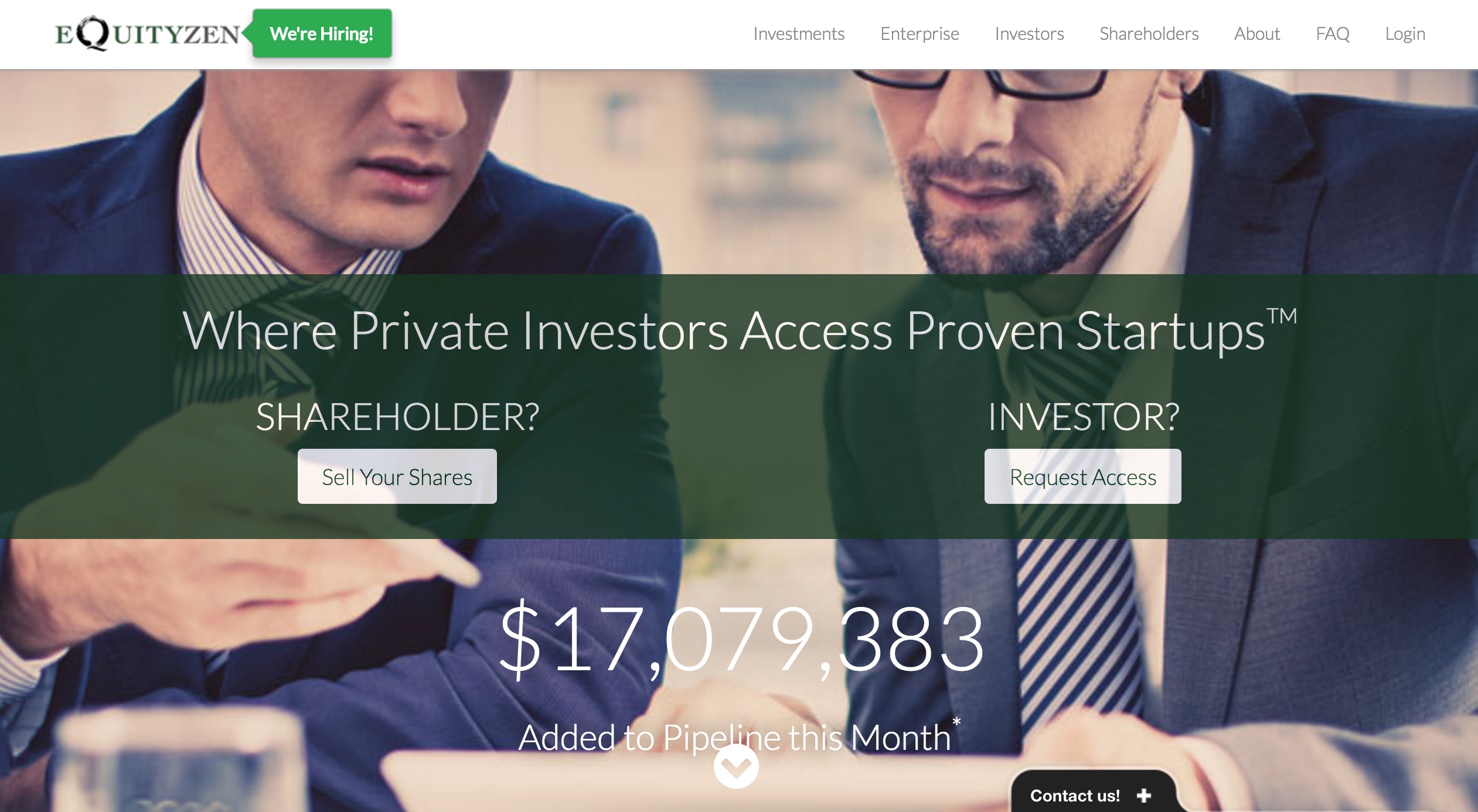

EquityZen was founded in 2013 as a platform to exchange private company shares. Its online marketplace conducts secondary transactions where users buy and sell existing shares of private companies with at least $100 million in enterprise value.

EquityZen’s roots stem from when CEO Atish Davda left his job at a hedge fund to pursue a career at a startup. Davda, who needed a down payment for a house and cash to purchase an engagement ring, wanted liquidity for his private company equity. At a time when startups are staying private longer and consumer familiarity with startups is greater than ever, this seemed the ideal time for Davda to launch EquityZen.

