This post is part of our live coverage of FinovateFall 2015.

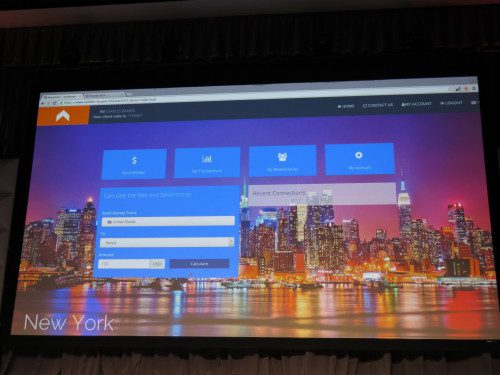

Urban FT demonstrated how its white-labeled banking platform offers comprehensive banking features:

Urban FT demonstrated how its white-labeled banking platform offers comprehensive banking features:

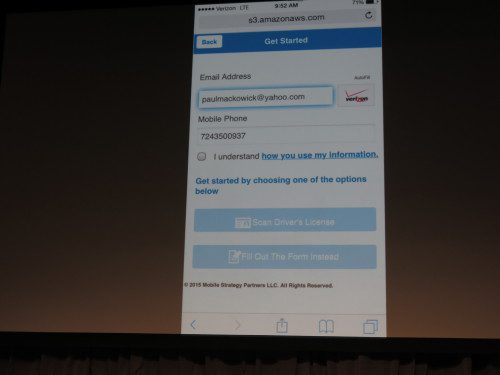

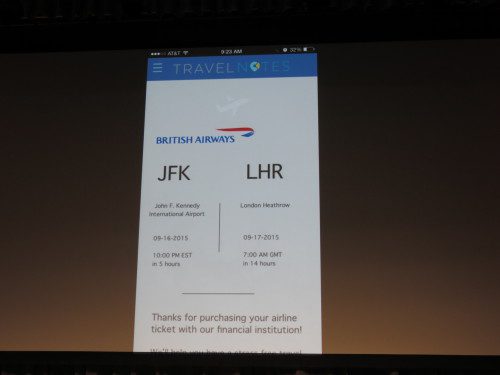

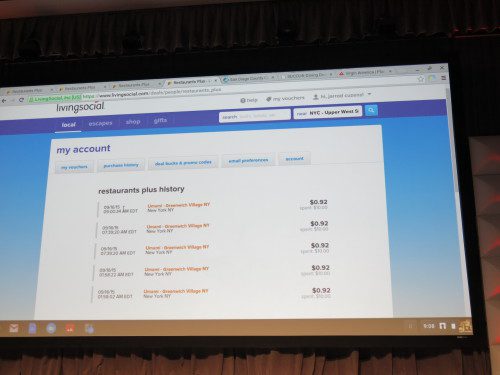

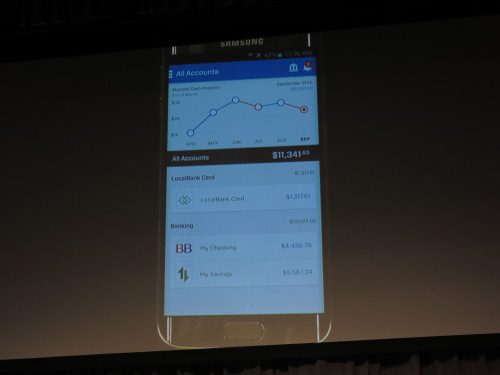

This is a fully white-label, self-managed platform that allows you to provide your customers with comprehensive core banking functions, personal financial management tools, targeted deals, and social sharing features. By combining these features, you are able to drive greater user engagement, increase brand touchpoints, and build customer loyalty in ways previously unavailable.

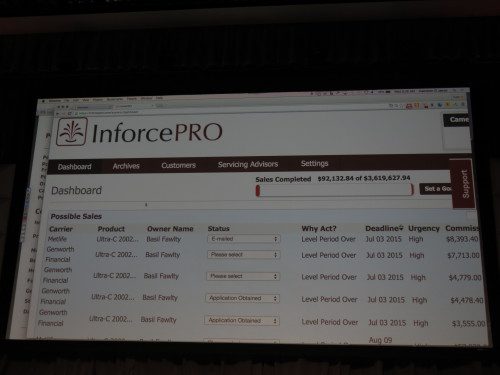

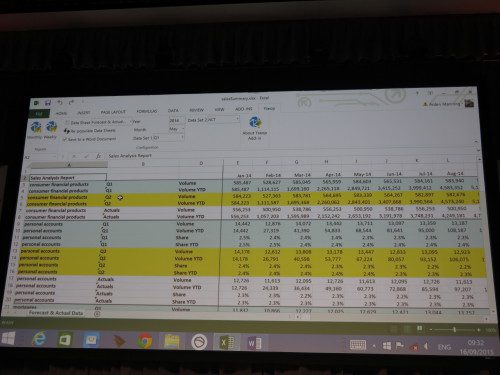

The analytics produced by the UFT Platform also drive growth in other areas of your business, such as lending or other complementary offerings. The UFT Platform connects directly to your core or third-party processor, has fully integrated analytics reporting capabilities, and plug-ins for all necessary customer care and compliance systems.

Presenters: COO Kasey Kaplan and Chief Product and Brand Officer Mark Kilpatrick

Product Launch: June 2014

Metrics: To date we have raised $14.5 million; currently employ 32 people throughout 3 offices; and service 700,000 registered users.

Product distribution strategy: Direct to Business (B2B), through financial institutions

HQ: New York City, New York

Founded: May 2012

Website: urbanft.com