To steal a line from Rob Base and DJ EZ Rock, when it comes to innovation in fintech, it takes two to make a thing go right. Whether the “thing” is an end-to-end digital transformation or creating the technology infrastructure to enable firms to build and market their own innovations, collaboration and partnership with fintechs increasingly seems to be the path that the most forward-looking banks and other financial institutions are pursuing.

With this in mind, here’s a look at some of the more interesting recent partnership announcements over the past month – with an eye toward what these collaborations might be saying about the near-term future of fintech.

DBS Bank: Headquartered in Singapore. Total assets of $420 billion (SGD 579 billion) in 2019. Largest bank in Southeast Asia. Operates in 18 markets around the world.

- Partner: Infor

- Project: Digital trade financing

- Objective: Faster “more cost efficient” financing for the 68,000+ SMEs on Infor’s Nexus network.

Royal Bank of Canada (RBC): Headquartered in Toronto, Ontario, Canada. Has 17 million clients in Canada, the U.S., and 34 other countries. Total assets of $1.2 trillion (1.49 trillion CAD) as of 2019.

- Partner: Red Hat, Nvidia

- Project: In-house, AI-based private cloud platform

- Objective: The new build will allow the bank to develop “transformative intelligent applications” and to bring those solutions to market faster.

Orange: Telecommunications corporation headquartered in Paris, France. Fourth largest telecom in Europe and one of the ten largest in the world with 26 million customers. Total assets of $124 billion (€106 billion) and revenues of $49 billion (€42 billion) as of 2019.

- Partner: Temenos, NSIA

- Project: Orange Bank Africa launch

- Objective: Partnership will bring savings and micro credit services to underserved customers in Cote d’Ivoire, Burkina Faso, Mali, and Senegal.

Lloyds Banking Group Headquartered in London, U.K., Lloyds is the country’s largest digital bank with 16.9 million active customers online and 11.5 million on mobile. Founded in 1765, the bank currently has total assets of more than $1 billion (£833 billion).

- Partner: Form3

- Project: Along with partners Google Cloud and Microsoft, Form3 will help the U.K.-based bank “investigate and develop” a cloud-payments-as-a-service platform.

- Objective: The collaboration, which also includes a minority equity stake in Form3, will simplify Lloyd’s payment capabilities and support enhanced data and new overlay services.

Banca Ifis: Specialty commercial and corporate banking firm for SMEs headquartered in Venice, Italy. The firm has more than 130,000 retail clients in the country, and online funding and deposits totaling more than $4.7 billion (€4 billion).

- Partner: Raisin

- Project: New deposit products

- Objective: Raisin’s customers in Germany will gain access to deposit solutions available from Banca Ifis. The collaboration will enable German customers to take advantage of relatively higher interest rates available in Italy.

Other fintech/financial institution partnerships of note this month:

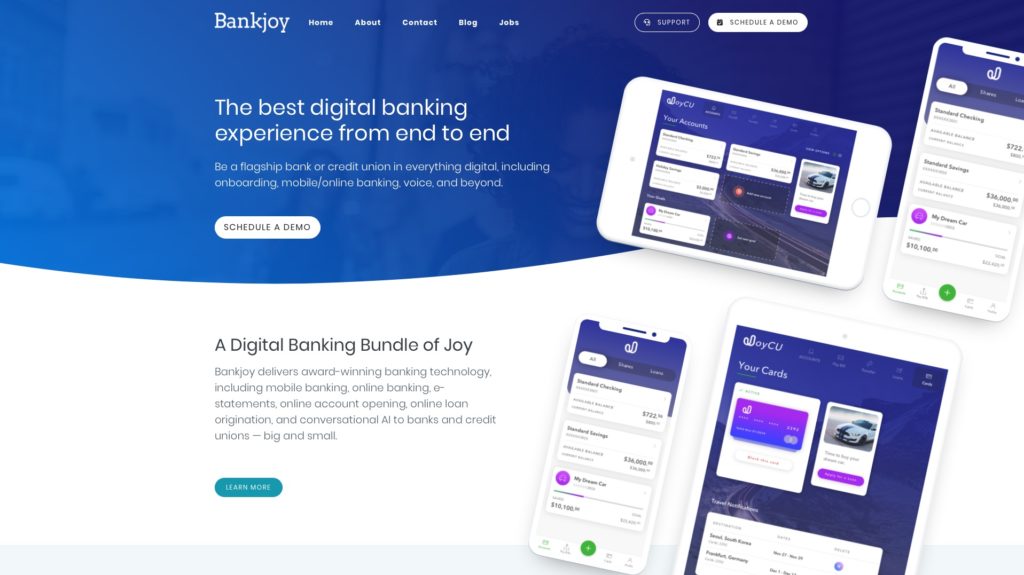

- Bankjoy and CACL FCU and SIU CU

- Compass Plus and Xalq Bank

- Finastra and Educational Systems FCU, The Peoples Community Bank

- Fiserv and American Eagle Financial Credit Union

- Minna Technologies, Visa, and Lloyds

Photo by maitree rimthong from Pexels