- Morgan Stanley has agreed to acquire private company trading platform EquityZen. Terms of the transaction were not immediately available.

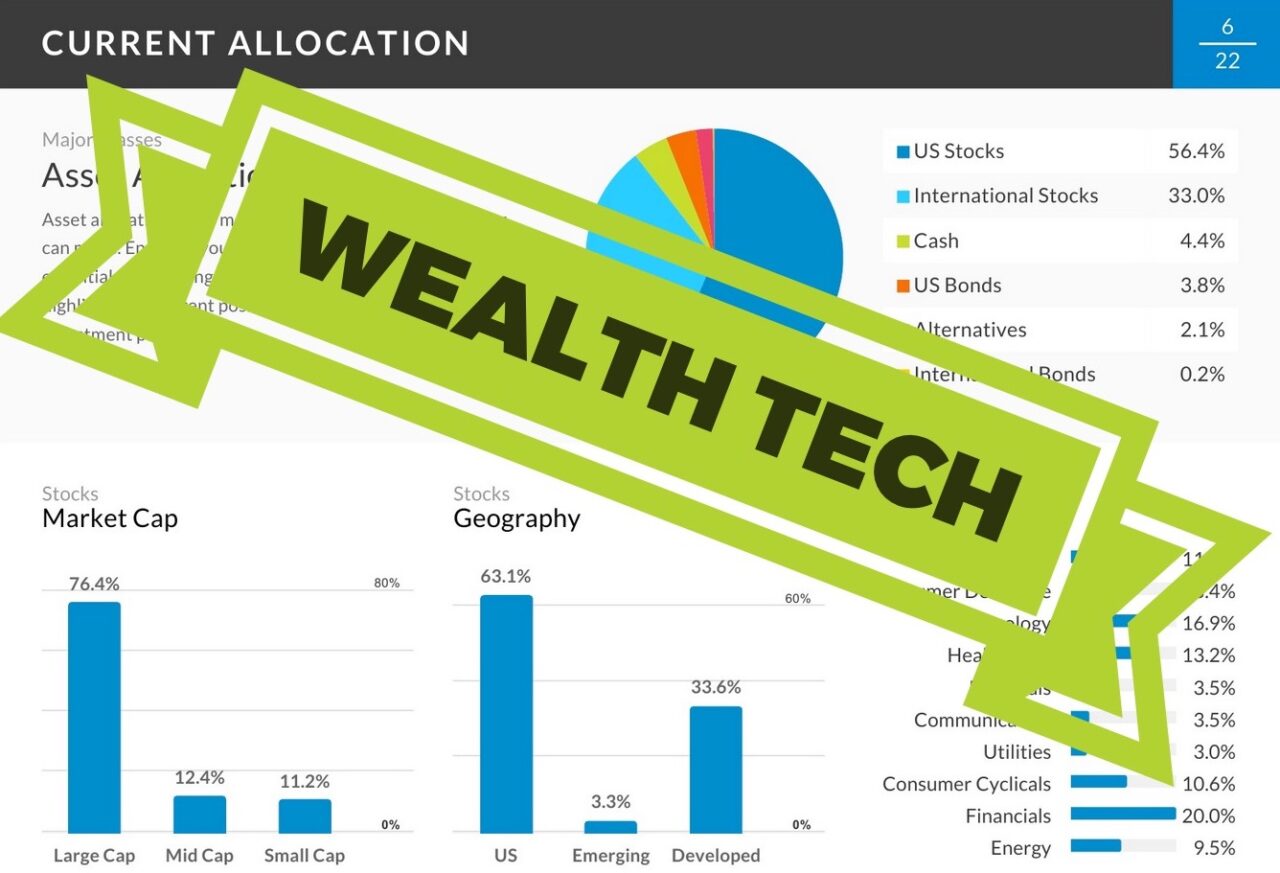

- The acquisition will help Morgan Stanley offer a full suite of solutions for its private company and wealth management clients, including cap table solutions, tender and liquidity programs, direct and co-investment opportunities, and secondary trading.

