Bluescape’s visual collaboration solution is an interactive, visual platform to help banks bring products to market faster. It gives teams tools they need to ideate, design, and create better products while offering the structure necessary to keep the new product within the bank’s boundaries by using a process-approval flow.

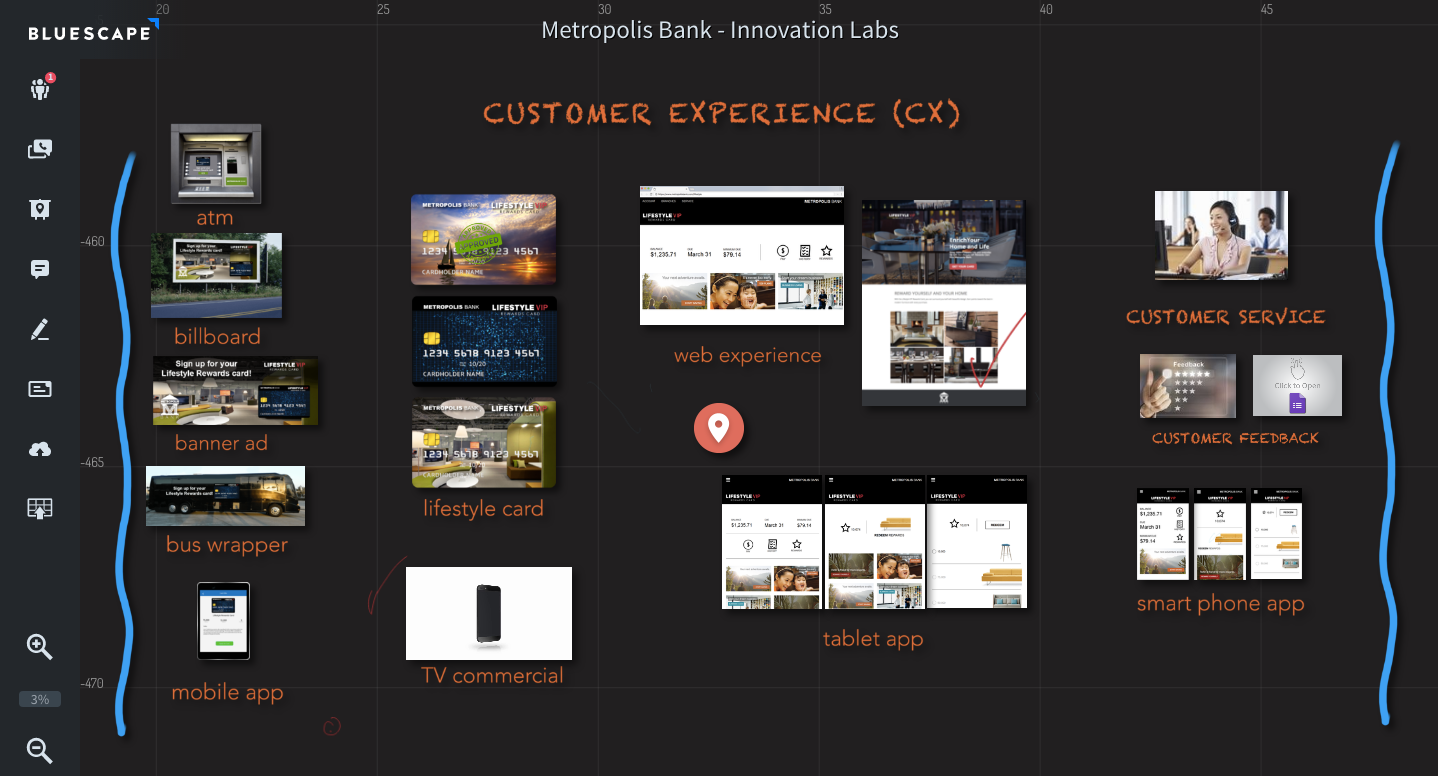

In the company’s demo at FinovateFall in New York City, Bluescape’s VP Products and Marketing, Nick Brown, mapped out an idea for a new credit card on the company’s multitouch display board. From there he showed how multiple teams, including marketing, legal, and compliance, can generate end-to-end workflows using tools such as drag-and-drop, sketch, media uploads, and more. Brown went on to demonstrate how the Bluescape platform enables screen sharing and audio visual conferencing to facilitate remote collaboration.

