FinTech Innovation Lab London has unveiled its 2019 cohort. And among the 20 startups selected, three – Exate Technology, FutureFlow, and Anorak – are Finovate alums.

“The U.K. is a hotbed for fintechs, which are starting to bite at banking revenues,” Julian Skan, executive sponsor of FinTech Innovation Lab London, said. “But banks and insurers are also capitalizing on the opportunity to work with emerging technologies and new talent to compete.”

Skan added, “With our accelerator programme in its seventh year, we’re looking forward to exploring how startups are using the changes to evolve the financial industry for the better.”

The program, founded by Accenture and its partners in 2012, runs for three months between January 7 and March 28. Participating startups will work with executives from banks and insurers such as BlackRock, HSBC, Santander, and Wells Fargo to further develop their business models and solutions. In total, 35 financial institutions are providing mentors for the program.

“The team at Exate Technology (is) extremely proud to have been selected for Accenture’s Seventh Annual FinTech Innovation Lab,” Sonal Rattan, co-founder and CTO of Exate Technology wrote in a post at LinkedIn. “Fantastic kick-off day.” Founded in 2015 and headquartered in London, U.K., Exate demonstrated its data middleware IT solution at FinovateEurope 2018. The company’s technology enables users to apply rules to determine how data is accessed. Exate calls the solution “a virtual visa for your data.”

Demonstrating its BigData Analytics Platform at FinovateAsia 2017, FutureFlow provides institutions with a map of movement of money through the financial system. Like “cookies for money,” the company’s solution gives users deep money flow insights, showing where money in each transaction has been before, how quickly it moved, and what good, services, and locations it has covered. Headquartered in New York City, the company was founded in 2016.

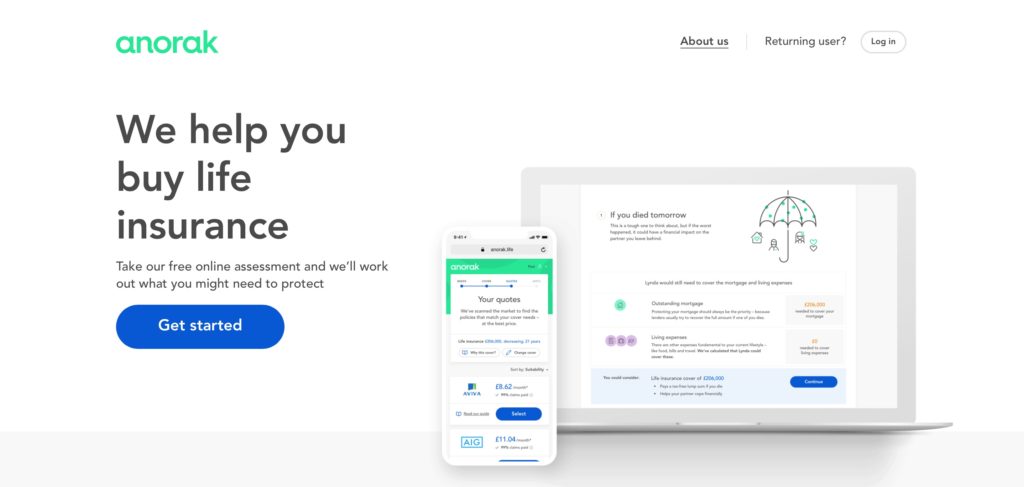

Insurtech innovator Anorak offers personalized, regulated life insurance purchasing advice to help insurance consumers get the best policy at for the least cost. The company leverages data science and machine learning – as well as decades of insurance industry experience – to analyze risk and coverage needs, turning bank data into customized insurance solutions. The London, U.K.-based company was founded in 2016, and demonstrated its technology at FinovateEurope 2018.

Interested in fintech in the U.K. and Europe? Join us next month in London for FinovateEurope 2019, February 12 through 14. Live fintech demos, insightful keynotes, and more.