Have you had a chance to look through what’s ahead at FinovateFall next week? Between the live demos, keynotes, stream discussions, and summit sessions, there will be a lot of content coming your way.

The event will take place on September 24 through 26 in New York (tickets are still available). During the first two days, 80 companies will take the stage to show off their newest technologies, live in front of an audience of financial professionals. The final day we’ll host industry analysts and experts to share their knowledge of key trends, as well as hold panel discussions regarding the grittiest topics in banking.

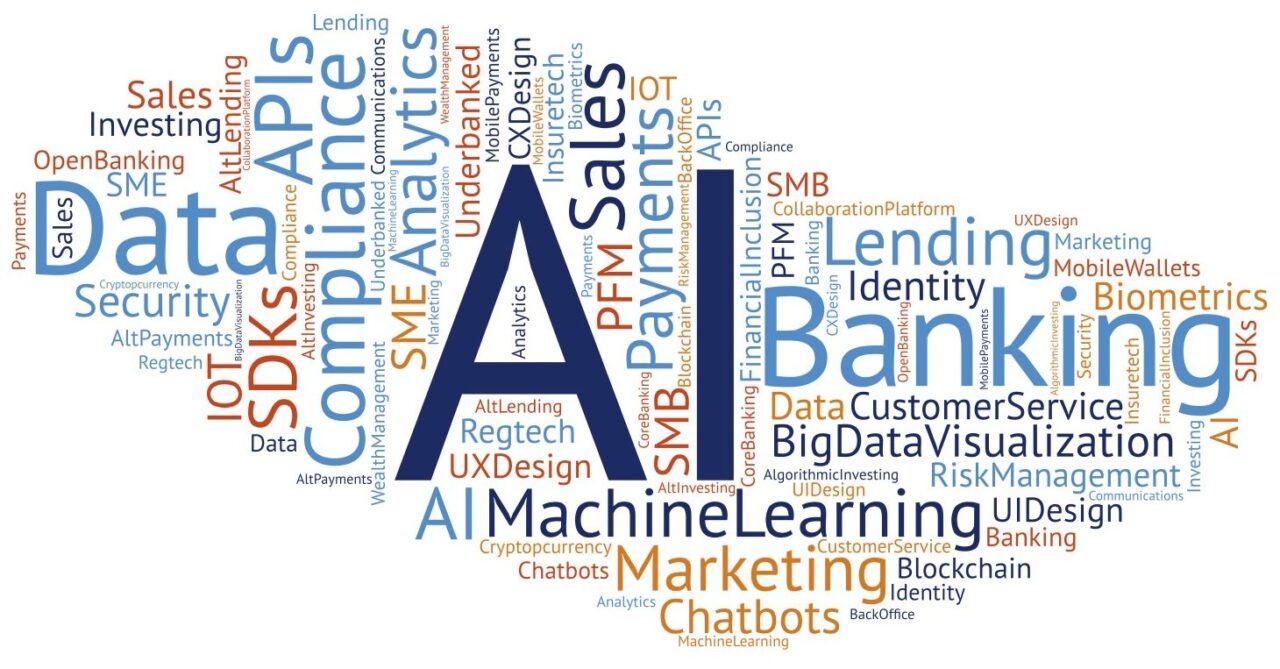

Behind this grit are the individual trends we’ll see at this year’s event. Check out the word cloud below that depicts the biggest driving forces of new fintech in 2018:

AI

It’s not a surprise to see AI come out on top as one of the biggest themes at this year’s FinovateFall. The enabling technology is pervasive throughout fintech, making shifts in security, investing, customer relationship management, sales, and marketing. In next week’s demos, we’ll see where and how AI is being used in fintech and learn how you can leverage this powerful technology.

Data

In financial services, it’s data or die. No matter what sector of fintech you’re in, if you haven’t started leveraging your data yet, you’re behind the competition. Data is increasingly critical in credit scoring and risk underwriting for loans, personalization of banking services, analytics marketing, investing, and security. Unlocking the value of data requires not only access to large sets of consumer data but also a way to sift through and organize the data, making it useful for analysis. Next week, not a demo will go by that doesn’t use data in some way. It’s up to you to decide which use case is most valuable for your institution.

Compliance

Compliance isn’t sexy; in fact, most firms simply see it as an obligation and a stumbling block. But who says compliance can’t be fun? Many fintechs are using enabling technologies such as the blockchain and AI to create efficiencies, and some are even using gamification to boost active participation during training exercises. We’ll host a number of companies demoing compliance tools that make regulation seem more exciting than ever.

Customer engagement

There are more tools than ever to help financial services companies gain consumer interest in their products and services. From marketing campaign personalization to predictive analytics that anticipate consumers’ needs, these revenue-boosting technologies are worth implementing. We’ll host multiple demos next week that showcase the latest tools to help your organization boost sales numbers.

What are you hoping to discover at FinovateFall next week? Check out the agenda to learn more of what’s in store. Have questions? Visit our contact page to get in touch and we’ll help you out.