FinovateSpring’s 72 fintech innovators have 3 weeks left to perfect their live demos before debuting their new technology on stage 12/13 May in San Jose, Calif. That means there’s still some time left for you to pick up a ticket and take a closer look at the types of technology you’ll see demonstrated live at San Jose’s City National Civic.

Today, we’re featuring seven companies:

Check out the previous installments of our Sneak Peek series below. And stayed tuned for Part 6 on Thursday:

- Sneak Peek Part 1: Alpha Payments Cloud, CUneXus, DRAFT, FundAmerica, SayPay, StockViews, and TrueAccord

- Sneak Peek Part 2: Bento for Business, DoubleNet Pay, Karmic Labs, SizeUp, Stratos, TickerTags, and Trulioo

- Sneak Peek Part 3: 3E Software, Corezoid, Malauzai Software, PayActiv, PsychSignal, Someone With Group, and Trizic

- Sneak Peek Part 4: Currency Cloud, Dream Payments, Hip Pocket, INETCO Systems, LoanNow, WealthForge, and Yodlee

DarcMatter is an online platform solving inefficiencies in the alternative-investments market through enhanced capital connectivity, data-driven investing, and advanced syndication.

DarcMatter is an online platform solving inefficiencies in the alternative-investments market through enhanced capital connectivity, data-driven investing, and advanced syndication.

Features:

- Institutional-level access to prescreened and compliant alternative investments

- Issuers are empowered to raise capital on their own

- Over $100 billion of investor capital

Why it’s great

DarcMatter provides an infrastructure for the alternatives market and enhances the capital process from start to finish.

Presenters

Presenters

Sang Lee, CEO & Founder

Formerly an investment banker in the energy field at WestLB and BNP Paribas, Lee has accrued a wealth of expertise in financial regulation, business, and financial structuring.

LinkedIn

Stan Solodkyy, CTO

Stan Solodkyy, CTO

Solodkyy has experience from integration of financial institutions with the SWIFT network to providing software consultancy to world-leading brands.

LinkedIn

Digital Insight will illustrate the use of beacons within its mobile banking app, creating a more personal, relevant, and contextual experience based on a user’s location.

Digital Insight will illustrate the use of beacons within its mobile banking app, creating a more personal, relevant, and contextual experience based on a user’s location.

Features:

- Personalizes a user’s experience in banking branches

- Provides financial institutions relevant, timely information to engage with users more effectively

Why it’s great

Digital Insight is designing more personal, relevant, and contextual experiences based on knowing a user’s location.

Presenters

Presenters

Marshall Yuan, Senior Product Manager, DI Labs

Yuan is senior product manager at DI Labs where he leads experimentation in new solutions to help financial institutions engage and delight their end users.

LinkedIn

Ronald Leung, Engineering Lead, DI Labs

Ronald Leung, Engineering Lead, DI Labs

Leung is the engineering lead at DI Labs where he has been working with financial institutions to build innovative solutions and user experiences.

LinkedIn

Emailage uses email as a key data-element for detecting fraud trends across industries and regions. Emailage’s machine-learning algorithms detect fraud in real time.

Emailage uses email as a key data-element for detecting fraud trends across industries and regions. Emailage’s machine-learning algorithms detect fraud in real time.

Features:

- Analyze any email address on any web site

- 90% confirmed fraud has not been previously detected

- Real-time fraud score based on current trends

Why it’s great

No sensitive, transactional data is ever shared or stored by Emailage. It requires only an email address to provide an extremely precise risk assessment.

Presenter

Presenter

Amador Testa, Chief Product Officer

Testa is Emailage’s CPO and has 15 years experience in financial fraud prevention. Prior to Emailage, Amador was a leader for AMEX and Citigroup.

LinkedIn

Hedgeable is a robo-adviser on steroids.

Hedgeable is a robo-adviser on steroids.

Features:

- Advanced portfolio customization and sophistication

- Downside risk protection

- Access to alternatives

Why it’s great

First generation robo-advisers are cookie-cutter, like Altavista; Hedgeable is innovating like Google.

Presenters

Presenters

Matthew Kane, Co-founder & Chief Ninja

Kane is co-founder and CTO of Hedgeable where he leads all product, design, UI/UX, development, and strategy initiatives.

LinkedIn

Michael Kane, Co-founder & Head Sensei

Michael Kane, Co-founder & Head Sensei

Kane is co-founder and CEO of Hedgeable where he leads all investment-management and business-development duties. Previously at Bridgewater Associates.

