What do you get when you cross a serial entrepreneur identity/security expert (who has created billions of dollars for investors) with a technologist responsible for moving more than a quadrillion dollars every year in his previous incarnation as Citibank CTO?

In a word: Token, a new way to secure payment ecosystems based on end-to-end secure protocols and digital signatures that is designed specifically for payments.

“Regulators are demanding faster, more secure payments for banks,” Token CEO Steve Kirsch said. “We supply software so (they) can meet those needs.”

Left to right: Token CTO Yobie Benjamin and CEO Steve Kirsch demonstrated Token at FinovateSpring 2015.

Kirsch initially had been interested in taking a bitcoin-oriented path toward creating a better payment system for banks (think Ripple). But he decided that innovating with bank technology was a “much better strategy” than dealing with many of the frustrations of the bitcoin world (including the difficulty in getting a business bank account as a bitcoin company).

What Kirsch and his team have developed is an end-to-end payments system complete with account ledger, money-transfer protocol, identity server, mobile and web apps, and developer tools. It’s a solution Kirsch says is faster than ACH, less expensive than wire transfer, and more secure (and less expensive for businesses) than credit cards. And instead of a shared-secrets regime of passwords and account numbers, Token relies on state-of-the-art cryptography and pamper-proof digital signatures.

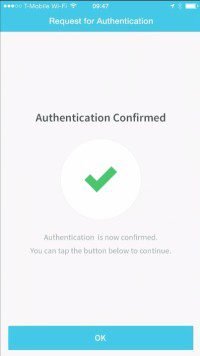

In their Finovate debut, Kirsch and Chief Technology Officer Yobie Benjamin showed four different ways that banks can use Token to offer a variety of faster, more secure services to their customers: mobile payments, billpay, authentication, and push notifications for payment authorization. Token also introduced its API to show how easy it is for developers to use the technology.

Company facts:

- Founded January 2012

- Headquartered in Palo Alto, California

- 10 employees

- More than $50 billion in sales leads

How it works

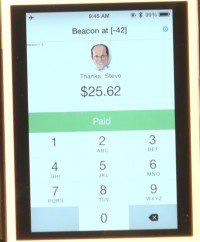

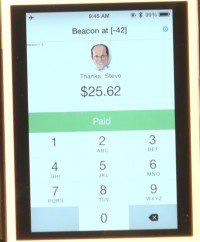

Each of the examples in Token’s demo at FinovateSpring emphasized the main points about the technology’s speed and security. The security of the mobile payments feature, for example, was highlighted by the use of cryptographic keys in both the phone used to make the transaction and in a wearable—in this case a FitBit wristband—that needed to be matched in order for the mobile-payment transaction to go through. Having only the phone, or only the wristband, would not be enough.

Each of the examples in Token’s demo at FinovateSpring emphasized the main points about the technology’s speed and security. The security of the mobile payments feature, for example, was highlighted by the use of cryptographic keys in both the phone used to make the transaction and in a wearable—in this case a FitBit wristband—that needed to be matched in order for the mobile-payment transaction to go through. Having only the phone, or only the wristband, would not be enough.

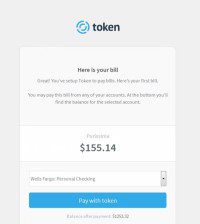

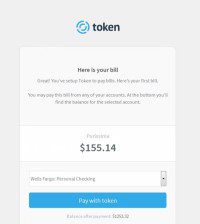

In a second example, Token’s billpay feature requires a 30-second process of entering a phone number and banking credentials; after that, paying bills with Token is a one-touch process. Once signed up, customers will be able to click on a “Pay with Token” button and a Token receipt will appear. The customer clicks on the receipt and the bill is paid.

In a second example, Token’s billpay feature requires a 30-second process of entering a phone number and banking credentials; after that, paying bills with Token is a one-touch process. Once signed up, customers will be able to click on a “Pay with Token” button and a Token receipt will appear. The customer clicks on the receipt and the bill is paid.

“This kind of technology lowers the overall cost of bill-pay operations,” explained Benjamin, who added that a major Silicon Valley utility would be deploying the bill-pay technology this summer.

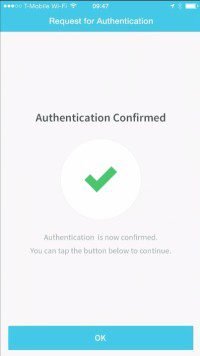

Other features demonstrated included the ability to send push notifications to mobile devices to authenticate users. Again, the exchange of the multiple, distinct, digital signatures between the mobile device and the platform is what allows Token to establish identity. “This is simpler, faster, and easier than anything anyone is doing now to verify identity,” Kirsch said. He also said that push notification could also be used to authorize payments.

“If I want to order a pizza, for example, I could call up the pizza company and tell them to send me a push notification to authorize the charge, and also to release my address. So I don’t have to give out my credit card or my address when I order things,” Kirsch explained.

