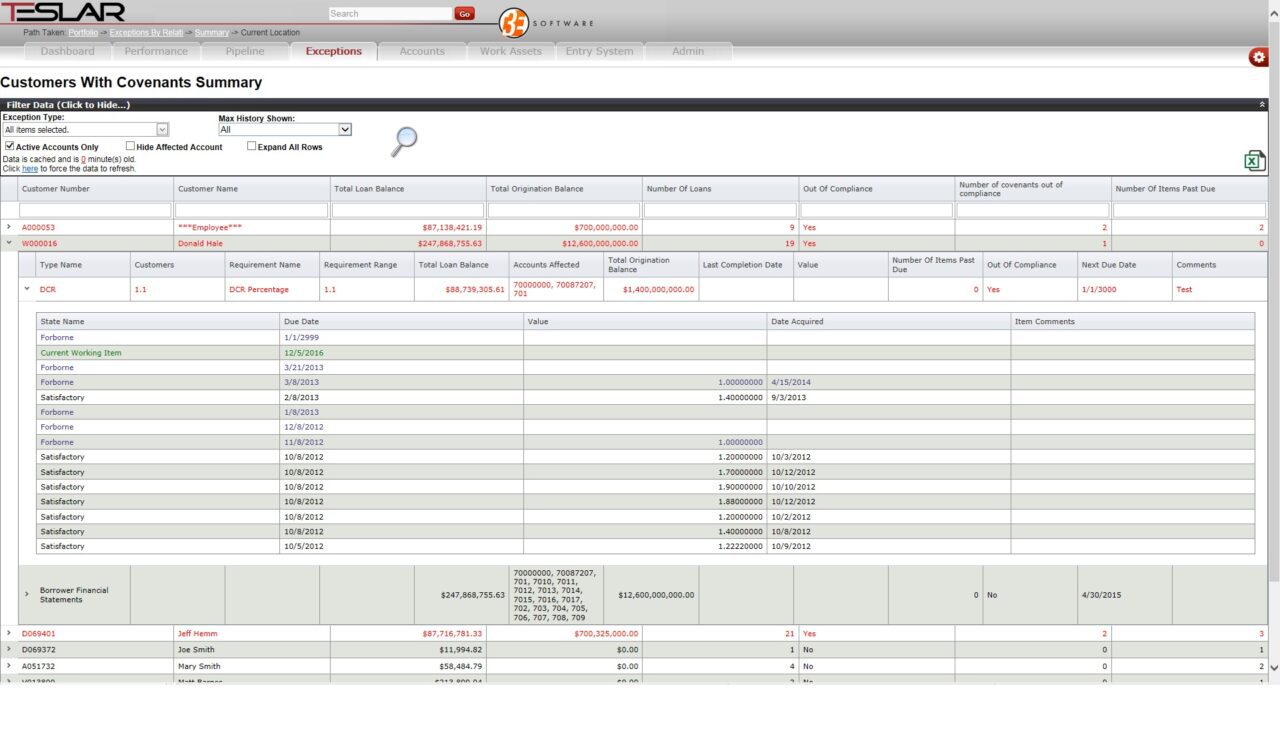

Covenant tracking

Banks that service large commercial loans with complex covenants often need a system to track and monitor them. Covenant tracking is one of the more popular modules.

Teslar pulls in information for each covenant, then tracks loan documents, calculates values such as debt-service-coverage ratios, and maps the historical values over time.

![]()

Tailored Covenant Exception Summary (above)

Teslar also offers a waiver and forbearance system that helps banks handle covenants in default.

Summary of Customers with Covenants (above)

Summary of Customers with Covenants (above)

We’ve looked at just three of Teslar’s large feature set. 3E Software can also integrate with a bank’s entire lending system, including:

- Image systems

- Origination systems

- Core

- Factoring

- Small businesses

3E Software demoed Teslar live at FinovateSpring 2015 in San Jose. It is the first company from Arkansas to take the Finovate stage.