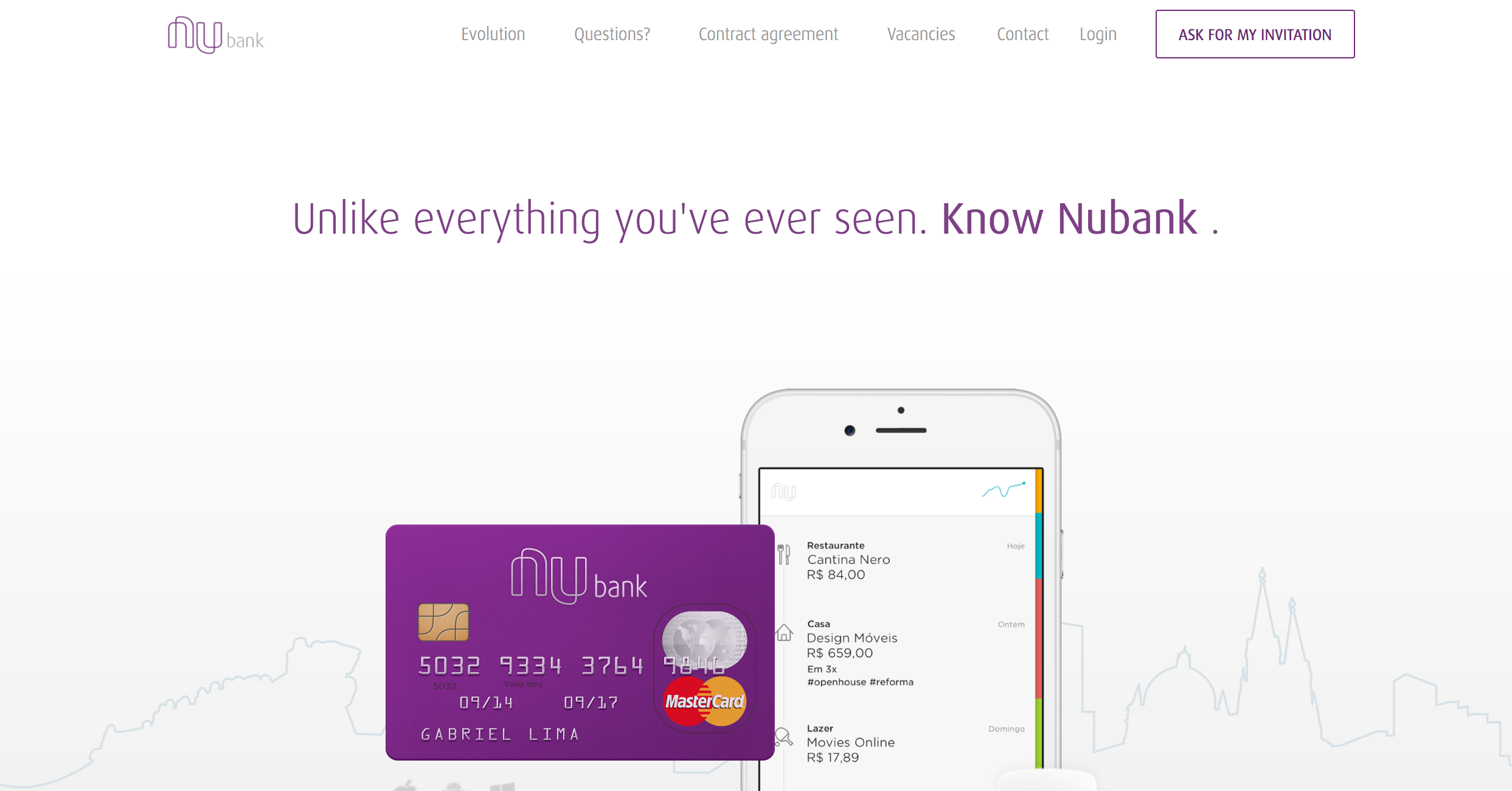

Onboarding software provider Agreement Express helps wealth management firms, payments, and insurance companies create and manage a consistent onboarding experience across channels for all of their product offerings.