“If I want to order a pizza, for example, I could call up the pizza company and tell them to send me a push notification to authorize the charge, and also to release my address. So I don’t have to give out my credit card or my address when I order things,” Kirsch explained.

“Never before have banks been able to do both push and pull transactions that are secured by digital signatures,” Kirsch said. “We’re moving payment protocols from outdated, closed protocols to modern, simple, open APIs.”

Speaking of APIs, Kirsch and Benjamin also showed how Token works from a developer perspective. Benjamin emphasized the power, security and simplicity of the API, showing how easy it was for programmers to build features like pre-authorizations (“spend up to $100 on Uber”) that can give customers greater payment flexibility and convenience and thus encourage wider adoption of the technology.

The future

Token is launching this summer with a major Silicon Valley utility, having signed its first financial services company client in April. The utility will be deploying the billpay technology that will allow customers to pay their bill with a single click. “Certain companies like cable, mobile phone companies have a huge reach and that’s why we’re targeting them,” Kirsch said.

That said, at Finovate, it was conversations with banks and financially savvy investors that he and his team were after. Token followed up its first Finovate appearance with a winning appearance at the Innotribe Startup Challenge 2015 in New York, and will join four of its fellow Finovate alums in Singapore at Sibos for the Finale.

Kirsch sees Token as part of an “inevitable transition” away from “closed, proprietary, slow, manual processes” to open protocols, straight-through processing, and technologies like digital signatures to secure identity, rather than “shared secrets” like passwords. He calls it a “once every 50-year opportunity” and has positioned Token at the forefront of it. “This is the big, final transition into secure payments,” he said. “It’s a really, really big deal.”

Check out the video of Token’s live demo at FinovateSpring 2015.

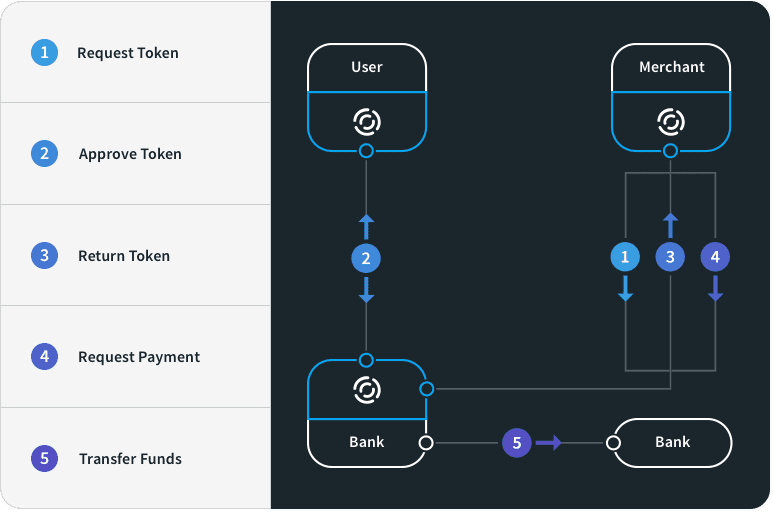

Token uses smart tokens, a digital representation of money, to secure the transaction flow and keep banks in control of the entire process. Here’s how it works:

Token uses smart tokens, a digital representation of money, to secure the transaction flow and keep banks in control of the entire process. Here’s how it works:

Token

Token

FinDEVr Previews

FinDEVr Previews

Each of the examples in Token’s demo at FinovateSpring emphasized the main points about the technology’s speed and security. The security of the mobile payments feature, for example, was highlighted by the use of cryptographic keys in both the phone used to make the transaction and in a wearable—in this case a FitBit wristband—that needed to be matched in order for the mobile-payment transaction to go through. Having only the phone, or only the wristband, would not be enough.

Each of the examples in Token’s demo at FinovateSpring emphasized the main points about the technology’s speed and security. The security of the mobile payments feature, for example, was highlighted by the use of cryptographic keys in both the phone used to make the transaction and in a wearable—in this case a FitBit wristband—that needed to be matched in order for the mobile-payment transaction to go through. Having only the phone, or only the wristband, would not be enough. In a second example, Token’s billpay feature requires a 30-second process of entering a phone number and banking credentials; after that, paying bills with Token is a one-touch process. Once signed up, customers will be able to click on a “Pay with Token” button and a Token receipt will appear. The customer clicks on the receipt and the bill is paid.

In a second example, Token’s billpay feature requires a 30-second process of entering a phone number and banking credentials; after that, paying bills with Token is a one-touch process. Once signed up, customers will be able to click on a “Pay with Token” button and a Token receipt will appear. The customer clicks on the receipt and the bill is paid. “If I want to order a pizza, for example, I could call up the pizza company and tell them to send me a push notification to authorize the charge, and also to release my address. So I don’t have to give out my credit card or my address when I order things,” Kirsch explained.

“If I want to order a pizza, for example, I could call up the pizza company and tell them to send me a push notification to authorize the charge, and also to release my address. So I don’t have to give out my credit card or my address when I order things,” Kirsch explained.