“There’s a great future in plastics. Think about it. Will you think about it?”

–Walter Brooke, The Graduate

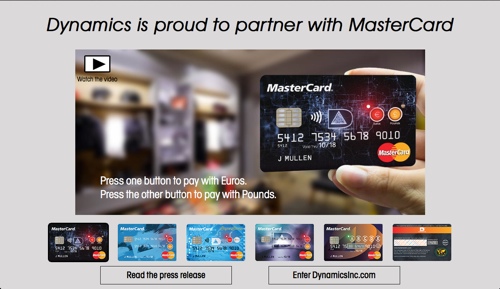

Dynamics announced today that it had completed a Series C investment round, raising $70 million from new and existing investors. Along with MasterCard is new investor, Canadian Imperial Bank of Commerce, both of which teamed up with existing investors, Adams Capital Management and Bain Capital Ventures.

The total capital for Dynamics is now more than $110 million.

In addition to the investment, MasterCard will enter a joint commercial initiative with Dynamics to bring the company’s cards to businesses in Mastercard’s global payments network as well as CIBC’s customers.

It is interesting to hear the way MasterCard and CIBC executives talk about the card technology from Dynamics. For these companies, as far as commerce is concerned, plastic cards and smart devices have more in common than some may think.

Carlos Menendez, group executive for global credit and debit products for MasterCard talked about the importance of turning

“every device” into a “commerce device.” “This not only includes a shift to mobile-based payments but also a move from ‘static’ plastic to ‘dynamic’ interactive payment cards and systems,” he said. A senior executive with CIBC added that the partnership with Dynamics was “already having a positive impact.”

What makes Dynamics unique is the fact that the company is the definition of a one-stop shop. As CEO Jeff Mullen explained from the stage at FinovateFall 2014 in New York last September: “We have the only facility in payments that actually does device design, device manufacturing, PCI compliant network-certified processing personalization fulfillment all under one roof.”

(Above: Jeff Mullen, CEO of Dynamics at FinovateFall 2014)

“And when you can do it all under one roof,” he said. “You start to see things, and it allows you to really take innovation to the next level.”

Founded in 2007 and headquartered in Pittsburgh, Pennsylvania, Dynamics has won multiple Best of Show awards for its card technology. The company’s last Finovate appearance was at

FinovateFall 2014 in New York.