Bitbond is a global peer-to-peer bitcoin lending platform. Get access to affordable loans and profitable savings from all around the world.

Features

With Bitbond AutoInvest:

- Build a loan portfolio automatically

- Define regions and risk categories to invest in

- Re-invest received loan repayments

Why it’s great

Bitbond AutoInvest creates a portfolio of profitable loans for you at 0% fees according to your preferences.

Presenters

Radoslav Albrecht, Co-founder and CEO

Background in economics. Prior to founding Bitbond, Albrecht was Senior Consultant at Roland Berger Strategy Consultants. Previously with Deutsche Bank London in structured equity.

Robert Nasiadek, Co-founder and CTO

Programmer since childhood. Before joining Bitbond, Nasiadek started the Ruby on Rails development company, El Passion. Board advisor at Gimmy.pl.

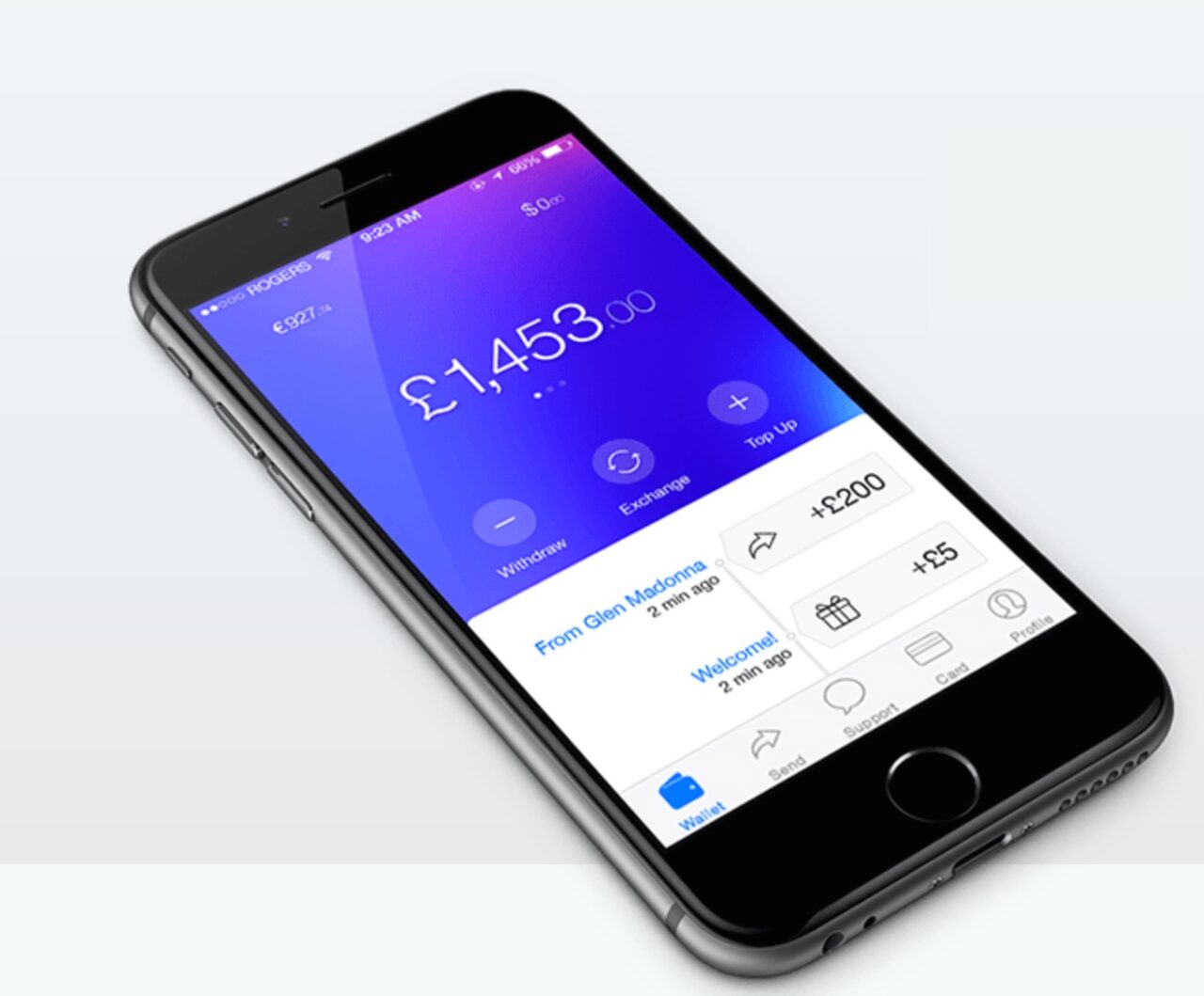

Revolut is a personal money cloud allowing you to avoid all hidden banking costs.

Features

You can exchange currencies at interbank rates, send them through social networks and spend with a multicurrency card acceptable anywhere.

Why it’s great

Revolut – Personal Money Cloud

Presenters

Nikolay Storonsky, CEO

Storonsky has eight years experience in financial services (trading). Most recently he worked for Credit Suisse and Lehman Brothers.

Vlad Yatsenko, CTO

Yatsenko has 12 years experience in developing IT projects in major financial institutions including Credit Suisse, UBS, and Deustche Bank.

Smart e-Money’s LockByMobile is an anti-fraud security solution which allows you to lock and unlock your cards in real-time using your mobile phone.

Features

- Provides an extra layer of security for your added peace of mind

- Easy-to-use interface to lock/unlock your cards with a simple swipe of the finger

- Customizable lock settings and built-in alerts

Why it’s great

Feel secure when using your card locally or even abroad. With LockByMobile, you have the power to prevent fraud from happening.

Presenters

Angelito Villanueva, VP & Head of Innovation

With over 20 years experience, Villanueva is the lead in unlocking the huge potential of e-money by introducing digital payments innovations for financial inclusion including building a dynamic ecosystem.

Guillaume Danielou, Senior Product Manager

With 12 years experience in IT Development/Consulting/Product Development, Danielou has experience working throughout the entire product development life cycle process in international environments.

TiViTz College $avings Game-a-thon is a fully automated, easy-to-use, market-disrupting, patent-pending, activity-based fundraising tool for children’s college savings.