- EquityZen made its Finovate debut at FinovateSpring 2016. The company is headquartered in New York.

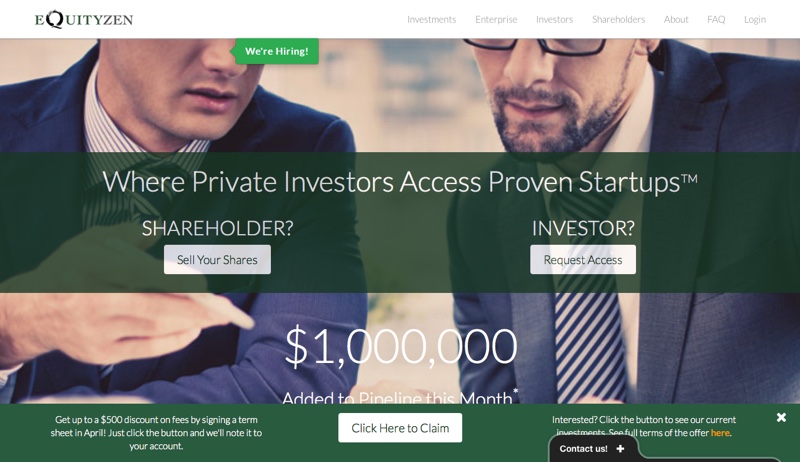

One of the biggest challenges in the world of private company investing is dealing with the liquidity gap that can arise between private companies and their stakeholders when stakeholders seek access to cash before companies are ready to officially exit via public offering or acquisition. As more and more companies stay private longer, an opportunity has developed for innovators that can not only democratize access to private market investments, but can also serve the interests of employees seeking liquidity, companies requiring control over secondary transactions, and investors wanting access to high-growth private startups.

