One of the initial aims of personal financial management (PFM) was making sense out of your spending. For a variety of reasons, most consumers view that as just too much work for too little in return. But, since the launch of Mint nine years ago, much progress has been made on that value equation. Thanks to mobile technologies and various APIs, tracking is easier as well as more data rich, resulting in output that is much more useful.

For example, Simple’s Safe to Spend predicts when you will run out of cash with virtually no user input. It’s a great benefit for numbers-oriented customers who already pay close attention to their balances. But what about the other 90% of the world? Can PFM services deliver value for those that will never appreciate an animated graphic of their 10-year moving average of Starbucks purchases?

I believe the answer is yes.

PFM services need to broaden their role and help customers track their “financial stories.” Think about it. Unless you are an obsessive Facebook/Instagram/Foursquare poster, where else can you look back and find out where you ate last year in San Diego, what souvenirs you brought back for the kids, and which car rental company you want to avoid next time?

All that info, and much more, is locked away in your credit/debit card transaction history. Just being able to search your transactions helps tremendously (thanks, Mint). But what if you had ready access to all the information on your receipt? Then you could see not only where you ate, but also which entree you loved (since you would have made a note on the receipt at the time).

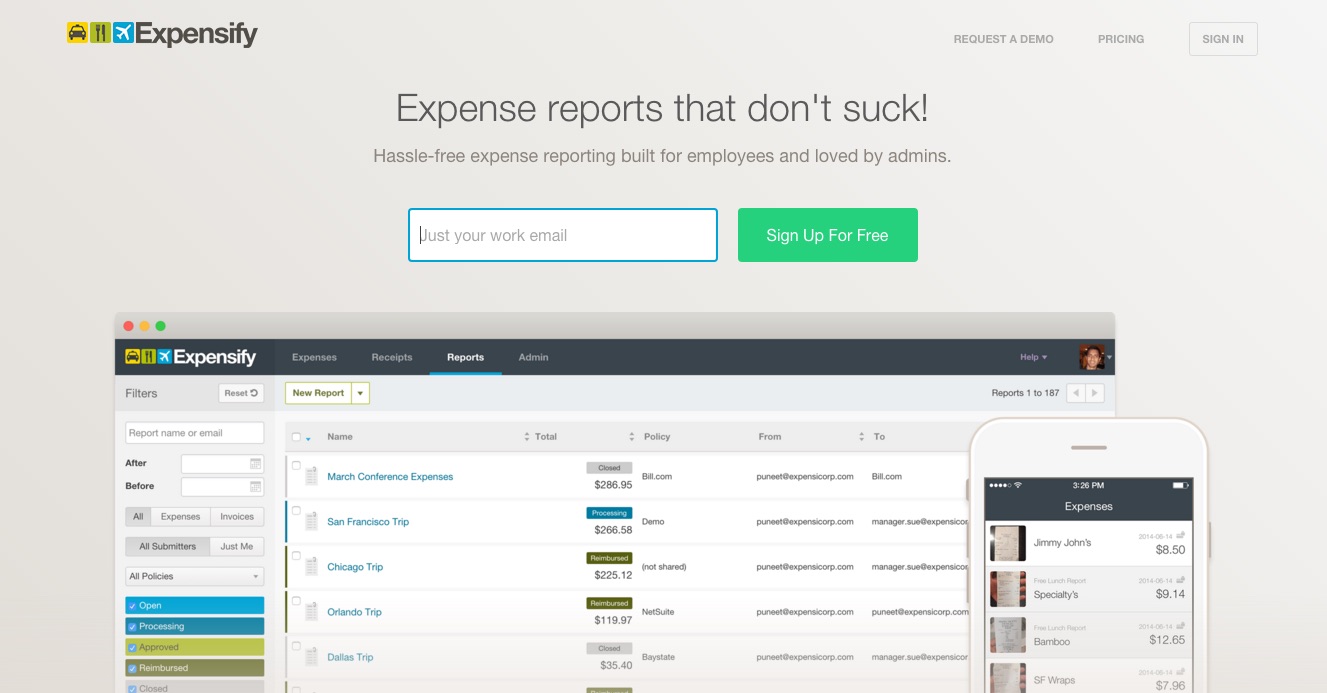

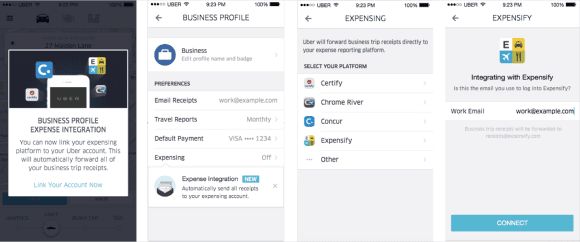

Currently, integration with camera phones, such as that offered by Expensify, do this for highly motivated users, such as those with a large financial incentive to track their reimbursable expenses. But what about everyone else?

That’s where startups—such as Finovate alums Ready Receipts, Shoeboxed, Xpenditure, as well as dozens of PFM providers and mobile payment specialists—come into play. They are devoted to getting the transaction detail on receipts aggregated into a single, easily accessible source.

We recently met another startup that seems to have good traction solving this problem (and happens to count Expensify as an investor), Washington D.C.-based Piper. Most of our conversation was off the record, but I love what they are doing, working with the POS players to reach critical mass in a difficult two-sided market—one in which retailers don’t want to spend money on enhanced receipts unless there are users, and users won’t bother unless they see a sizable number of receipts available.

Piper has also narrowed in on a business model that charges fees to the portion of the ecosystem that stands to gain the most from better receipt management; namely, the merchants, card issuers, and transaction acquirers who benefit massively from the 30% reduction in chargebacks that the system has proven in early tests.

I look forward to the time when Piper and the others have changed the PFM story.

——

Note: Y Combinator’s latest batch (W16), debuting this month, contains another receipt provider worth watching, FlexReceipts

Are you building new financial technology? Be sure to check out coverage from our recent developers conference in San Francisco. We’re taking the fintech developer tool showcase to New York, 29/30 March 2016. Stay tuned for details.

Are you building new financial technology? Be sure to check out coverage from our recent developers conference in San Francisco. We’re taking the fintech developer tool showcase to New York, 29/30 March 2016. Stay tuned for details.