Inspire FCU, a 15,000-member financial institution founded in 1936 that serves the community of Bucks County, Pennsylvania, is making the move to NYMBUS.

“In order to deliver the enhanced experience and competitive, digital financial products our members ask for, it was clear our legacy core was setting us up to fail,” President and CEO of Inspire FCU Jim Merrill said. He faulted the inflexibility of their legacy system, praising NYMBUS’s advanced core, digital, and payment solutions as an ideal replacement. And not just of the credit union’s legacy system, either.

“Inspire will eliminate 15 technology vendors after we convert to NYMBUS,” Merrill said, referring to the large number of different vendors the credit union had been relying on, which complicated workflows and detracted from the Inspire’s member experience. “And, we will deliver a much more intuitive user experience to better compete with larger financial institutions and new fintech companies that have entered the market.”

Inspire will take advantage of NYMBUS’ full suite of advanced banking solutions including SmartCore, NYMBUS’ turnkey core banking platform; SmartDigital; NYMBUS’ internet and mobile banking suite; and SmartPayments, which will manage the authorizations and transactions for Inspire’s debit card program while providing real-time fraud protection.

“Today’s financial institutions risk extinction if they don’t adapt to the disruption of digital innovation,” David Mitchell, President of NYMBUS said. “Inspire has recognized the scale of this disruption and embraced a digital-first view of banking.”

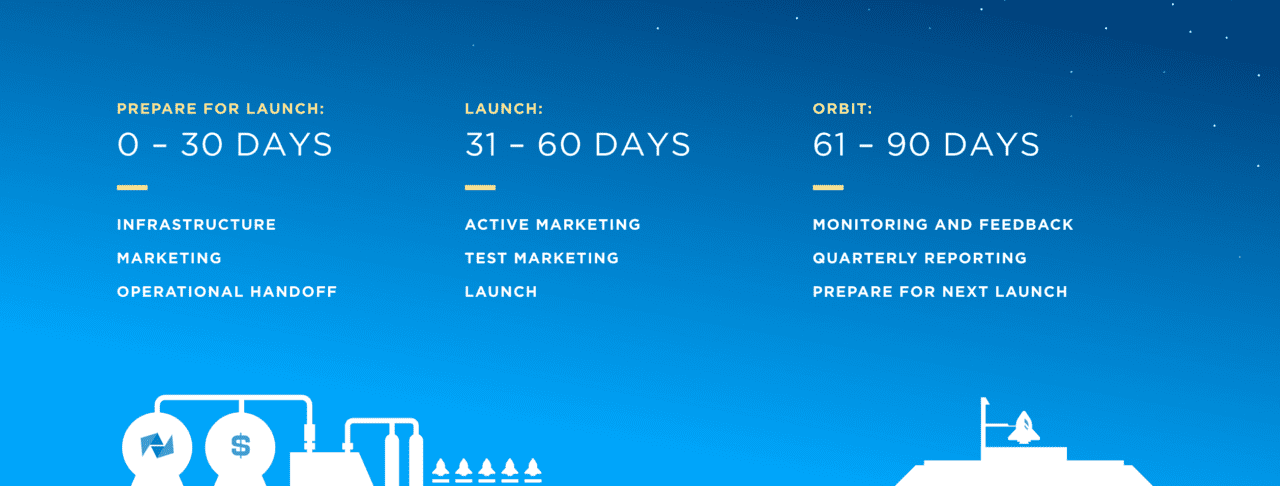

Based in Miami Beach, Florida, NYMBUS demonstrated its core banking technology at FinovateSpring 2016. Last month, NYMBUS completed a four-month conversion process for Surety Bank ($111 million in assets). In April, the core banking technology innovator unveiled its SmartLaunch solution that makes it easier for banks to build turnkey digital banking solutions in 90 days.

NYMBUS has raised $28 million in funding, and includes Home Credit Group and Vensure Enterprises among its investors.