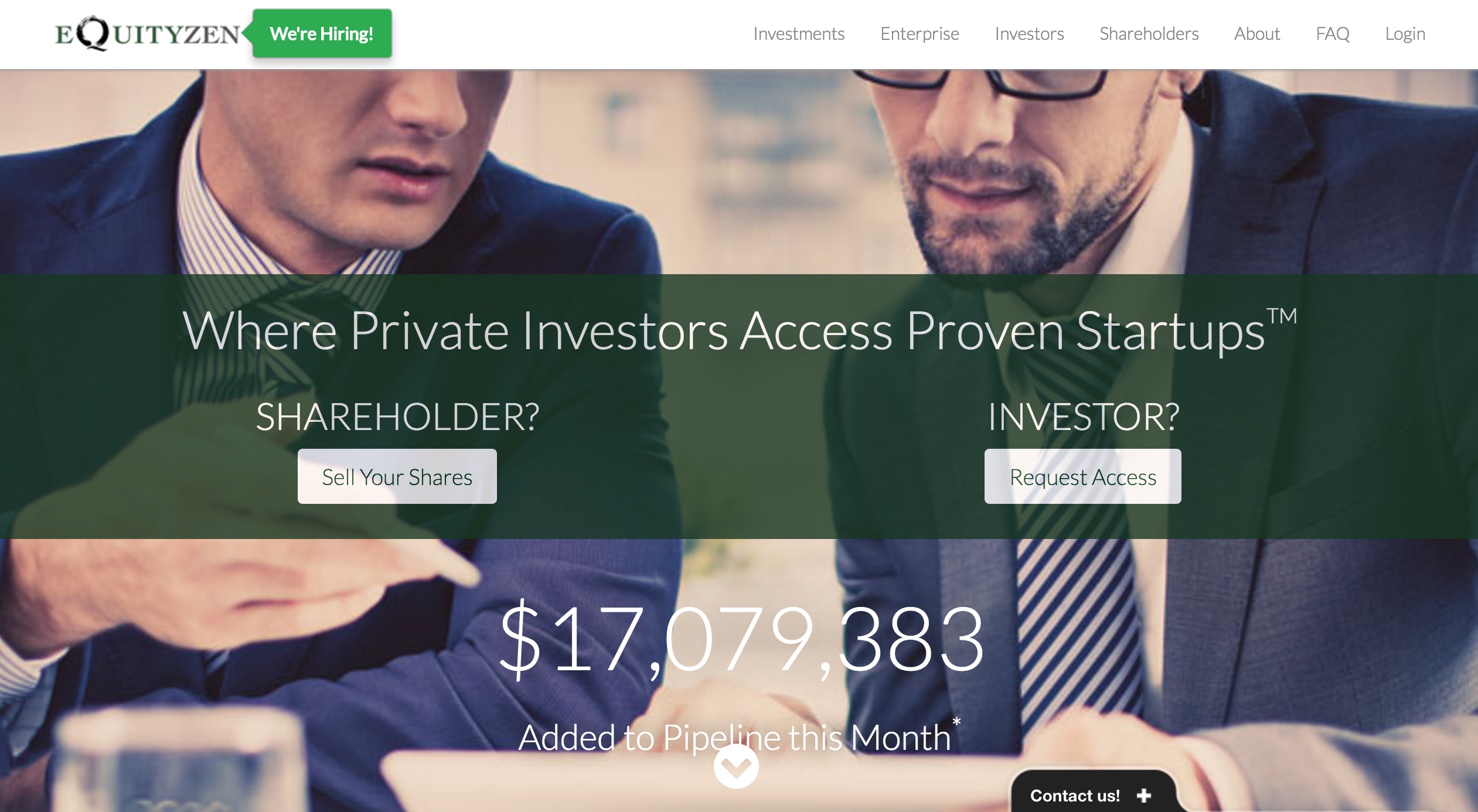

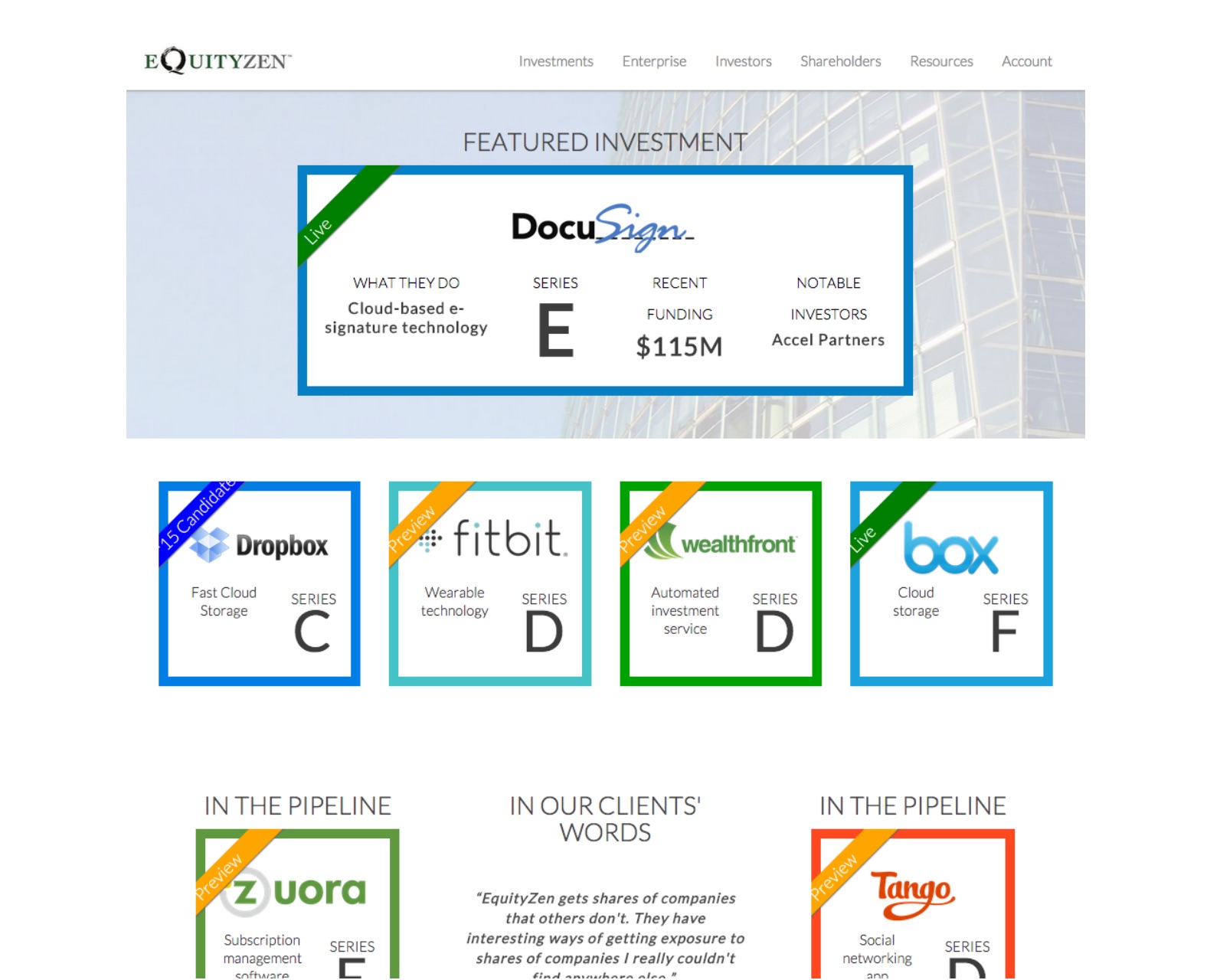

Tackling this challenge is EquityZen, a New York-based fintech founded in 2013 that made its Finovate debut at FinovateSpring 2016 in San Francisco. This week, we learned Morgan Stanley has announced its acquisition of the company, which offers a proprietary platform that facilitates secondary transactions in private firms, and works directly with shareholders and issuers to provide a seamless experience for buyers, sellers, and companies alike.

“This announcement comes at a critical time in the development of the private markets ecosystem,” Jed Finn, Head of Morgan Stanley Wealth Management, said. “The combination of EquityZen with Morgan Stanley will uniquely address client needs as companies stay private much longer, such as delivering liquidity solutions for their employees and early investors in a seamless yet controlled process of their own design. With EquityZen, we combine our cap table management solutions with a private shares marketplace to deliver end-to-end solutions to our private market company clients.”

EquityZen enables accredited investors to explore investment offerings on its platform, review offering documents, and conduct research before reserving investments in live offerings, or indicating their interest in upcoming offerings. Investors can execute documents and provide payment information in order to complete the investment via ACH or wire, and actively manage their investments and receive personalized updates on their companies in their portfolio. Investors receive investment proceeds in the form of cash or shares if the company exits successfully or simply if the investor requires liquidity.

The acquisition follows news of Morgan Stanley’s expanded partnership with private capital software platform Carta. Morgan Stanley noted that its acquisition of EquityZen will enhance its private markets ecosystem, and enable the firm to offer a range of services to private companies and their shareholders including cap table solutions, tender and liquidity programs, direct and co-investment opportunities, and secondary trading. Morgan Stanley will benefit from EquityZen’s issuer-aligned model, which will help it enhance its relationship with private companies and offer its wealth management customers greater access to private shares.

“Our entire mission has been to bring ‘private markets to the public’ and by integrating into Morgan Stanley, we will reach more investors and shareholders than ever before,” EquityZen CEO Atish Davda said. “When our category-leading technology and welcoming marketplace are matched with Morgan Stanley’s comprehensive suite of products, services, and offerings focused on the private markets, we can create a value proposition together for issuers, shareholders, and investors that is unrivaled in our space.”

EquityZen has 800,000 registered users. To date, the company has processed more than 49,000 transactions across 450+ private companies.

