Alternative small business lending platform Behalf has benefitted from its ties with Visa this week. The New York and Israeli-based company announced it landed an undisclosed amount of funding from the payments giant, marking Visa’s first investment in an Israeli company.

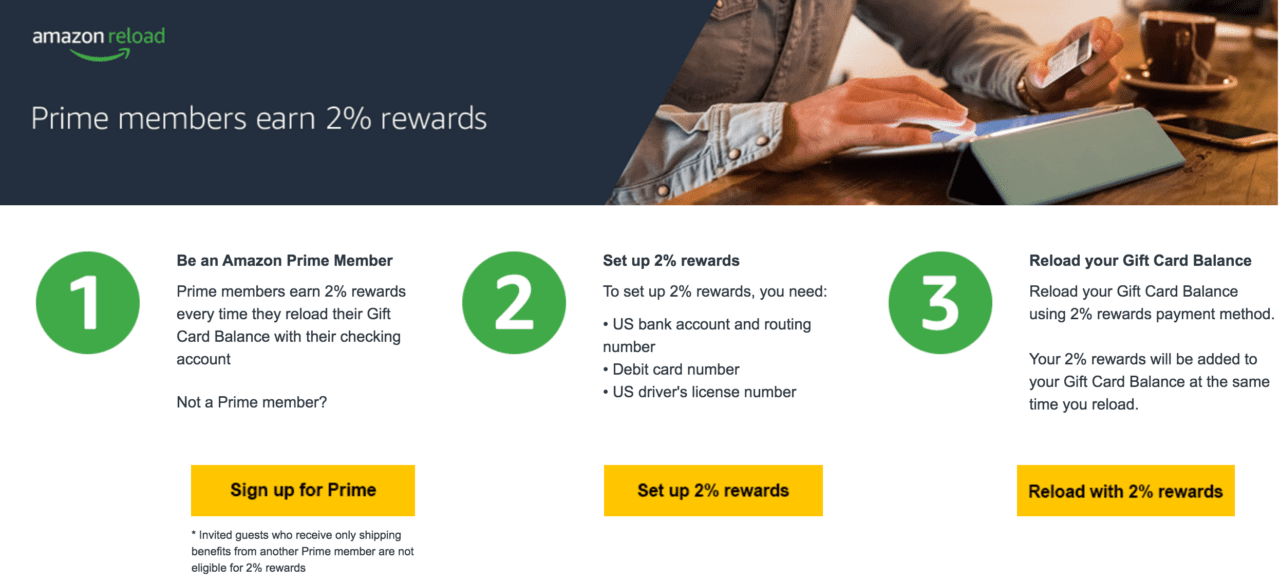

The investment will be added to Behalf’s previous total funding of $306 million in combined debt and equity. As part of today’s deal, Visa will have access to Behalf’s small business clients to market its tokenized Visa Virtual Card, a payment solution that offers businesses instant financing for business purchases. Visa will begin marketing the card in the U.S. and expand to more markets later this year.

“Our network of B2B merchants can fit Behalf seamlessly into their eCommerce flow, receive payment immediately and provide their business customers with more buying power and flexible payment options at checkout,” said Benjy Feinberg, Behalf CEO. “We are proud to partner with Visa with the goal of making purchases easier.”

The partnership is part of Visa’s strategy to promote its products through collaborations with startups and fits with the company’s commitment to invest up to $100 million in fintechs. Shahar Friedman, acting general manager for Visa in Israel, described small businesses as being “the backbone” of the global economy. “This partnership is a result of a close collaboration between the Visa Innovation Studio Tel Aviv and the dynamic Israeli start-up ecosystem to bring the power of the VisaNet global network to promising young companies in Israel such as Behalf,” he added.

Founded in 2012, Behalf offers short-term purchase financing for small-to-medium-sized businesses (SMBs). Unlike other alternative SMB lenders such as Kabbage or OnDeck, Behalf does not issue funds directly to the SMB. Instead, the startup pays the small business’ vendors on the SMB’s behalf. Having flexibility in repaying their suppliers helps merchants increase their production and ultimately grow their business.

Feinberg showcased Behalf’s vendor payment platform at FinovateFall 2014. Since then, the company has partnered with FinWise bank to offer SMB clients a broader range of financing solutions and, earlier this year, secured $150 million in debt financing.