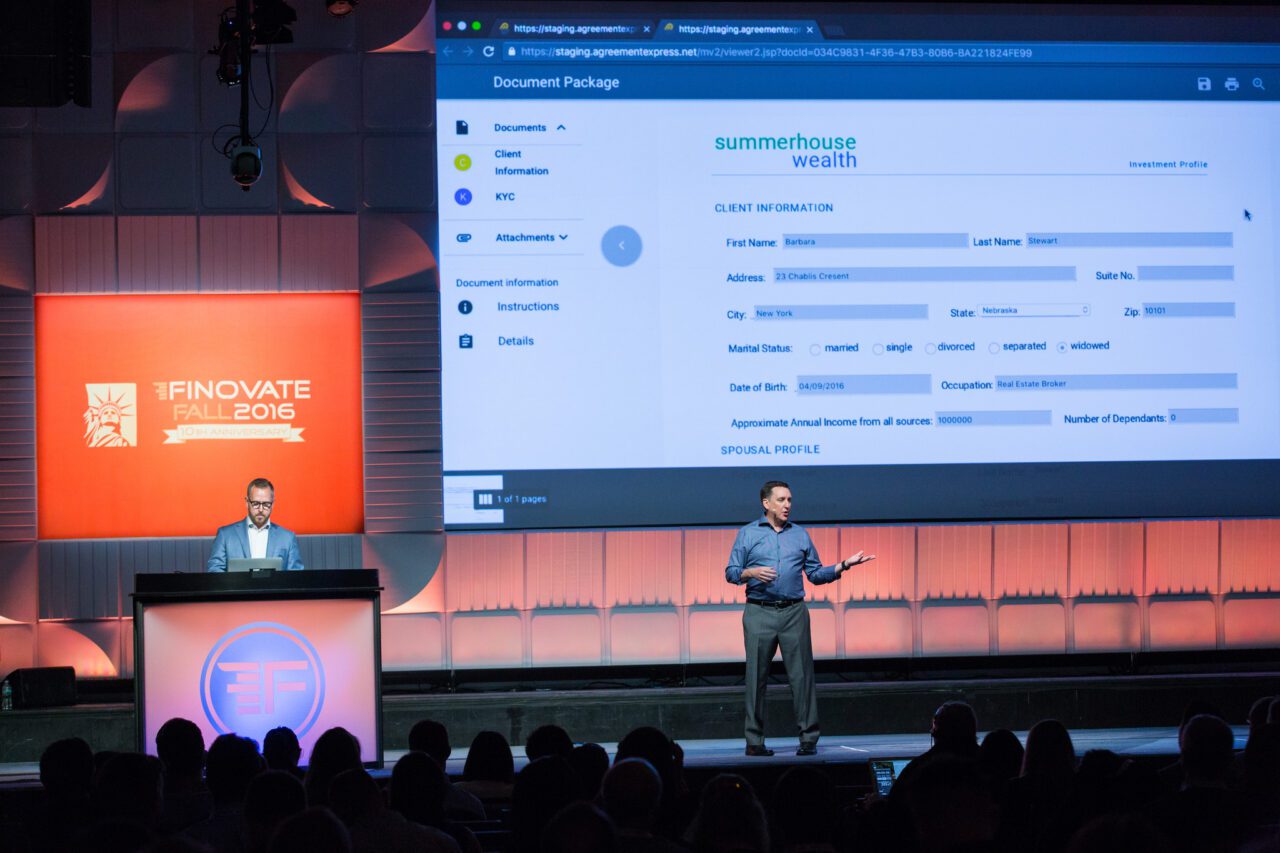

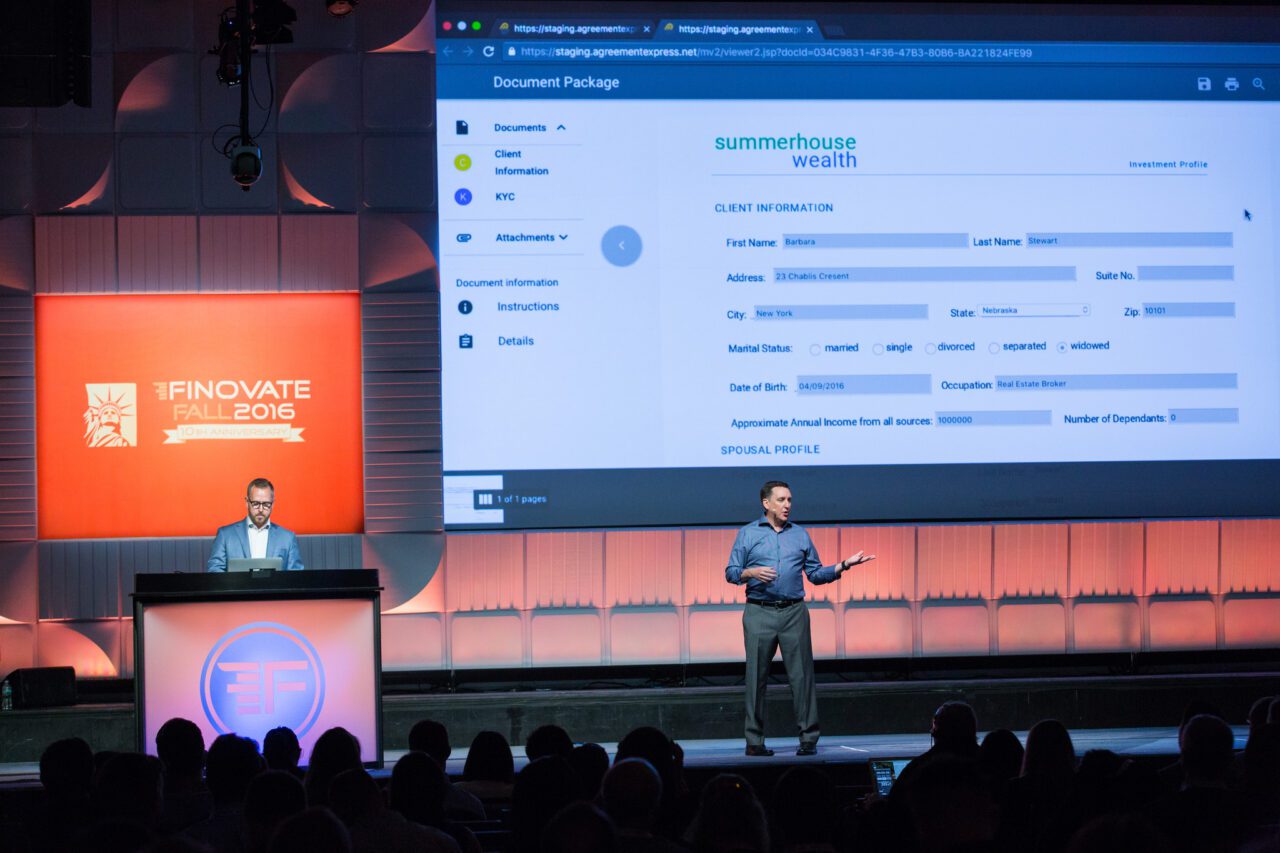

At FinovateFall 2016, the company demoed the newest version of its wealth management offering, an onboarding solution that helps advisers interact with clients in a nonintrusive, compliant manner. The new release improves the customer experience by helping firms gather and re-use existing client data instead of requesting the same information multiple times, which causes friction and deteriorates the client experience.

In his demo on the FinovateFall stage, Agreement Express CEO Mike Gardner opened by depicting the difficulty advisers have in getting solutions up-and-running quickly, saying, “At Agreement Express, we unite advisers, clients, back office teams, and compliance … in one platform that allows transformation in just two weeks.” He later noted the software is made to work quickly even for large firms.

Company Facts

- Founded in 2001

- Headquartered in Vancouver, British Columbia, Canada

- Working with Global Payments and M&T Bank

CEO Mike Gardner and Account Exec Andrew Grocholski demoed Agreement Express at FinovateFall 2016

CEO Mike Gardner and Account Exec Andrew Grocholski demoed Agreement Express at FinovateFall 2016

After his presentation at FinovateFall, we conducted an interview with Mike Gardner, Agreement Express CEO, to gather more information about the company and its future plans.

After his presentation at FinovateFall, we conducted an interview with Mike Gardner, Agreement Express CEO, to gather more information about the company and its future plans.

Finovate: What problem does Agreement Express solve?

Mike Gardner: Agreement Express solves the problem of slow, inefficient, paper-based client onboarding in financial services. Because it’s such a huge problem, FIs usually go one of two routes: reducing the scope and only solving one piece of the project, or trying to solve the whole thing in one go with a massive BPM project that takes a couple of years to go live. Agreement Express is onboarding software that financial institutions can implement in just a few weeks, and gives them the data and flexibility they need to iterate and configure their process on an ongoing basis. It’s essentially building the perfect path as you go, enabling firms to receive immediate value and get in the fast-paced technology race, without the risk of trying to predict the future and get it all right without consulting meaningful data.