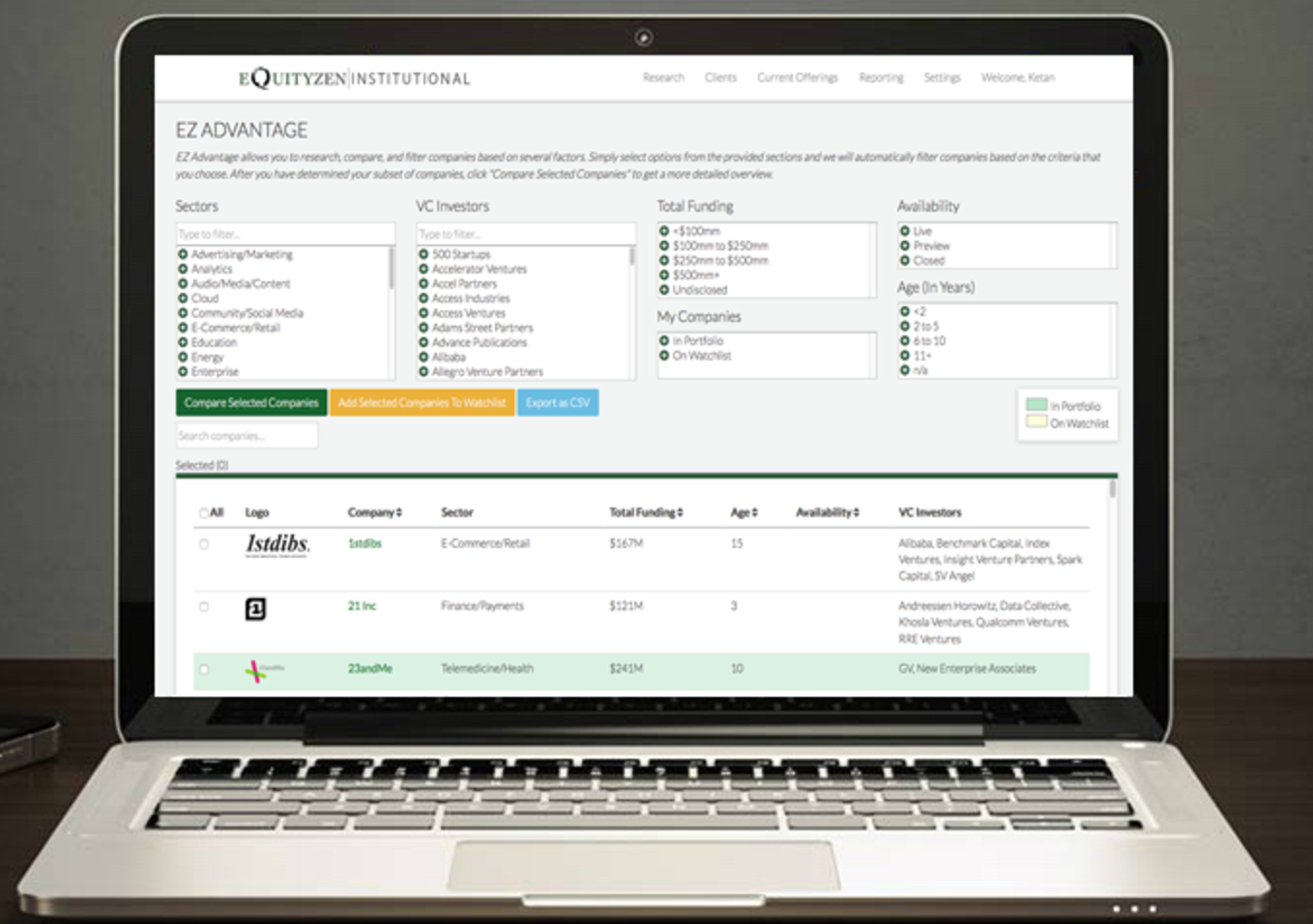

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

EquityZen’s EZ Institutional lets advisors give clients access to a diverse asset class

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been

Atish Davda, CEO

Atish Davda, CEO Ketan Bhalla, Product Lead

Ketan Bhalla, Product Lead