Features

- Complements existing financial savings vehicles

- Creates new college savings accounts and relationships

- Provides a marketing tool for consumer and business banking

Why it’s great

The Game-a-thon provides families with a solution to afford higher education by significantly increasing children’s savings, while improving their math skills and financial literacy.

Presenters

Siobhan Mullen, CEO

Former aerospace executive, Special Advisor to the NASA Administrator, and experienced high-tech entrepreneur in launch services, satellite communications and data distribution.

Stephen Scully, President

TransferTo’s Value Remittance service is an innovative and unique remittance solution that enables migrants to determine how the funds they send are allocated.

Features

Value Remittance provides direct payment of services such as electricity, mobile airtime, and education, while providing a new revenue stream for financial institutions and MTOs.

Why it’s great

Value remittance allows senders to know exactly how their money is being spent and provides the receiver with instant access to the selected service.

Presenters

Eric Barbier, CEO

As founder and Chief Executive Officer, Barbier oversees the strategic direction of the company as well as manages the relationships with many of TransferTo’s customers and partners.

Charles Damen, EVP Global Business Development

Damen is responsible for the development of new services, strategic partnerships, and the growth of global accounts with over 18 years of experience in telecommunications, Internet, and payments.

Wipro ngGenie Smart Banking Assistant provides the “next generation banking experience” for customers. It helps by providing you with right information at the right place.

Features

A personalized, contextual, next generation user experience for banking customers that can result in reduced costs of serving customers and an increased cross sell / up sell opportunities.

Why it’s great

Wipro myAdvisor helps in day-to-day transactions and acts as your personal financial advisor.

Presenters

Mukund Kalmanker, General Manager

Kalmanker is a general manager at CTO office and has a rich background in the banking domain. He had earlier handled the banking business for Wipro under the Analytics and Information Management domain.

Sudhakar Babu Tamminedi, Practice Head

Tamminedi has over 15 years of experience in Consumer and Enterprise Mobility applications across industries. He has provided end-to-end mobility solutions form conceptualization to deployment.