The Sneak Peek series looks at the innovators demoing live on stage at FinovateFall 2015. Be sure to pick up your tickets to our annual autumn conference, and we’ll see you in New York!

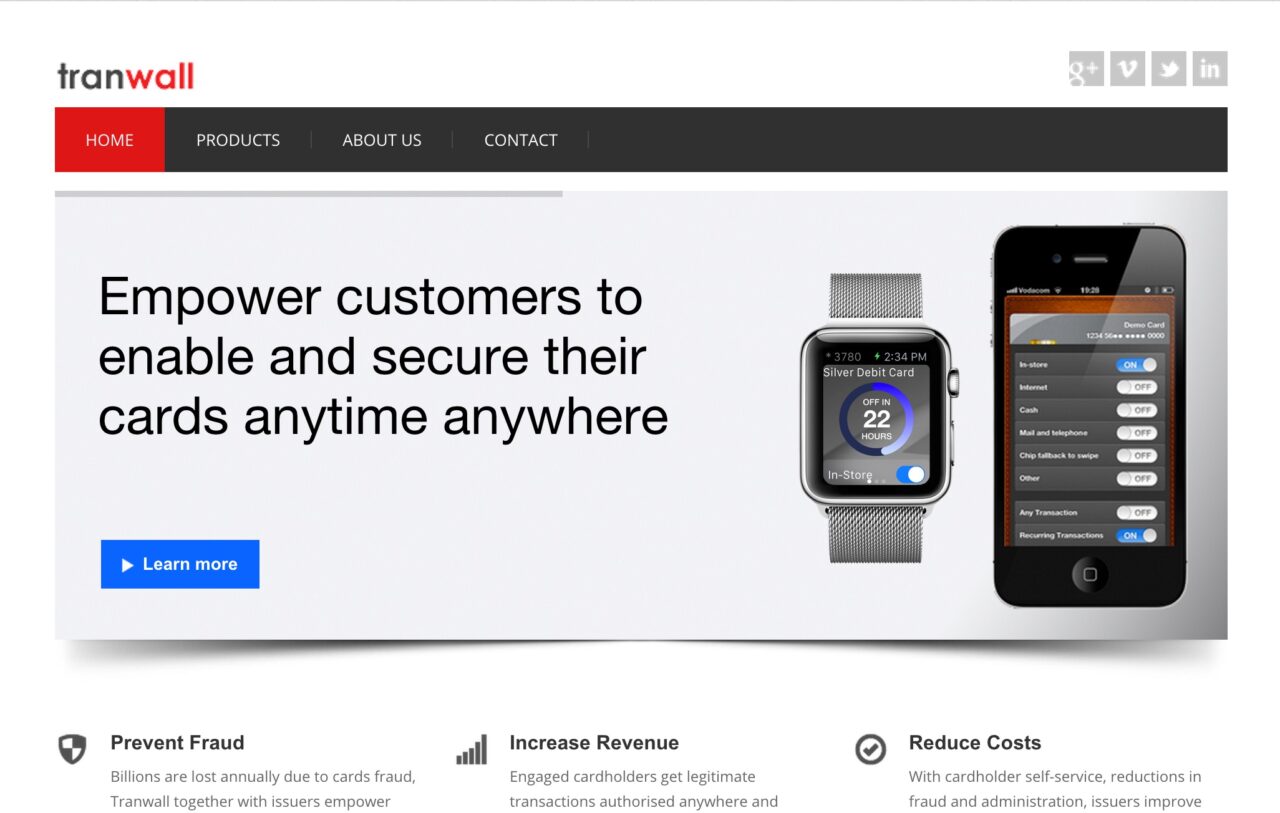

Tranwall helps banks give secure transaction control to their customers.

Tranwall helps banks give secure transaction control to their customers.

Features:

- Rules-based transaction authorization: peace of mind and fraud prevention

- Change authorization parameters: real-time interaction with customers

- Design your own card program: e.g., prepaid, business

Why it’s great

Tranwall will change the way card authorizations will be handled. Customers will now be able to control the authorization settings of their own cards.