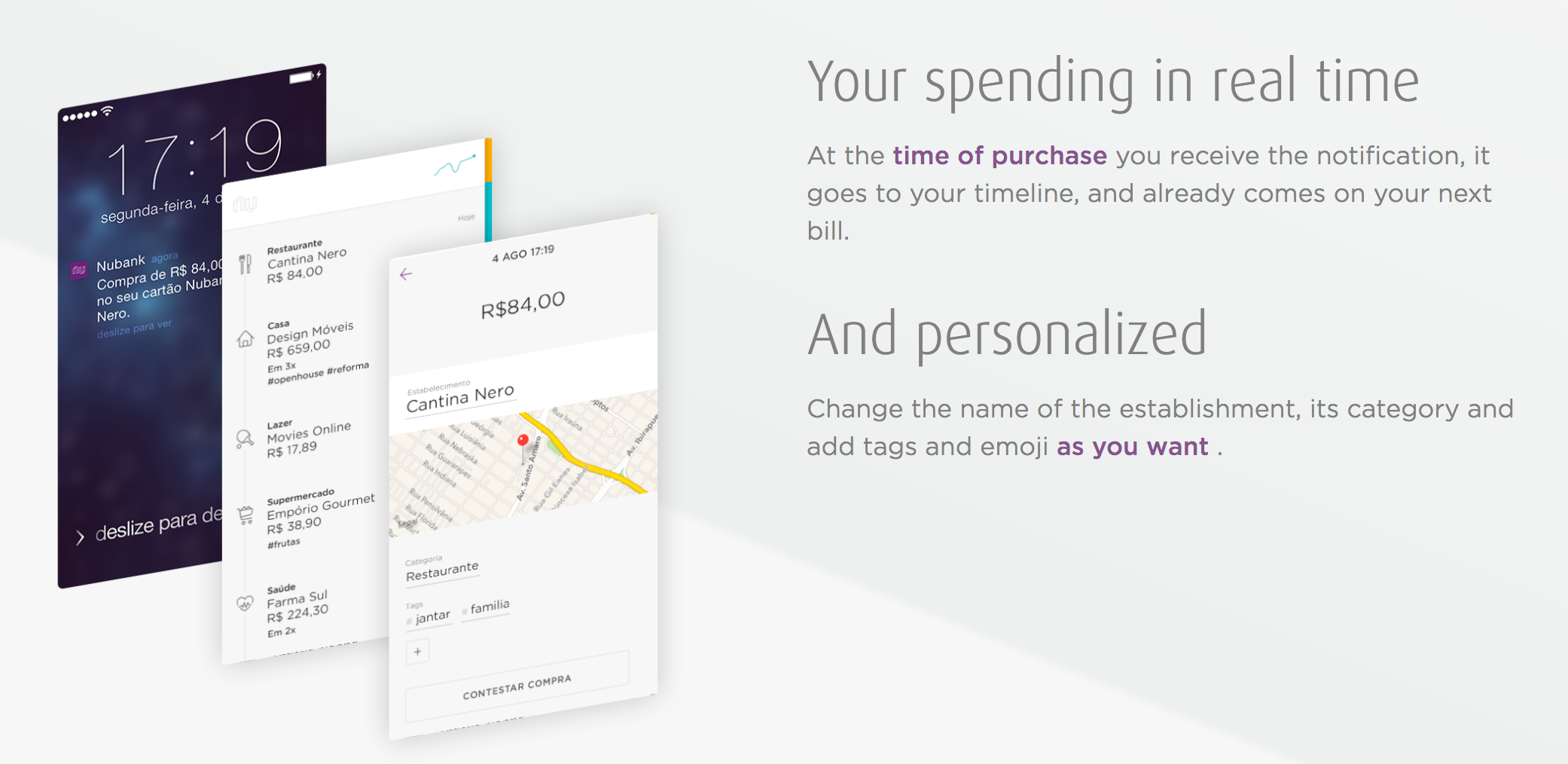

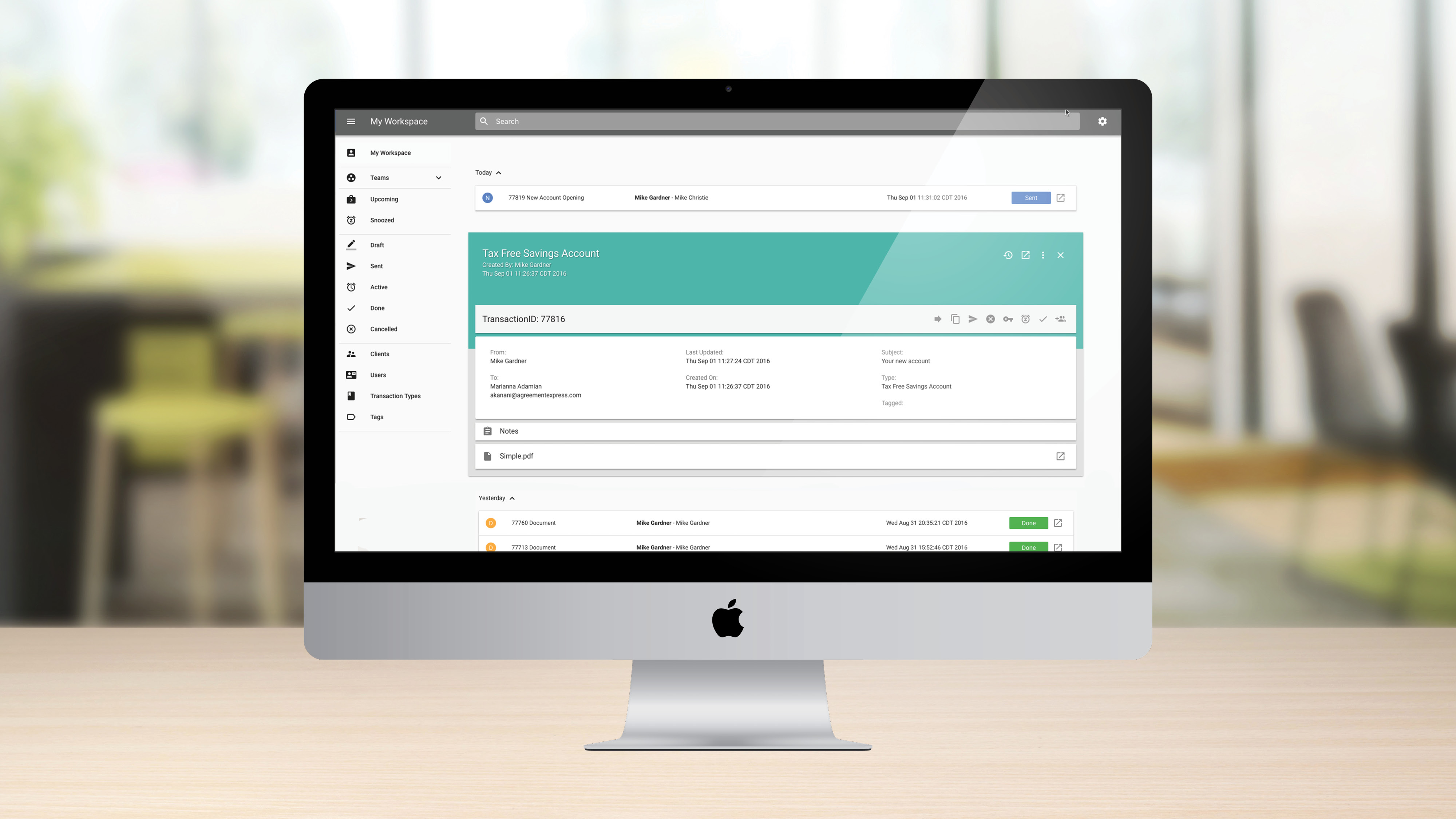

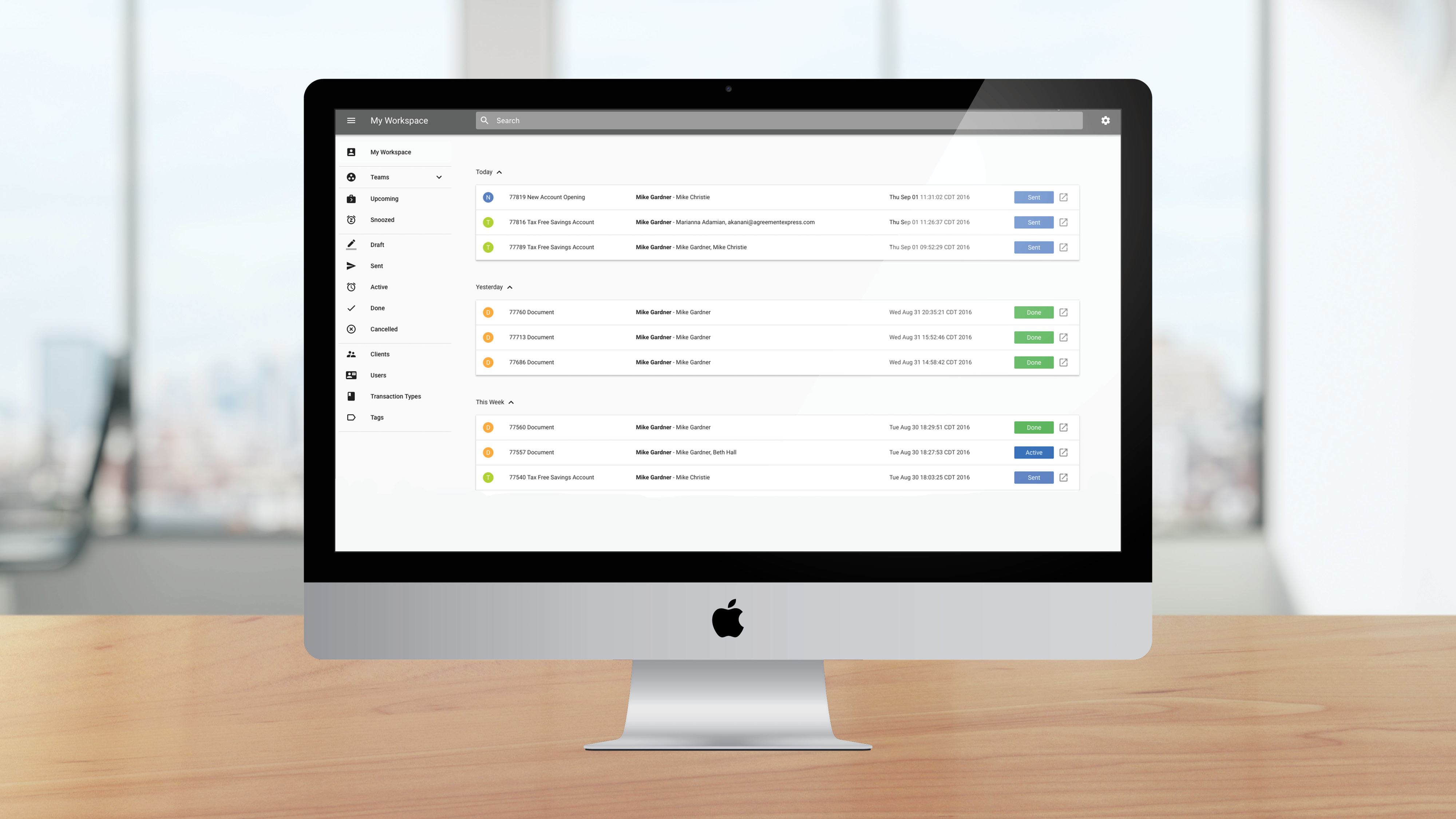

Agreement Express document management screen

Agreement Express document management screen

Finovate: Who are your primary customers?

Gardner: We service key financial institution markets globally, primarily wealth management, payments, banking, and insurance. In those markets, we serve Fortune 1000 companies and top industry leaders such as Global Payments, Elavon, M&T Bank, National Bank Correspondent Network, Questrade, and more.

Finovate: How does Agreement Express solve the problem better?

Gardner: Agreement Express does two things that sets it apart from the competition: it solves the entire client onboarding problem from front to back office, and enables firms to go live in weeks, not months or years.

Our platform solves more of the problem in less time, and allows users to configure and iterate on an ongoing basis. This allows firms to realize tremendous value right away, and lowers the risk of trying to get everything perfect in advance and delaying time-to-value for a year or more.

Finovate: Tell us about your favorite implementation of your solution.

Gardner: We are proud of the work we’ve done with all of our clients, but one that comes to mind is Global Payments, one of the largest merchant acquirers in the world. By consolidating all of their merchant onboarding processes into Agreement Express, they were able to increase application return rates from 40% to 100%, and virtually eliminate back-office data entry. It was exciting to watch such a large institution make so much digital progress in a short time.