Bluescape has a markedly unique background. The company is a subsidiary of Haworth, a workplace furniture and interior architecture firm. The idea for Bluescape was conceived when Haworth partnered with Obscura Digital. The two companies wanted to find a new way to interact with large data sets. Read more about Bluescape’s launch in our interview with CEO Scott Poulton, below.

Company facts:

- 70+ employees

- Privately owned and funded by Haworth Inc.

- Headquartered in San Carlos, California

- Founded in 2010

- Clients include Marriott and Mazda

Nick Brown, VP, products and marketing, demoed the Bluescape platform at FinovateFall 2016 in New York.

Nick Brown, VP, products and marketing, demoed the Bluescape platform at FinovateFall 2016 in New York.

After the company’s demo at FinovateFall in New York, we caught up with Bluescape CEO Scott Poulton to ask about the company’s current targets and future plans.

Finovate: What problem does Bluescape solve?

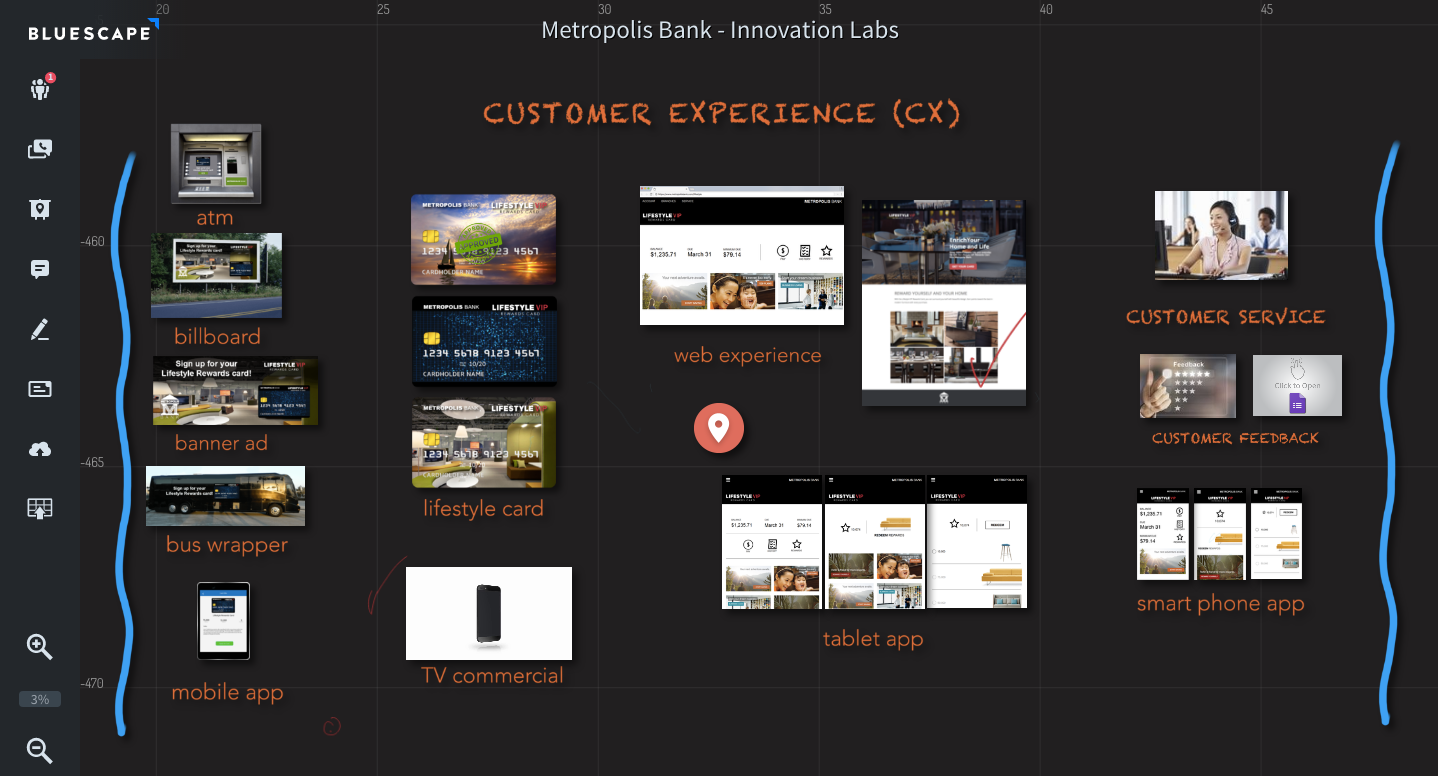

Poulton: The financial services industry is facing major disruption on just about every front. This large-scale disruption is requiring companies to significantly accelerate their pace of innovation. Bluescape helps financial services companies create better products, and more engaging and cohesive customer experiences, faster. Its visual collaboration platform lets UX/UI design teams see the whole picture as they ideate, design, refine, and develop in a workspace that’s ultra-scalable, all-capturing and accessible from any device.

Bluescape’s visual collaboration platform

Bluescape’s visual collaboration platform

Finovate: Who are your primary customers?

Poulton: Bluescape works with design and development teams within some of the most innovative enterprises in the world, from leading financial and professional services firms, to top media and entertainment studios (and even) the federal government.

Finovate: How does Bluescape solve the problem better?

Poulton: Bluescape connects teams across disciplines and time zones so everyone can see and play with concepts, plans and every iteration of those plans in one easy-to-use, easy-to-access place—where no idea is ever lost. Unlike other collaboration offerings, Bluescape is hardware and software tools agnostic: Users access Bluescape from any device, working with the tools they already enjoy using. Using Bluescape, individuals and teams can share ideas in real time, ignite breakthrough ideas, and bring better products to market more quickly.