Presenters

Presenters

Gerard van de Par, Director

Van de Par has a sound background at technology and international banks. He heads up the commercial operations within Tranwall with a focus on Europe and the United States.

LinkedIn

Diederik Bruggink, Business Development Manager

Diederik Bruggink, Business Development Manager

Bruggink is an internationally renowned cards-and-payment expert. He is acting as business development manager for Tranwall and brings a broad network with him.

LinkedIn

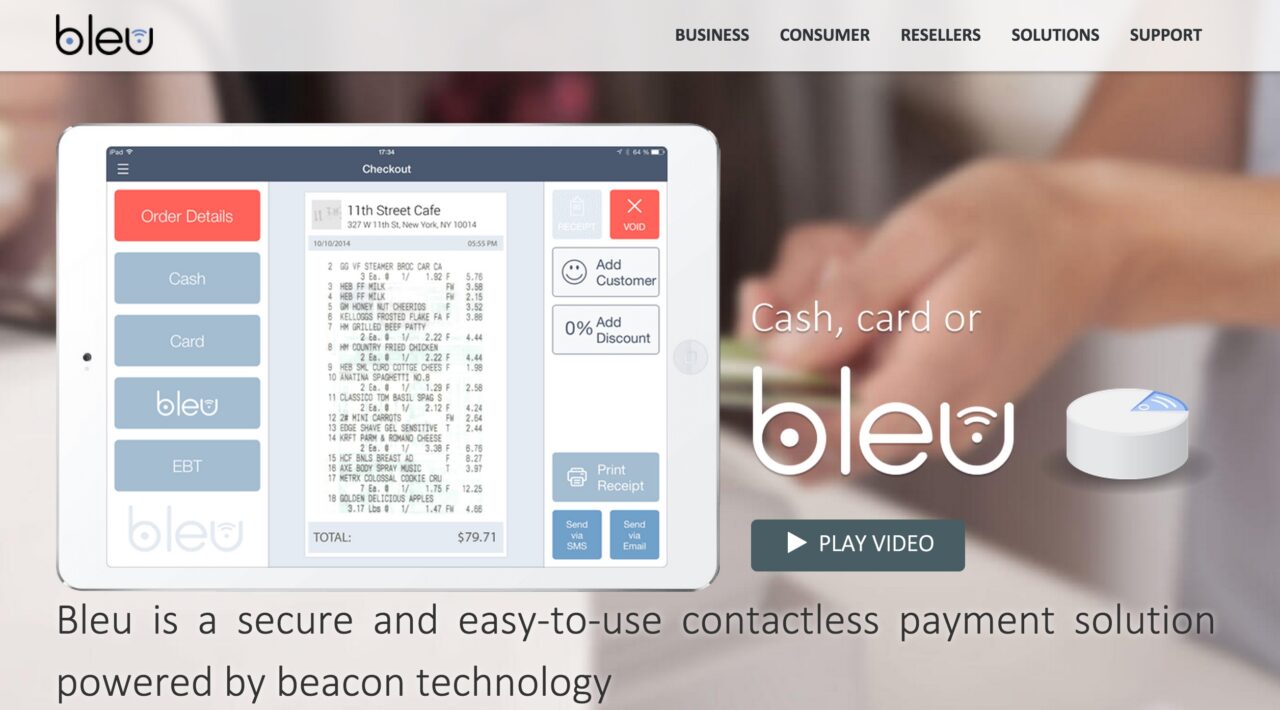

Bleu

Bleu Presenters

Presenters Brett Howell, Senior VP Business Development

Brett Howell, Senior VP Business Development

Urban FT

Urban FT Presenters

Presenters Mark Kilpatrick, Chief Product and Brand Officer

Mark Kilpatrick, Chief Product and Brand Officer

D3 Banking

D3 Banking Presenters

Presenters Andy Holdt, Director, Sales Support

Andy Holdt, Director, Sales Support

IDmission

IDmission

AcceptEmail

AcceptEmail Presenters

Presenters Geerten Oelering, CTO

Geerten Oelering, CTO

Alfa-Bank

Alfa-Bank Presenters

Presenters