Pini Yakuel, CEO and founder at Optimove, has extensive experience in analytics-driven customer marketing, business consulting, and sales. These traits, along with his innovative approaches to entrepreneurship and business-building, have earned him recognition as a thought leader. Yakuel demoed Optimove at FinovateFall 2017, where he showcased the company’s Science-first Relationship Marketing Hub.

Pini Yakuel, CEO and founder at Optimove, has extensive experience in analytics-driven customer marketing, business consulting, and sales. These traits, along with his innovative approaches to entrepreneurship and business-building, have earned him recognition as a thought leader. Yakuel demoed Optimove at FinovateFall 2017, where he showcased the company’s Science-first Relationship Marketing Hub.

Ahead of him speaking at FinovateFall – September 24 through 27 – about Data as Oxygen for your Business, we chat with him about his experience, his outlook, and what he thinks the future holds for emerging technologies.

Finovate: What was your window into fintech?

Pini Yakuel: Technology fascinates me. Always has, since I was a child. When I am thinking about it, I’m drawn in by the promise that the most bizarre, crazy, foolish and inexplicable idea you have can actually come to life. Looking at some of the inventions, developments and tools that have been brought to life in the last decade, you can’t help but think how foolish and crazy, bizarre and inexplicable they probably seemed when they were first originated, talked about in conference rooms, or pitched at board meetings.

This is the aspect that still fascinates me at my work. How will my role change in 10 years? How will my company look? What professions and skills will be necessary, and which will be lost forever, replaced by a simpler, faster solution?

So, I began speaking with a number of people both within my company and outside, to understand how marketing might look 10 years from now. I want to share some of the ideas and notions that were brought up in these conversations.

Finovate: How do you see the marketing world in a decade?

Yakuel: In 2028, rich and diverse customer data will become a commodity, and this data is relevant for everyone. It’s cheap, it’s abundant, and it is easily accessible. All the trends are pointing in the direction of data as a product; consumers are already preferring the benefits of personalization, and 3rd party data is readily available.

As a result of data commodification, consumer data will be available in every marketing channel; the trend toward this commodification can already be felt, although the full-scale effect has not yet taken place. I believe that if we look into the future and imagine a world with easily accessible data, we will also be able to create a single, continuous, customer lifecycle. If today we have three realms of marketing; acquisition, conversion and retention, that are treated as separate aspects of a customer lifecycle and are addressed by different departments, by 2028, we’re going to have one continuous customer cycle.

Finovate: What does this mean?

Yakuel: This potential change has two elements we can apply – the theoretical and the practical. In theory – all marketing campaigns will be built with a mindset of beginning a conversation, a relationship, rather than a “look at me” attitude. Marketers will no longer look at the process as acquiring, converting or retaining customers. Instead, we will all be working toward building relationships with people.

In practice – your CRM database will encapsulate every person in the world, creating an almost infinite database. Your key differentiator will be the ability to leverage AI and ML to discover and deploy actionable insights in a scalable manner.

Finovate: What else does it mean in practice?

Yakuel: This is maybe the most interesting part. Marketing teams will change from the core. Instead of having a few sub departments within marketing, the structure will transition to one self-sufficient relationship marketing studio, in which channels are not siloed. This will give marketers the speed to execute and expand. I also believe this will bring in amazing new talent – the best and brightest, a new breed of marketers – the data savvy individuals who are also highly creative, those who excel at both paths.

