This post is part of our live coverage of FinovateSpring 2015.

NAMU is on stage now. The company’s “social spending behavior algorithm” helps FI’s better engage their customers.

NAMU is on stage now. The company’s “social spending behavior algorithm” helps FI’s better engage their customers.

NAMU delivers a new standard in mobile banking by implementing new and intelligent behavior modeling, which focuses on customer behavior and digital experiences. All of this is based on a patent-pending “social spending behavior algorithm.” The product highlights include: highly visual user experience, Google-like search through the customer’s entire transaction history and across all banking products, new data organization, contextual, personal, and relevant permission-based advertising of targeted offers, promotion, and loyalty services to consumers as well as a virtual personal branch. For each bank, NAMU connects easily to many complex banking systems with a centralized API and data-centric architecture.

Presenters: Thomas Ko, co-founder and president, and Piotr Budzinski, co-founder and CEO

Product Launch: November 2014

Metrics: Early start-up phase, raised $200,00 from two angel investors; 10 employees

Product distribution strategy: Direct to Business (B2B), through other fintech companies and platforms

HQ: Mahwah, New Jersey

Founded: February 2014

Website: namuapp.com

Twitter: @namuapp

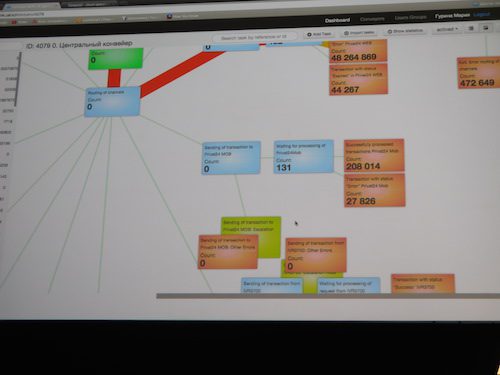

Corezoid is making its way to the stage now. The company is demonstrating its cloud-based platform to help FIs build better business processes.

Corezoid is making its way to the stage now. The company is demonstrating its cloud-based platform to help FIs build better business processes.