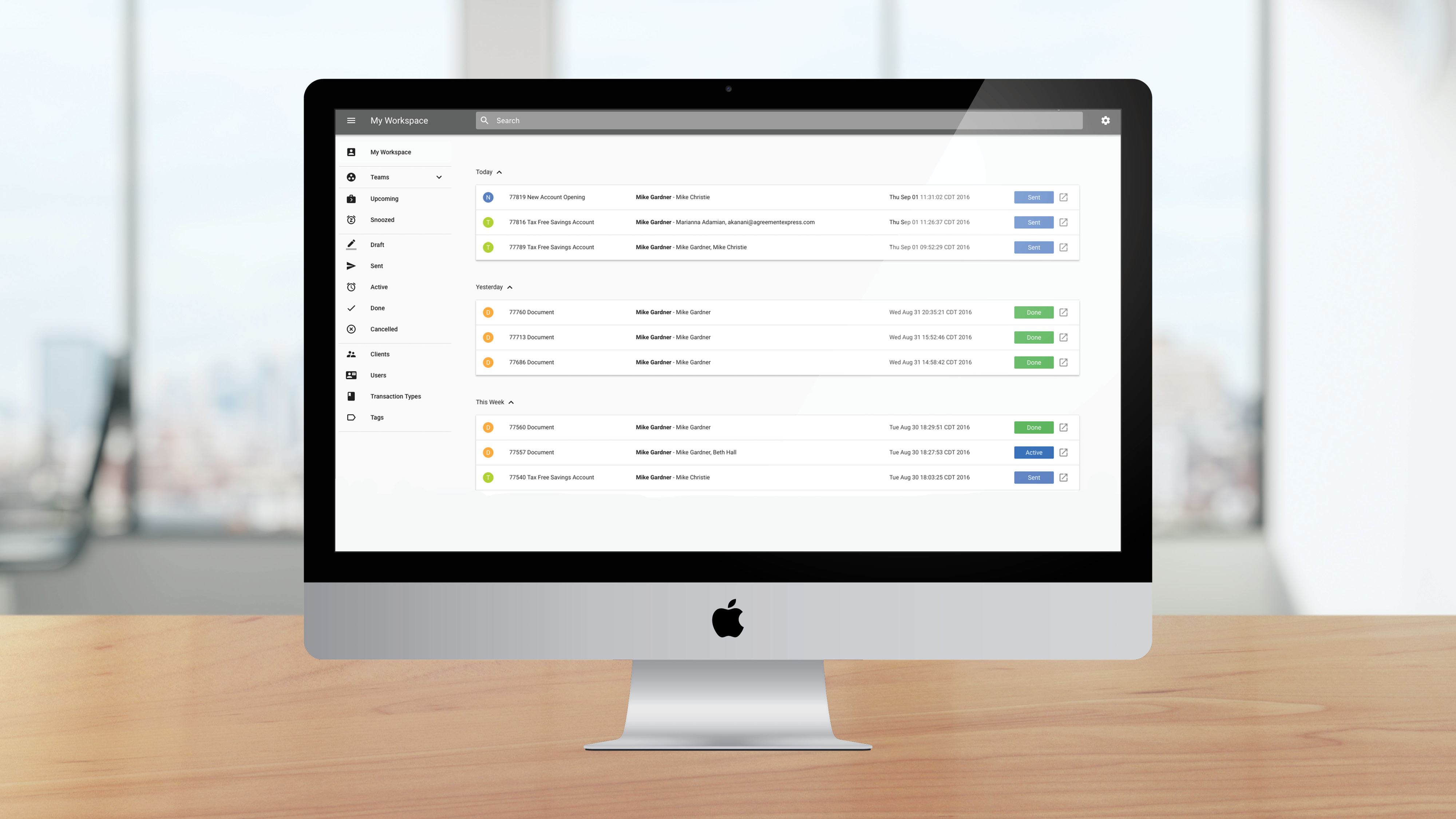

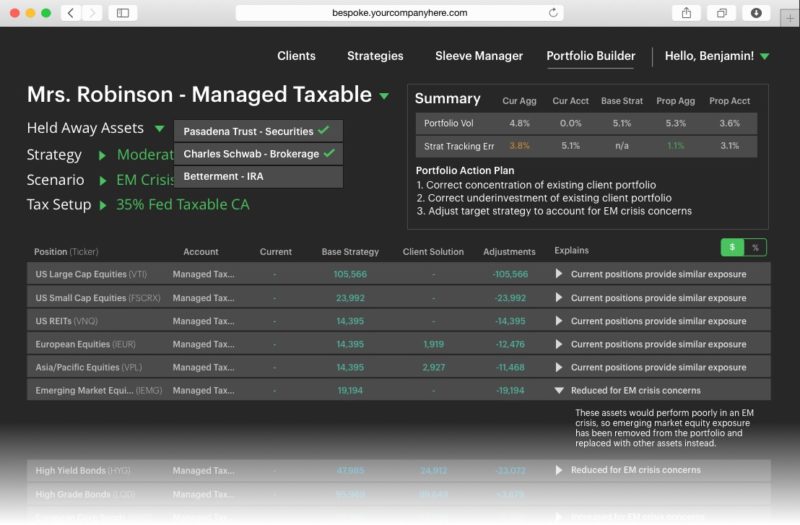

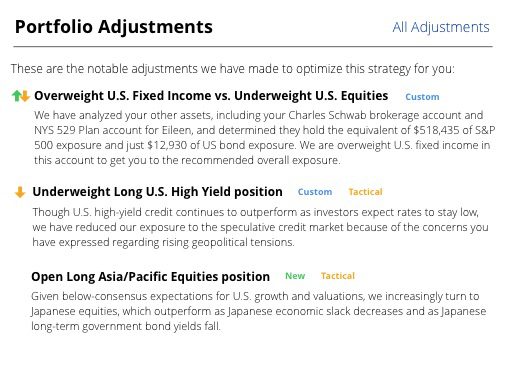

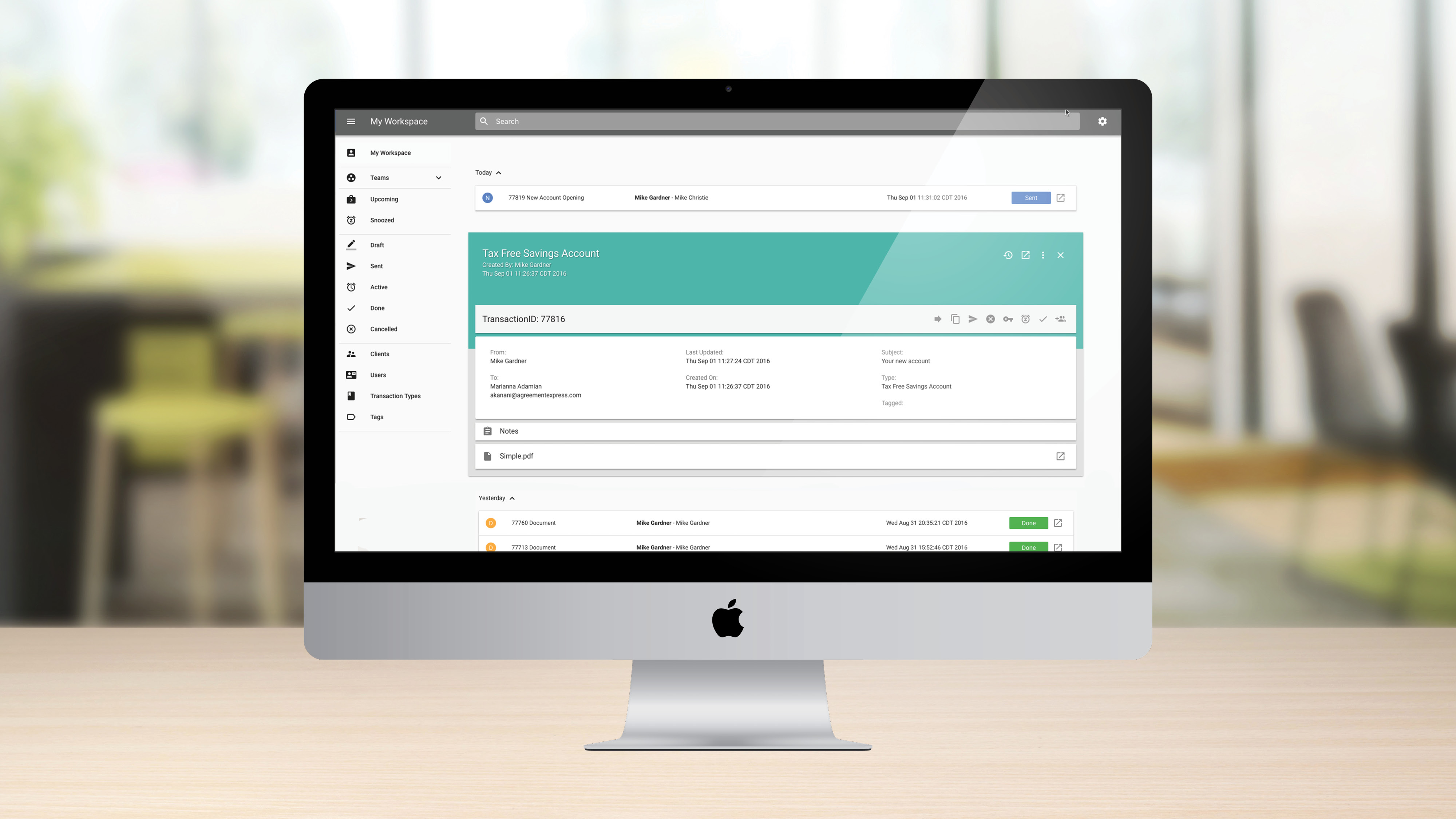

Agreement Express adviser workspace

Agreement Express adviser workspace

Finovate: What in your background gave you the confidence to tackle this challenge?

Gardner: We work with some of the largest global merchant acquirers, which gave us the confidence that we could successfully help Global Payments make a significant digital transformation.

Finovate: Where do you see Agreement Express a year or two from now?

Gardner: On our current trajectory, we’ll be continuing our global expansion, opening new offices around the world. We’ll be continuing to make Agreement Express accessible to the entire financial services enterprise, from the largest firms to the smallest partners in their network. Typically, software is either made for big or small companies, but Agreement Express will be used by the whole ecosystem for a completely integrated client onboarding experience.

Check out the video of Mike Gardner (CEO) and Andrew Grocholski (Account Executive) demoing Agreement Express at FinovateFall 2016.