Finovate: Tell us about your favorite implementation of your solution.

Poulton: A bio-tech institution, top design firm, and large pharmaceutical company are working together using Bluescape to share information, collaborate, and discover in real-time the important patterns around genetic research, which is revolutionizing scientific research. That implementation means a lot to us.

Finovate: What in your background gave you the confidence to tackle this challenge?

Poulton: Our founding company, Haworth, saw a need to have a better way to design products. The inspiration for Bluescape came from a love of designing new solutions that make the process of work and design better. We had the luxury of being able to test the proof of concept within Haworth—one of the top privately held furniture companies in the world with more than a $1B in revenue—and see firsthand the possibilities for this technology. Since then, Bluescape has been implemented in multiple Fortune 500 companies. This has given us all a high degree of confidence in Bluescape’s future success.

Finovate: What are some upcoming initiatives from Bluescape that we can look forward to over the next few months?

Poulton: We have redesigned our thin-client interface and are certifying our solution on some new, large-scale, tiled wall platforms in the last quarter of 2016. These new solutions will greatly change the price performance for the ultimate experience with Bluescape.

Finovate: Where do you see Bluescape a year or two from now?

Poulton: We see Bluescape changing the way design and development teams work. We believe it’s the kind of product that once you employ it, there is no going back. To quote a Bluescape customer, ‘Bluescape is what we’ve all been waiting for. It’s the way we were all meant to work.’

Nick Brown, VP, products and marketing, demoed the Bluescape platform at FinovateFall 2016 in New York.

Nick Brown, VP, products and marketing, demoed the Bluescape platform at FinovateFall 2016 in New York.

Bluescape’s visual collaboration platform

Bluescape’s visual collaboration platform