Core banking innovator NYMBUS has always helped banks chase their digital dreams. Starting today, the Florida-based company is continuing that mission, but making it even faster with SmartLaunch.

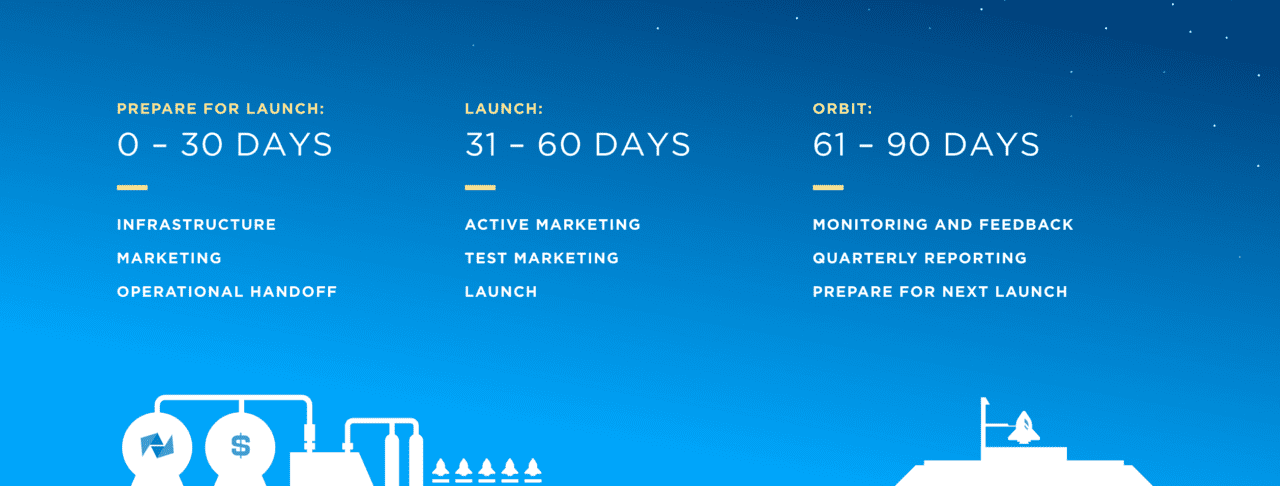

Built on NYMBUS’ SmartCore platform, SmartLaunch allows banks to set up a turnkey digital banking solution in as few as 90 days. The new offering grants banks access to technical resources, targeted digital marketing, website services, AML/BSA compliance, debit card issuance and management, and workflow management.

“The race is on to capture today’s digital banking customers, but legacy technology, operational risk, and a lack of resources and expertise make it difficult for financial institutions to deliver the exceptional Amazon-like experience consumers have come to expect,” said NYMBUS President David Mitchell. “SmartLaunch accelerates the goal by removing those barriers, while also leveraging a largely untapped brand approach for engaging loyal new customers and revenue opportunities.”

Banks can choose to launch the digital banking capabilities under their own brand or create a standalone, digital-only brand that targets a specific customer segment. In creating digital services, SmartLaunch helps banks expand consumer reach and increase cross-selling opportunities. “Digital banks are a profitable strategy, but NYMBUS recognized that a new model was needed to eliminate operational risk while also attracting more of today’s digital-savvy consumers,” Mitchell said. He described SmartLaunch as a “sign and recline” alternative to a core conversion that doesn’t require hiring additional staff.

NYMBUS offers four products in addition to SmartLaunch, including SmartCore, a digital-first core data processing platform; SmartDigital, a core agnostic digital integration platform launched last fall; SmartPayments, an integrated real-time payments suite, and SmartServices, a service that allows banks to tap into the knowledge of the NYMBUS team. Since it was founded in 2015, the company has made three acquisitions, including R.C. Olmstead, KMR, and Sharp BancSystems. Most recently, NYMBUS completed its SOC 2 Type 1 Certification, an audit of the company’s security protocol. NYMBUS has raised $28 million.