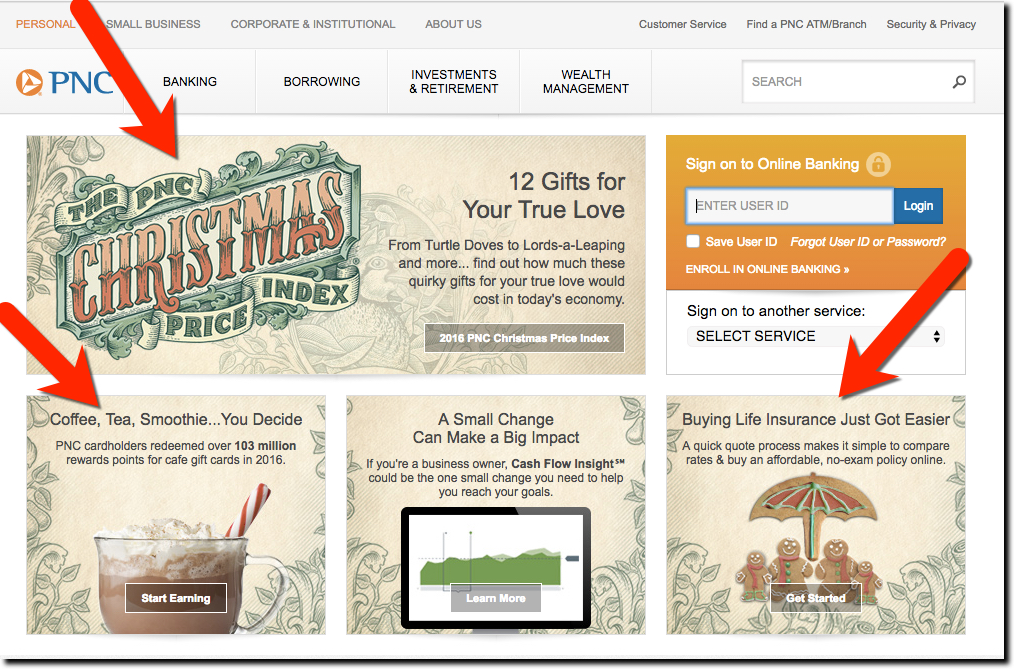

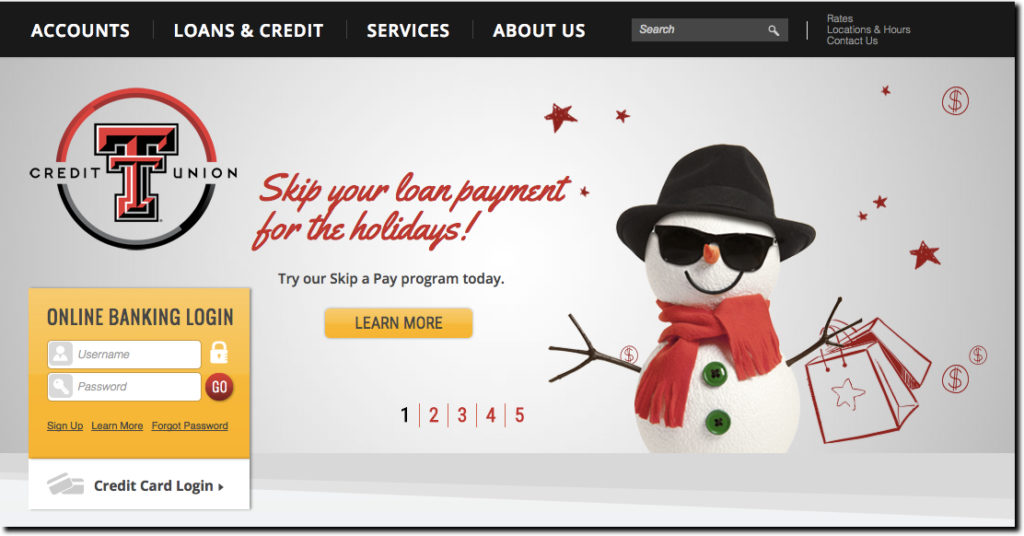

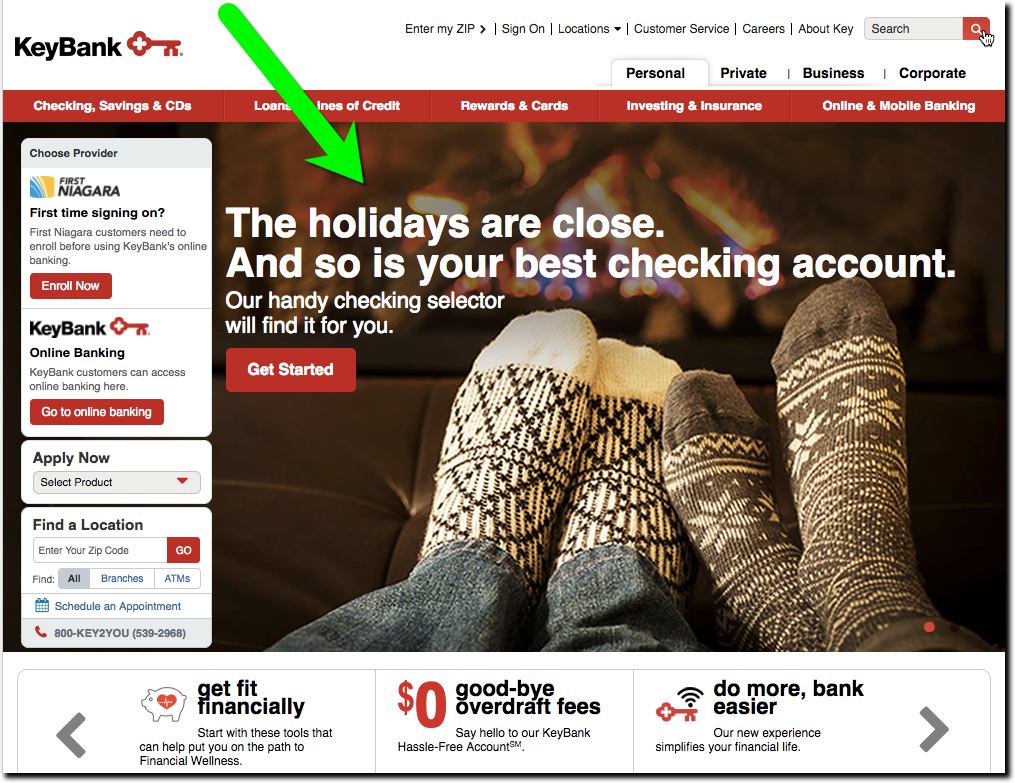

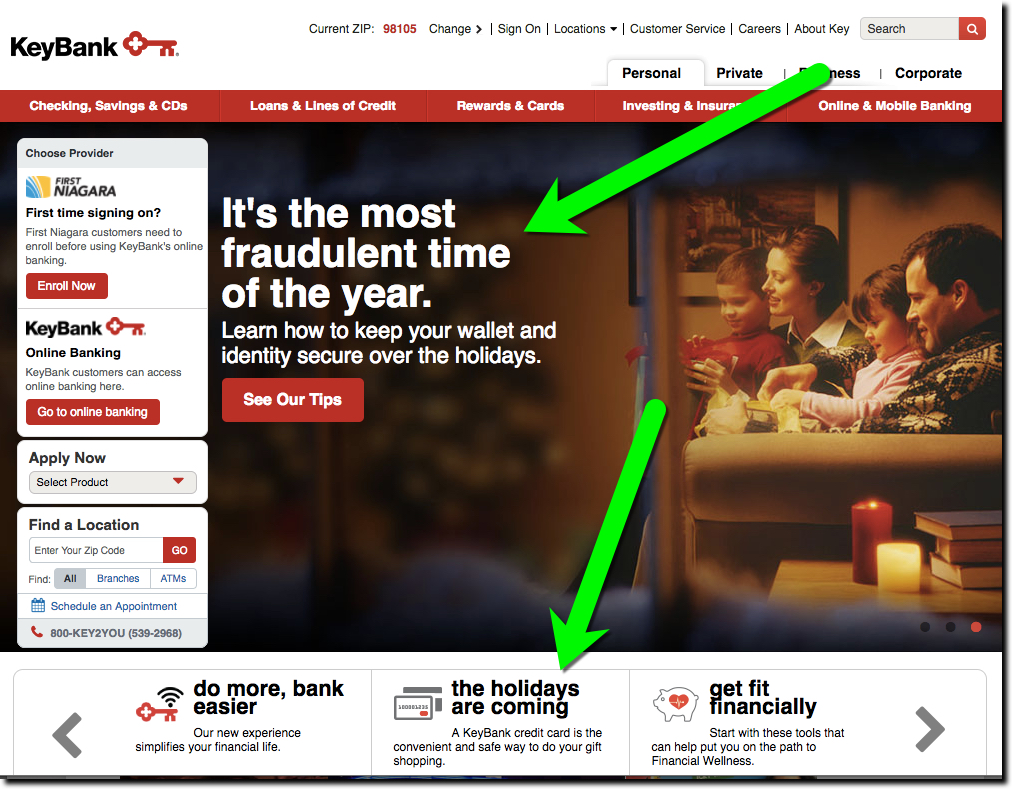

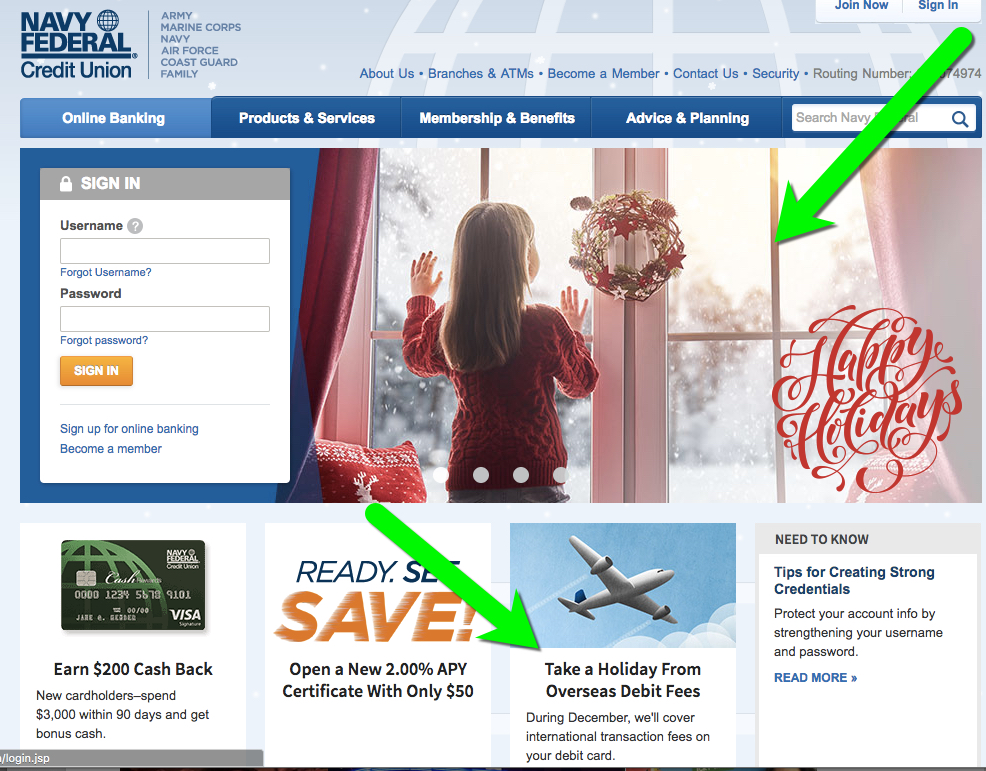

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

can’t wait to join the team and to work with Manolo to extend the success story of BBVA Compass.” Genç will replace Manolo Sanchez, who became CEO of BBVA Compass in 2008 and will transition into a new role of non-executive chairman.

