- Australia digital finance platform SocietyOne is adding new checking and savings accounts, SpendOne and SaveOne.

- SocietyOne is leveraging Westpac’s banking-as-a-service platform to offer the new accounts.

- Today’s news comes three months after SocietyOne was acquired by alternative lender MONEYME.

It’s 2022 and digital banking is in the air. P2P lending platform SocietyOne is among the many fintechs that have added checking and savings accounts to compete with this decade’s new crop of challenger banks.

The Australia-based company recently unveiled it has tapped its long-time investor Westpac to add these new checking and savings accounts, SpendOne and SaveOne. Westpac’s banking-as-a-service platform will fuel the new accounts, which will work in conjunction with SocietyOne’s fixed rate secured and unsecured personal loans, as well as its free credit score product.

SpendOne and SaveOne can be accessed via SocietyOne’s new mobile app, which offers customers visibility of their transactions and allows them to take out a SocietyOne loan, set up automatic repayments, and access their credit score.

Today’s news comes three months after SocietyOne was acquired by alternative lender MONEYME. According to the press release, the launch of SpendOne and SaveOne “is aimed to fast-track the MONEYME Group’s goal of becoming Australia’s largest non-bank credit provider.” Once the acquisition closed in March of this year, combining the companies significantly increased MONEYME’s customer base and created a $1.2 billion loan book.

“The launch strongly aligns with MONEYME’s diversification strategy and our focus on delivering leading digital-first experiences to empower Generation Now,” said MONEYME CEO and Managing Director Clayton Howes. “The SpendOne and SaveOne accounts are designed to automate good financial habits, giving customers more freedom, flexibility, and a one-stop shop to manage their money.”

Marketed as a transaction account, SpendOne will not charge transaction or account fees. The account comes with many of the features users would expect from a large bank, including a debit card, account-to-account transfer capabilities, and ATM cash withdrawals. Additionally, SpendOne has a round-up feature that lets customers opt to round up their everyday transactions to a select amount, sending the balance to their SaveOne account.

The SaveOne account comes with an interest rate of 1% per year. In addition to the roundup feature mentioned above, SaveOne also helps users save with an autosave option that allows a percentage of customers’ deposits to be automatically transferred to their SaveOne account.

“Adding these products creates a frictionless experience for SocietyOne customers, who can now monitor and manage everyday transactions, savings, SocietyOne personal loans, and their credit score, all in one app,” said MONEYME COO Jonathan Chan. “With easy oversight and automated features to help customers save more, it provides increased control over their finances.”

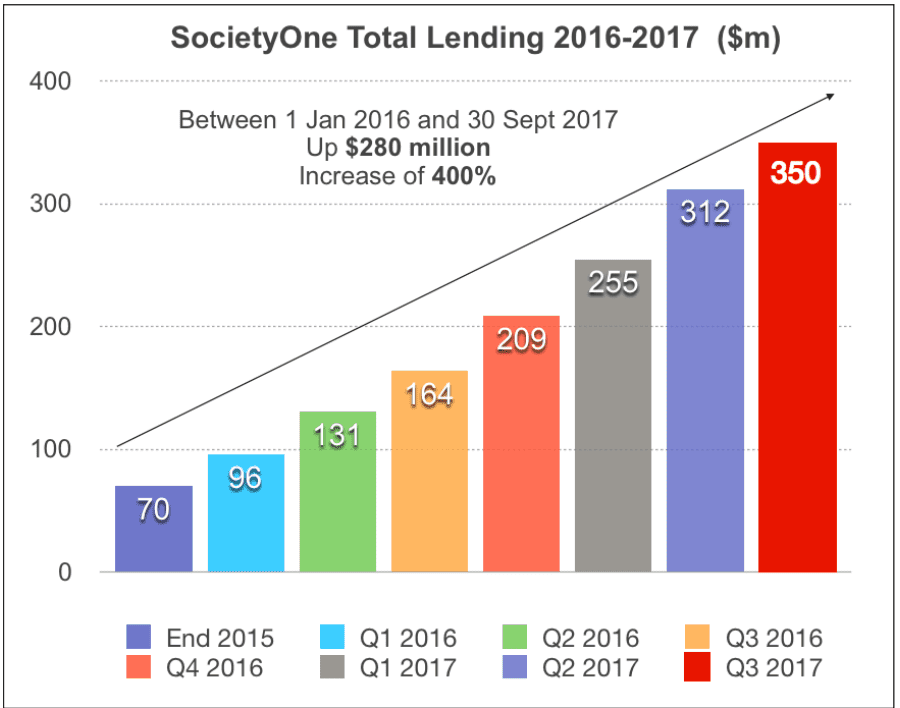

SocietyOne was founded in 2012. Since then, the company’s platform has matched investors’ funds with over 35,000 customers and, last January, surpassed $1 billion in lending. SocietyOne is a wholly-owned subsidiary of MONEYME, which is listed on the ASX under the ticker MME and has a market capitalization of $220 million.

Australian peer-to-peer lending company

Australian peer-to-peer lending company