Business Insider rounded up the 40 most exciting people in fintech in the United Kingdom. As it turns out, Brexit isn’t enough to shake the fintech scene in the U.K. In fact, according to KPMG, British fintech startups raised $962 million in 2015. Of that amount, London companies raised $743 million.

Business Insider rounded up the 40 most exciting people in fintech in the United Kingdom. As it turns out, Brexit isn’t enough to shake the fintech scene in the U.K. In fact, according to KPMG, British fintech startups raised $962 million in 2015. Of that amount, London companies raised $743 million.

The list includes these seven leaders from Finovate and FinDEVr alumni:

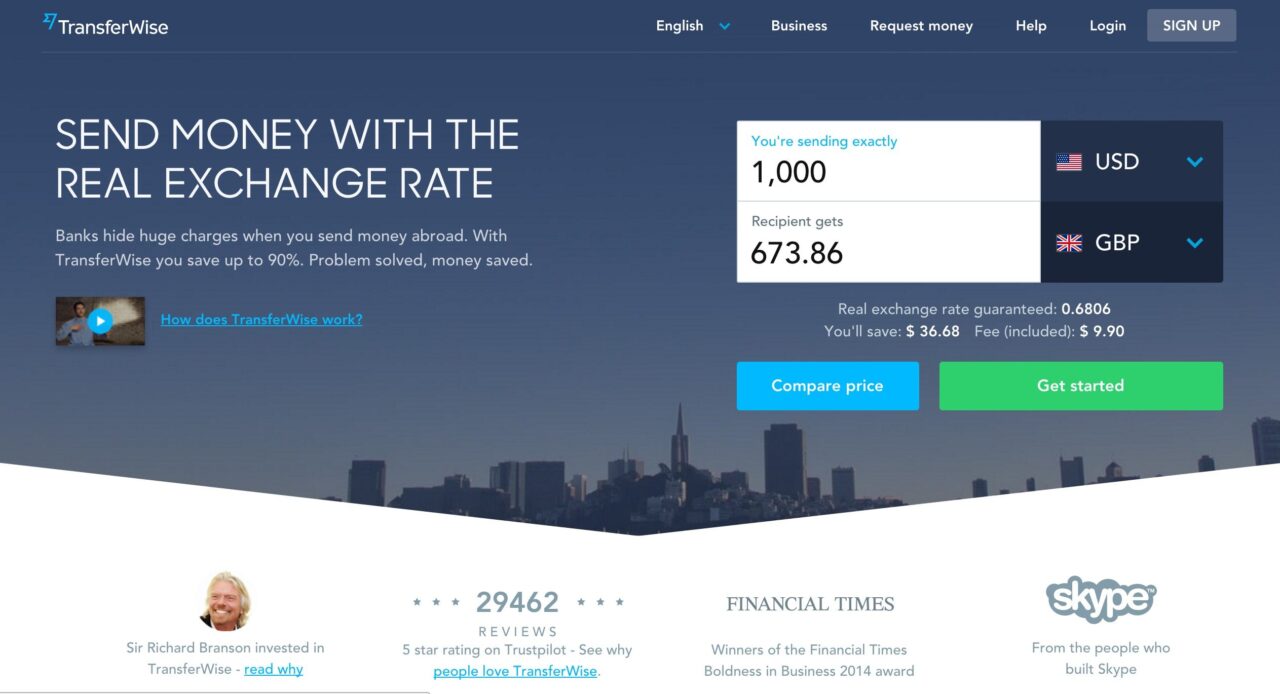

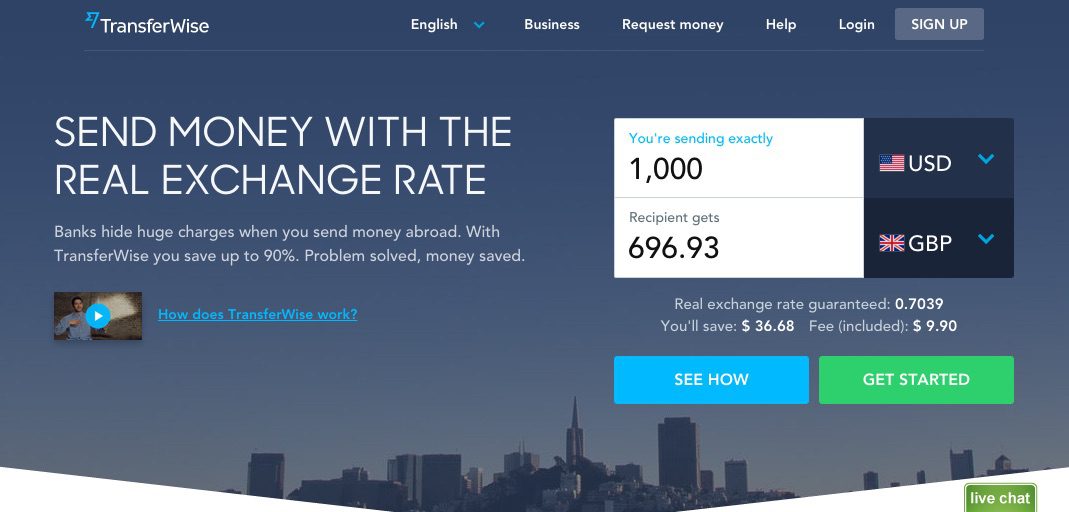

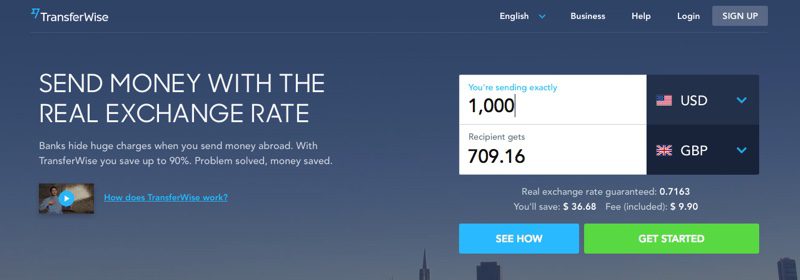

Taavet Hinrikus, CEO and cofounder of TransferWise

- Rank: 2

- Founded: 2010

- Funding: $91 million

- FinovateEurope 2013 demo

Marta Krupinska, General Manager and cofounder of Azimo

- Rank: 9

- Founded: 2012

- Funding: $33 million

- FinovateEurope 2013 demo

Nikolay Storonsky, CEO and cofounder of Revolut

- Rank: 10

- Founded: 2013

- Funding: $7 million

- FinovateEurope 2015 demo

Giles Andrews, Executive Chairman and cofounder of Zopa

- Rank: 25

- Founded: 2005

- Funding: $80 million

- FinovateSpring 2008 demo

Peter Smith, CEO and cofounder of Blockchain

- Rank: 32

- Founded: 2011

- Funding: $30 million

- FinDEVr Silicon Valley 2014 presentation

Usman Khan, CTO and cofounder of Algomi

- Rank: 33

- Founded: 2012

- Funding: undisclosed

- FinovateFall 2014 demo

Nick Hungerford, CEO and founder of Nutmeg

- Rank: 36

- Founded: 2011

- Funding: $46.6 million

- FinovateEurope 2012 demo

Check out all 40 leaders who made the list. Wonder how Business Insider made its selections? Here’s how the publication described its process:

We looked at who’s done cool and interesting things in the past year, including companies that have raised money or grown rapidly. We’ve also tried to include some of the less obvious names—the people doing great things behind the scenes—as well the faces out front.