can’t wait to join the team and to work with Manolo to extend the success story of BBVA Compass.” Genç will replace Manolo Sanchez, who became CEO of BBVA Compass in 2008 and will transition into a new role of non-executive chairman.

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank

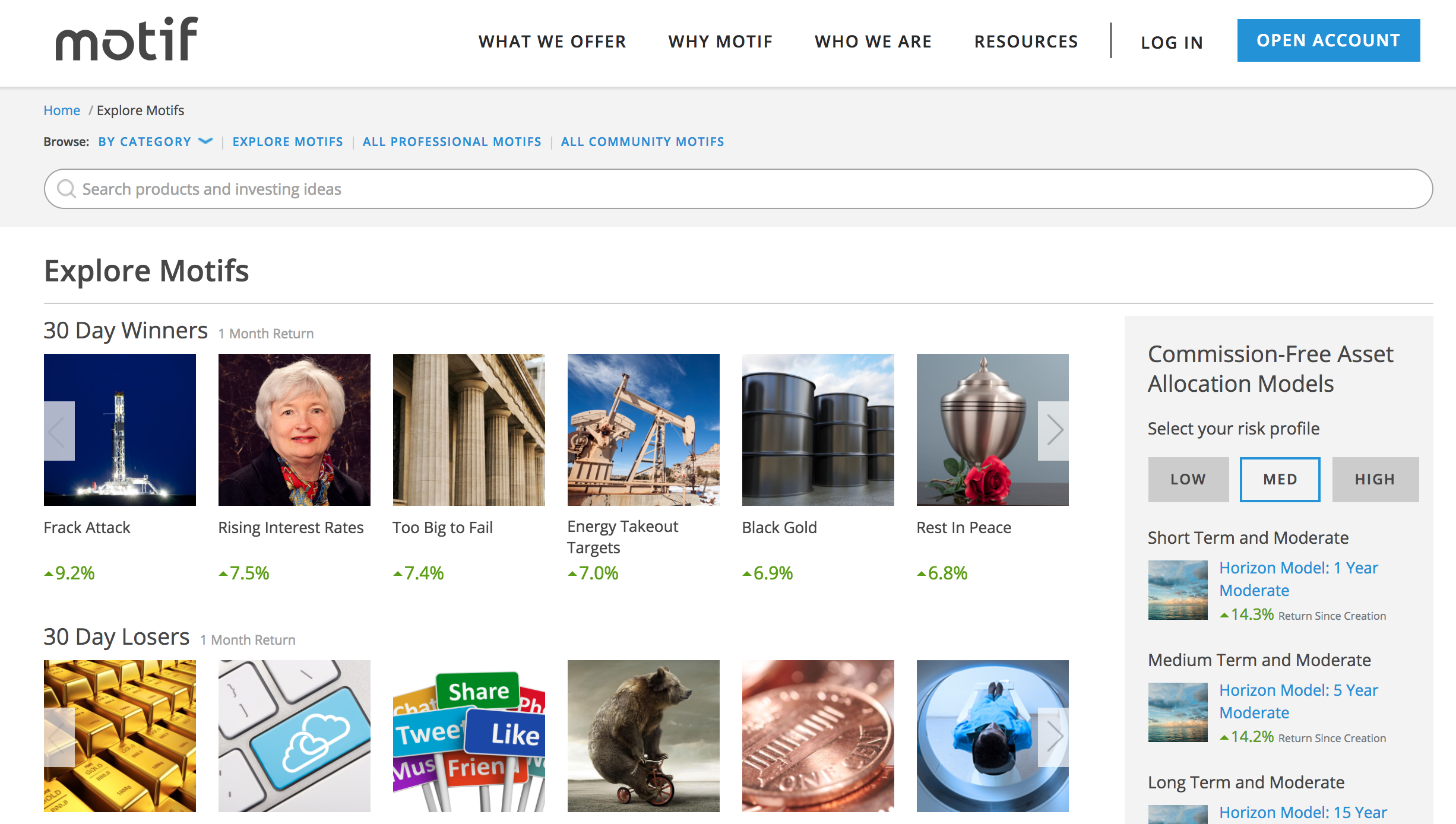

SigFig has partnered with multiple banks, including Wells Fargo, Pershing, and Citizens Bank With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme