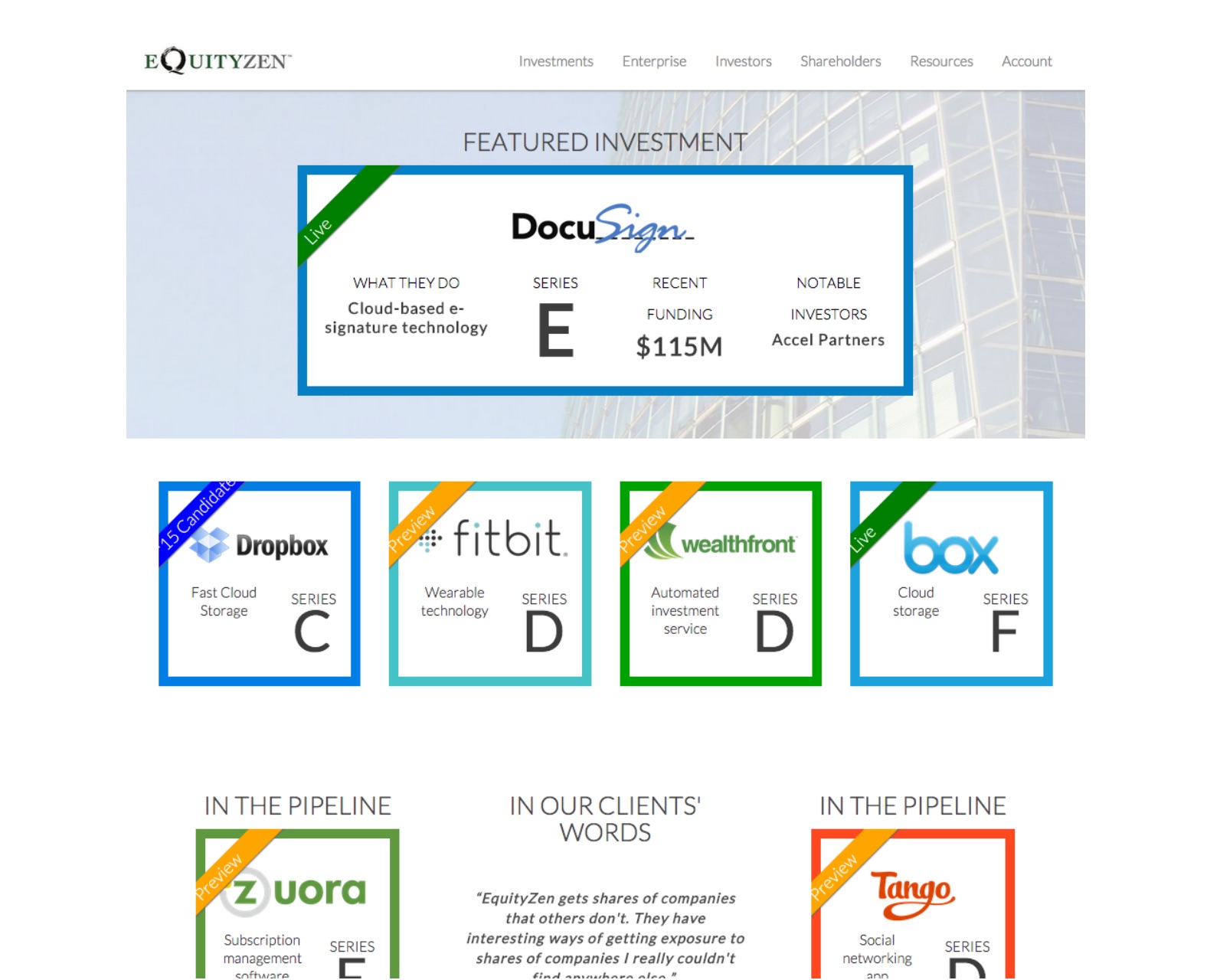

“We bring private markets to the public,” CEO Davda explains in his FinovateSpring demo, where the company launched EquityZen Institutional, an offering that enables professional wealth managers to offer their clients further diversification through investing in private companies.