LinkedIn

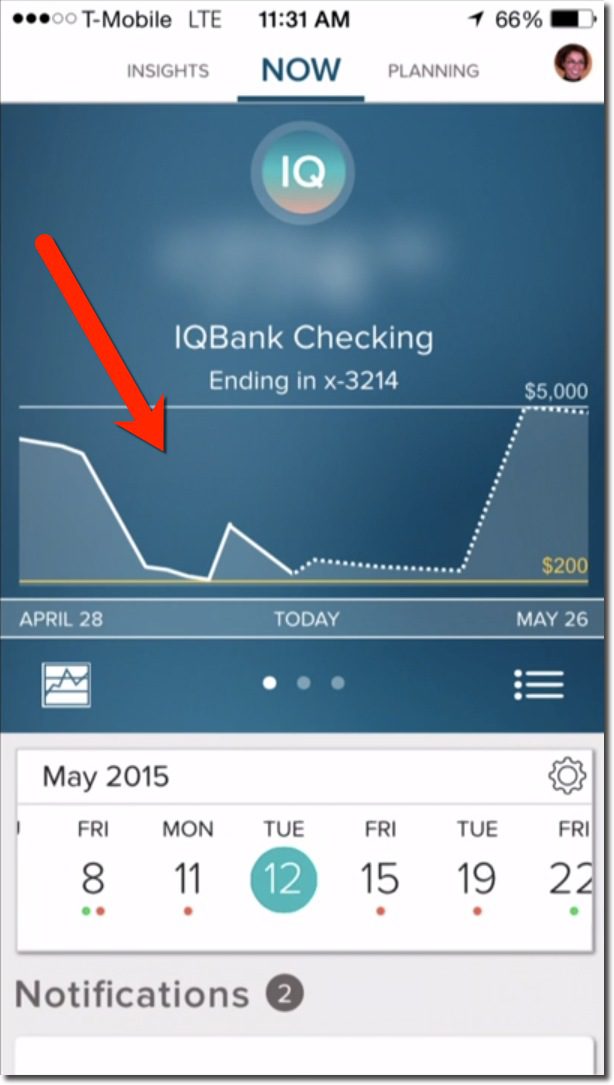

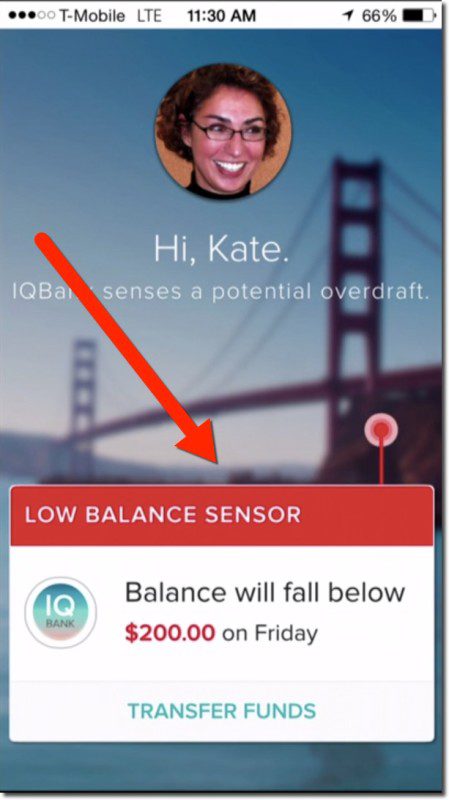

Moven is a disruptive digital experience and debit card designed to provide real-time feedback so users can build better money habits and save more.

Moven is a disruptive digital experience and debit card designed to provide real-time feedback so users can build better money habits and save more.

Features:

- Frictionless account onboarding with incremental prospecting

- A real-time financial wellness experience driving customer engagement

- A global, agile, and scalable platform for international banks

Why it’s great

Moven has created real-time, contextualized notifications to gamify savings and create a behaviorally driven experience that goes beyond traditional goal-based paradigms.

Presenters

Presenters

Brett King, CEO, Founder

King is an Amazon best-selling author, well-known industry commentator, host of the BREAKING BANK$ radio show and founder of revolutionary mobile-based banking service Moven.

LinkedIn

Alex Sion, President, Co-founder

Alex Sion, President, Co-founder

Sion is President of Moven and an adviser on digital strategy and disruption to global financial leaders such as HSBC, Citi, and Barclays.

LinkedIn

RAGE Frameworks’ LiveCredit is a flexible, scalable origination and servicing solution that enables the design and launch of any financing product, end-to-end, from origination to underwriting to booking and service.

Features:

- Dynamic Product Configurator enables new products without custom coding

- Scalable origination and servicing

- Enables flexible financing, accounting and compliance

Why it’s great

Its framework-based approach empowers unprecedented flexibility and market-leading, time-to-market deployment.

Presenters

Presenters

Nick Adams, Vice President, Risk Solutions

Adams runs business development for LiveCredit and is a 10+ year veteran of startups and multinational companies. He holds a bachelor’s degree from Brandeis University and an MBA in finance from Northeastern.

LinkedIn

Aashish Mehta, SVP, Business Banking Solutions

Aashish Mehta, SVP, Business Banking Solutions

Mehta is responsible for all LiveCredit business operations. He sits on the management team and has been with RAGE for nearly 10 years.

LinkedIn

Shoeboxed is launching the next banking standard. The pioneers in email and mobile receipt-capture now open the door to receipt data for financial institutions.

Shoeboxed is launching the next banking standard. The pioneers in email and mobile receipt-capture now open the door to receipt data for financial institutions.

Features:

- Automated receipt-capture for consumers and small businesses

- Item-level extraction of purchase details

- Turnkey implementation for financial institutions

Why it’s great

Receipt-capture is becoming a standard banking feature, giving access to previously unattainable data.

Presenters

Presenters

Tobi Walter, COO, Co-founder

An investment banker-turned-entrepreneur, COO Walter oversees the business and corporate development efforts of Shoeboxed.

LinkedIn

Alex Anderson, Business Development Manager

Alex Anderson, Business Development Manager

Anderson oversees the planning and implementation of strategic banking and accounting partnerships.

LinkedIn

Alpha Payments Cloud

Alpha Payments Cloud

DarcMatter

DarcMatter Presenters

Presenters Stan Solodkyy, CTO

Stan Solodkyy, CTO Digital Insight

Digital Insight Presenters

Presenters Ronald Leung, Engineering Lead, DI Labs

Ronald Leung, Engineering Lead, DI Labs Presenter

Presenter Hedgeable

Hedgeable Presenters

Presenters Michael Kane, Co-founder & Head Sensei

Michael Kane, Co-founder & Head Sensei Alex Sion, President, Co-founder

Alex Sion, President, Co-founder

Presenters

Presenters Aashish Mehta, SVP, Business Banking Solutions

Aashish Mehta, SVP, Business Banking Solutions Shoeboxed

Shoeboxed Presenters

Presenters Alex Anderson, Business Development Manager

Alex Anderson, Business Development Manager