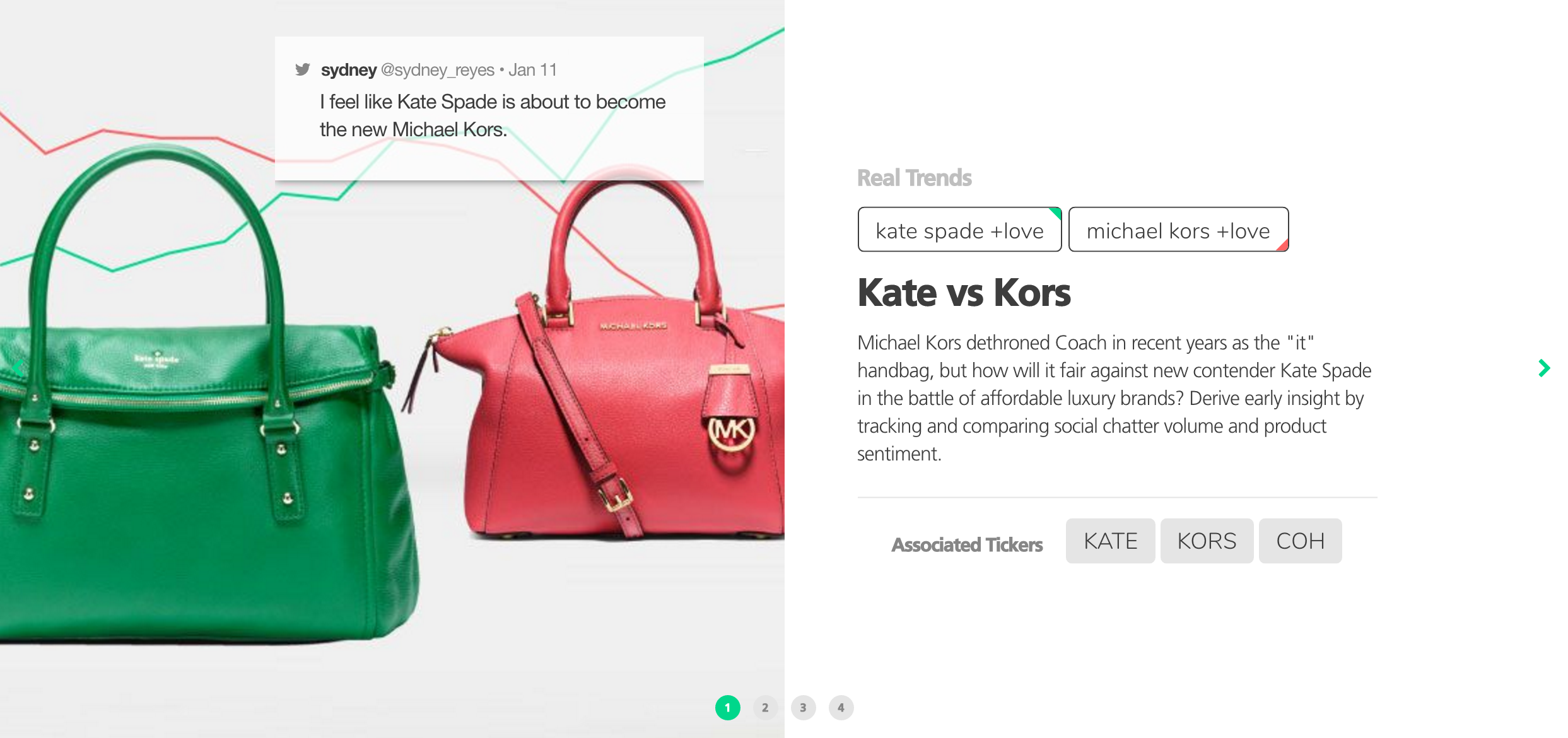

With Motif, uses invest in grouped stocks and ETFs that revolve around a common theme TickerTags helps users discover trends even before they become news

TickerTags helps users discover trends even before they become news

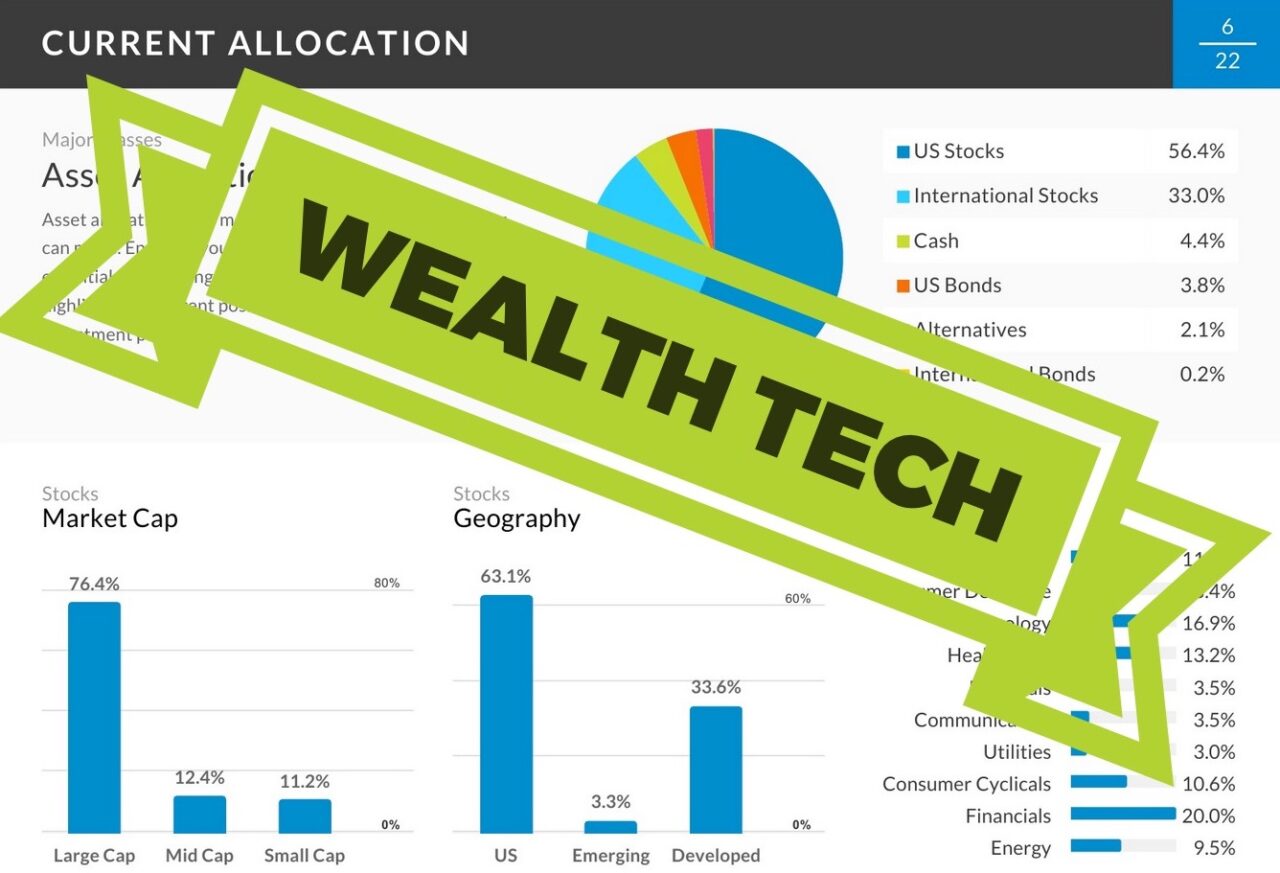

leverage the model portfolios offered by the financial adviser. “Many advisers use very basic model portfolios,” says Tom McCosker, Polly Portfolio’s COO and CFO. “We built BCI to plug into model portfolios. Then customize around (their) model, using basic risk exposure, and then customize for taxes, headway assets, views on the economy, and so on.” The integration is API-driven, so there is no need for full stack integration.

leverage the model portfolios offered by the financial adviser. “Many advisers use very basic model portfolios,” says Tom McCosker, Polly Portfolio’s COO and CFO. “We built BCI to plug into model portfolios. Then customize around (their) model, using basic risk exposure, and then customize for taxes, headway assets, views on the economy, and so on.” The integration is API-driven, so there is no need for full stack integration.

CEO Mike Gardner and Account Exec Andrew Grocholski demoed Agreement Express at FinovateFall 2016

CEO Mike Gardner and Account Exec Andrew Grocholski demoed Agreement Express at FinovateFall 2016 After his presentation at FinovateFall, we conducted an interview with Mike Gardner, Agreement Express CEO, to gather more information about the company and its future plans.

After his presentation at FinovateFall, we conducted an interview with Mike Gardner, Agreement Express CEO, to gather more information about the company and its future plans. Agreement Express document management screen

Agreement Express document management screen Agreement Express adviser workspace

Agreement Express adviser workspace