Company facts:

- Founded in 2013

- $3.5 million in funding raised

- Headquartered in New York City, New York

- 10,000+ accredited investors from 15+ countries

- 5,000+ sellers, 80% of them from a unicorn startup

- On pace to reach $500 million of equity on its platform this year

CEO Atish Davda, founder, and Ketan Bhalla, product lead, launching EquityZen Institutional at FinovateSpring 2016 in San Jose.

CEO Atish Davda, founder, and Ketan Bhalla, product lead, launching EquityZen Institutional at FinovateSpring 2016 in San Jose.

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been featured on CNBC’s SquakBox and Fox Business News. He speaks English, Hindi, Gujarati, and Python.

Before his presentation at FinovateSpring last month, we chatted with Atish Davda (pictured right), the company’s CEO, for further insight on EquityZen. Davda has been featured on CNBC’s SquakBox and Fox Business News. He speaks English, Hindi, Gujarati, and Python.

Finovate: What problem does EquityZen solve?

Davda: EquityZen is a stock exchange for private company shares.

Amazon went public with a market capitalization of $440M at an age of four years; today, companies remain private almost until they’re teenagers before they are accepted by public markets. With the longer gestation period, there is a gap between the financing timeline of the company and that of individuals supporting the company (shareholders wanting to sell and investors looking to invest). EquityZen has filled this gap.

Finovate: Who are your primary customers?

Davda: EquityZen’s platform helps shareholders (founder, investor, employee, or ex-employee) of any private company that passes our extensive filters before they can enlist. By working directly with the company, not only does EquityZen enjoy a greater trust, but also a direct channel for future shareholders who wish to sell while the company is private.

EquityZen’s platform offers these investment opportunities to accredited investors and qualified purchasers. Investors on our platform include small institutions (asset managers, family offices) as well as retail (HNWIs, financial advisers). This investor base now spans over 15 countries, and makes way to offer other asset classes.

EquityZen has established itself as one of the hubs for educating financial advisers and investors alike regarding the risks and benefits of investing in the asset class.

Finovate: How does EquityZen solve the problem better?

Davda: While it was accepted practice to build a phone-sales brokerage, EquityZen is building a future where the days of phone broker—and the overhead they bring—are numbered. Using our technology, therefore, EquityZen is able to conduct $100,000 transactions profitably, while deriving greater profits from transactions well above $1 million.

Finovate: Tell us about your favorite implementation of your solution.

Davda: While everyone else is trying to find a way to let investors put more money into the ecosystem, EquityZen is the only platform through which folks actually get money out—liquidity!—when they need it.

Finovate: What in your background gave you the confidence to tackle this challenge?

Davda: Atish Davda, CEO; Shriram Bhashyam, counsel and shareholder relations; and Phil Haslett, investments, founded EquityZen with one goal in mind: to reinvent the private market. All three have previous experience in financial services and have collectively called New York City home for over 20 years.

Prior to EquityZen:

- Atish was product lead and first engineer at Ampush, a big-data advertising-technology firm. He began his career as a financial engineer at AQR Capital, before which he founded and operated the education-technology firm, Knolsoft.

- Shri was an attorney at Shearman & Sterling LLP, a New York-based global law firm. Shriram advised market participants on regulatory, transactional, and trading and markets issues, with a focus on U.S. broker-dealer and securities regulation. He also advised banks and other financial institutions on U.S. bank regulation, including the Dodd-Frank Act of 2010.

- Phil was a vice president at Pomelo Capital, a NYC-based hedge fund, focusing on capital structure arbitrage. After helping launch the fund (now $300mm+ AUM), he was responsible for trading, research, and operations. Phil started his career at Barclays Capital in their Proprietary Trading group trading credit and equity derivatives.

Finovate: What are some upcoming initiatives from EquityZen that we can look forward to over the next few months?

Davda: Wider adoption of EquityZen Institutional beyond the 1,000+ financial advisers on our platform that know about it. EZ Institutional is a new offering EquityZen launched at Finovate in 2016, allowing financial advisers and institutional investors to invest capital and manage alternatives portfolios on behalf of their clients.

Finovate: Where do you see EquityZen a year or two from now?

Davda: While we remain focused on the U.S. market for now, I would not be surprised if EquityZen increases our investor network reach from 15 countries to a bit more than that.

CEO Atish Davda, founder, and Ketan Bhalla, product lead, presenting EquityZen at FinovateSpring 2016 in San Jose: