With a combined membership of more than 55,000 and a total of more than $760 million in assets, three credit unions have announced partnerships with digital banking solution provider Bankjoy.

The firms are Fort Community Credit Union, headquartered in Fort Atkinson, Wisconsin; Alltrust Credit Union (formerly Southern Mass Credit Union) based in Fairhaven, Massachusetts; and Statewide Federal Credit Union, headquartered in Starkville, Mississippi.

“We couldn’t ask for a better way to start 2021, signing these three progressive credit unions,” Bankjoy CEO Michael Duncan said. “Since we are now officially in the digital age thanks to the pandemic, these credit unions are now poised to hit the ground running with our most advanced online, mobile, and voice banking technologies. We are excited to see how they will perform and how their members will take advantage of these new offerings.”

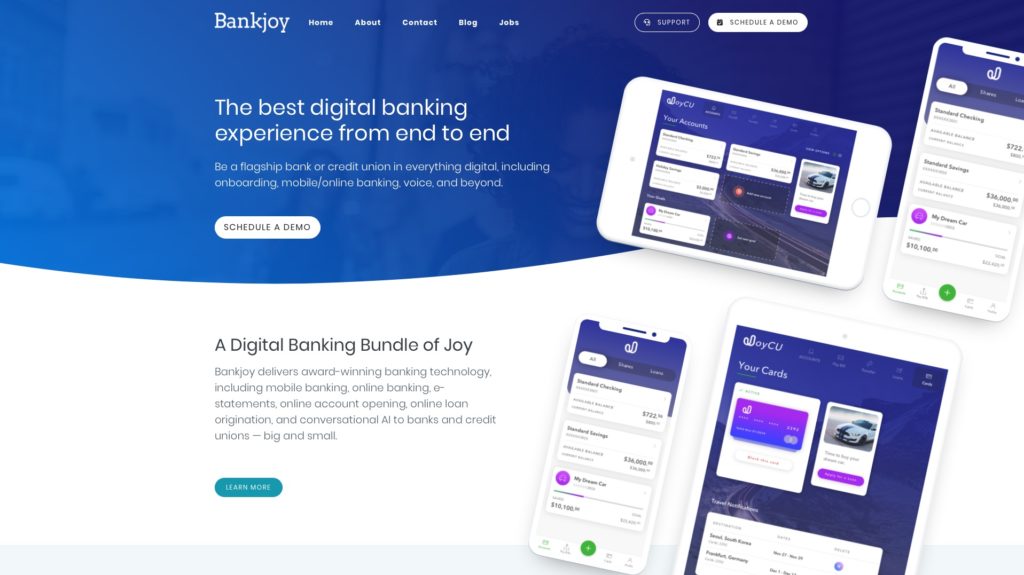

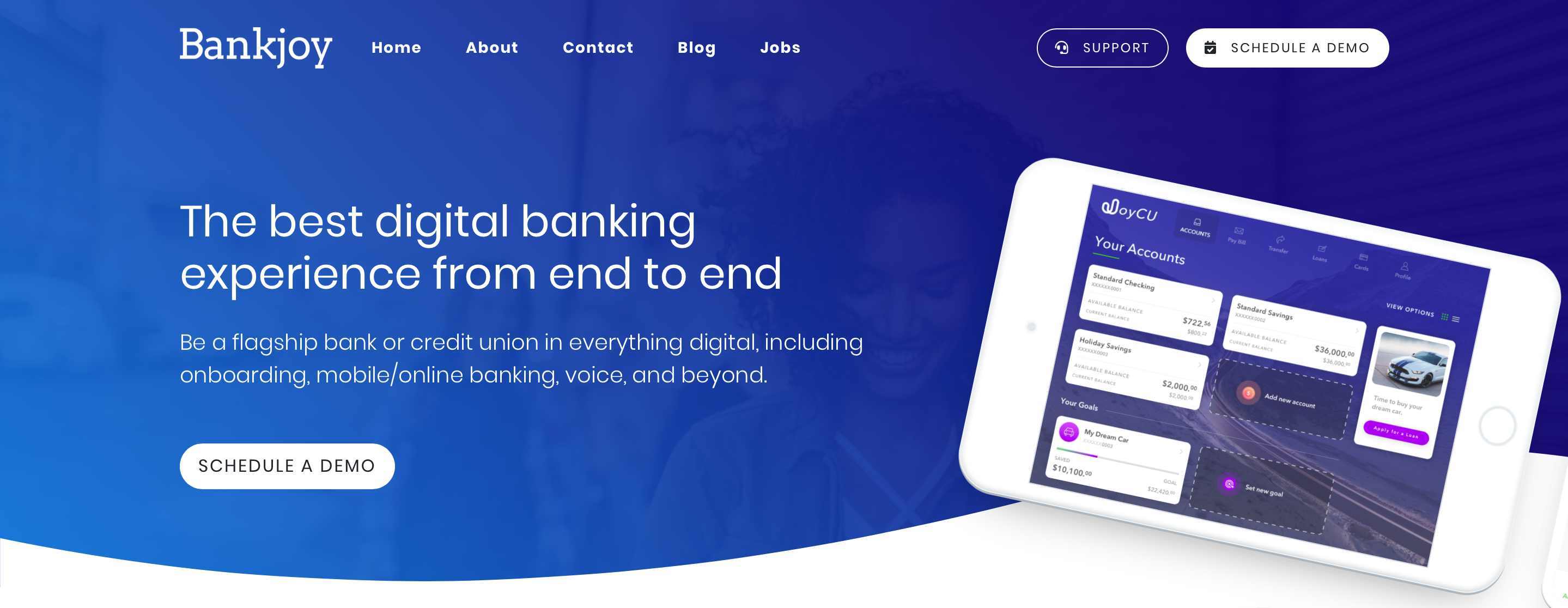

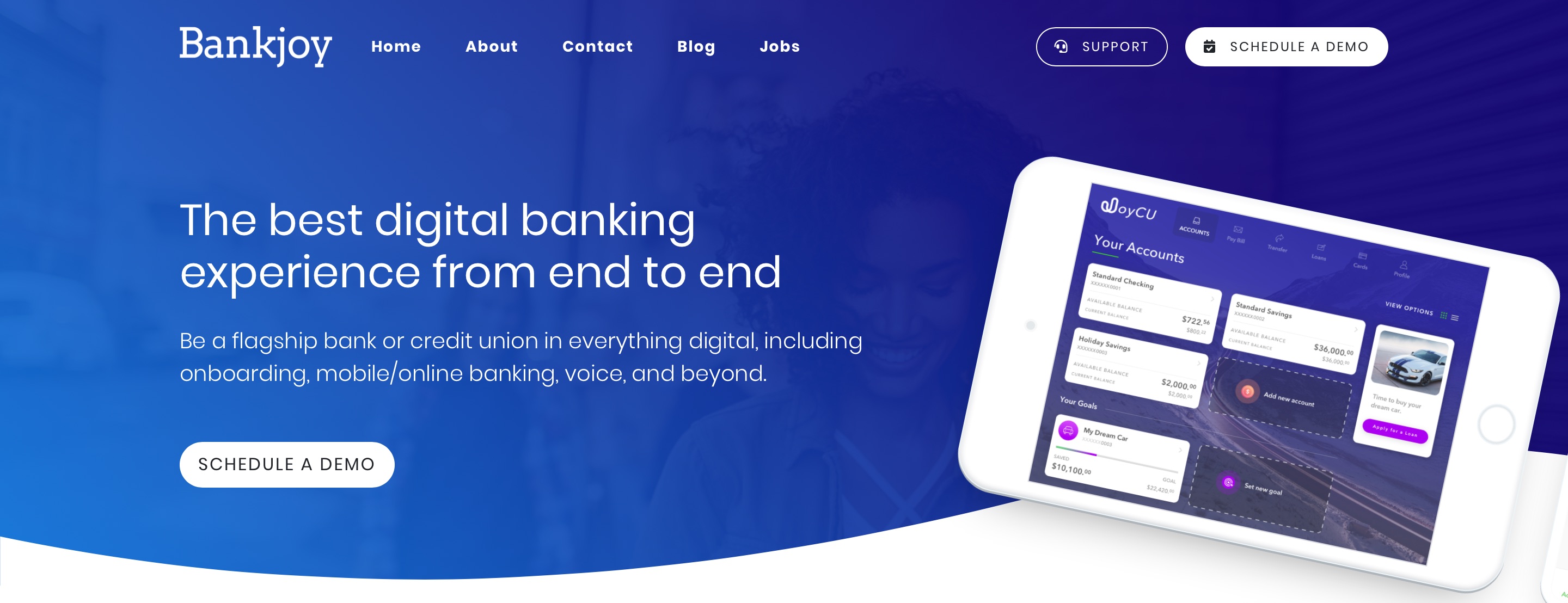

Founded in 2015 and making its Finovate debut a year later at FinovateFall in New York, Bankjoy provides financial institutions with a variety of digital banking solutions ranging from mobile / online banking, and e-statements to online account opening and loan origination, as well as access to conversational AI-based products. From flagship banks to credit unions, Bankjoy offers an out-of-the-box alternative to outmoded legacy systems that prevent banks and credit unions from being able to meet the rising digital expectations of their customers and members.

“Bankjoy will improve our credit union’s digital banking solution and offer an experience that is in line with our members expectations,” Alltrust Credit Union Vice President of Operations Stephanie Medeiros said. “Our partnership with Bankjoy will allow us to maintain our commitment to our members while delivering the latest digital technology.”

“The Bankjoy solution will allow our members to access and manage their account from anywhere,” Statewide Federal Credit Union CEO Casey Bacon added. “They will have access to all of the conveniences of modern banking at their fingertips.”

Headquartered in Troy, Michigan, Bankjoy has raised $1.8 million in funding from investors including SixThirty and CheckAlt. The company is an alum of the Y Combinator incubator program.

Photo by Aleksandr Balandin from Pexels