Inc. 5,000 Europe

Inc. 5,000 Europe

Presenters

Presenters Sara Martins, Business Developer

Sara Martins, Business Developer

Francis Hwang, CEO

Francis Hwang, CEO

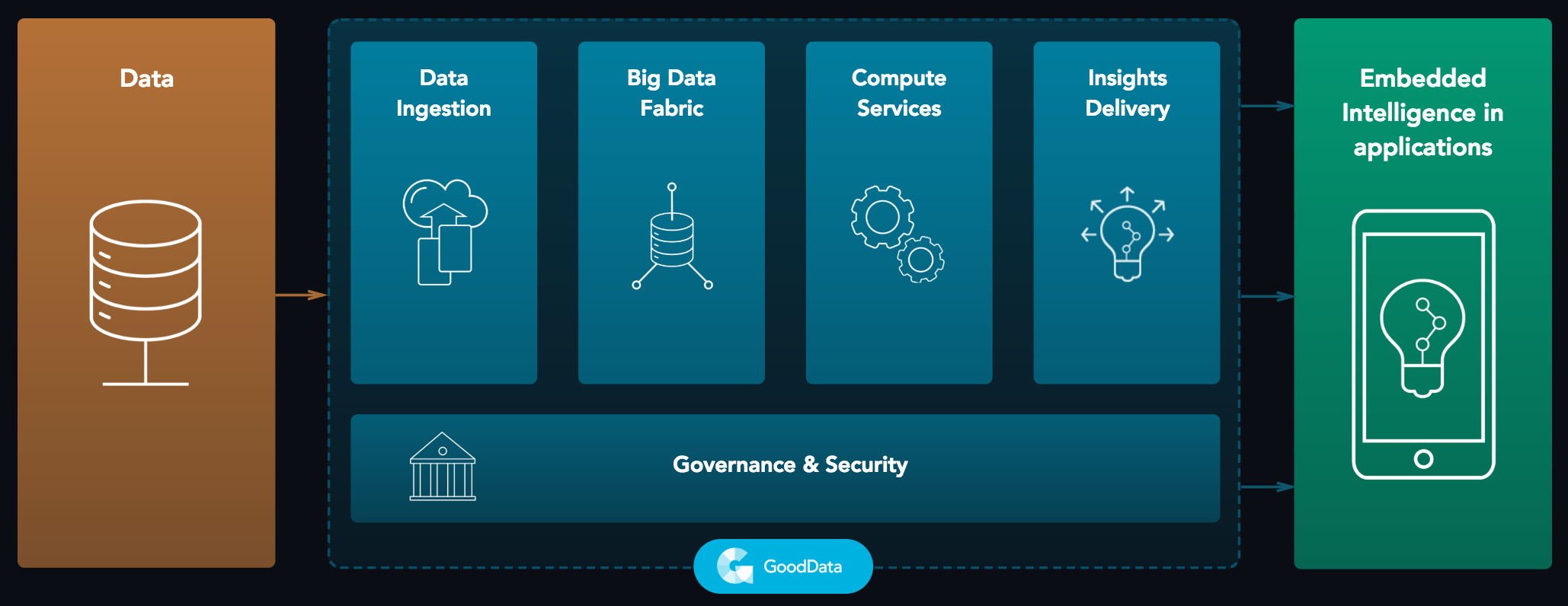

Above: GoodData’s process for transforming raw data into actionable predictions and recommendations

Above: GoodData’s process for transforming raw data into actionable predictions and recommendations Fraud protection

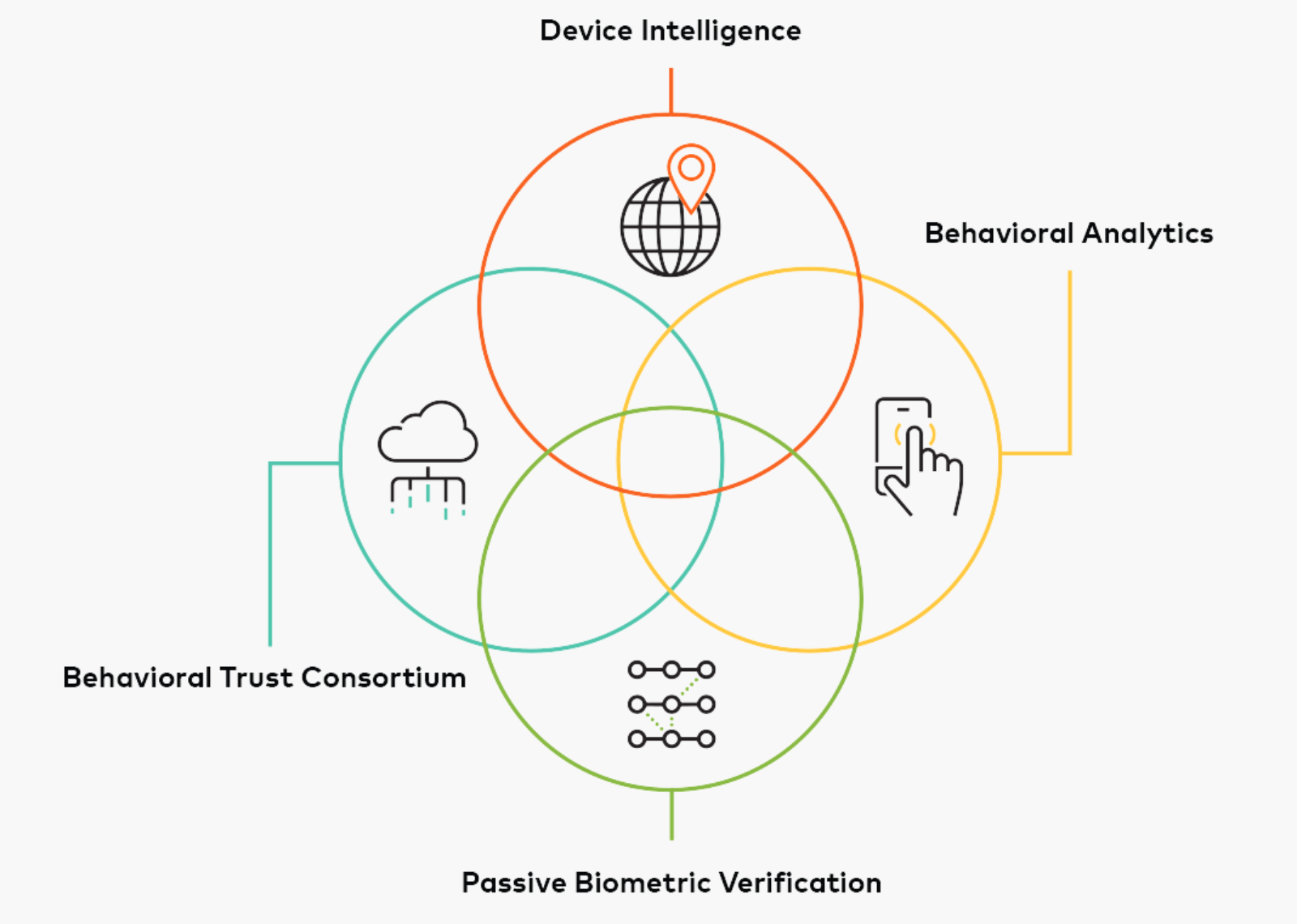

Fraud protection

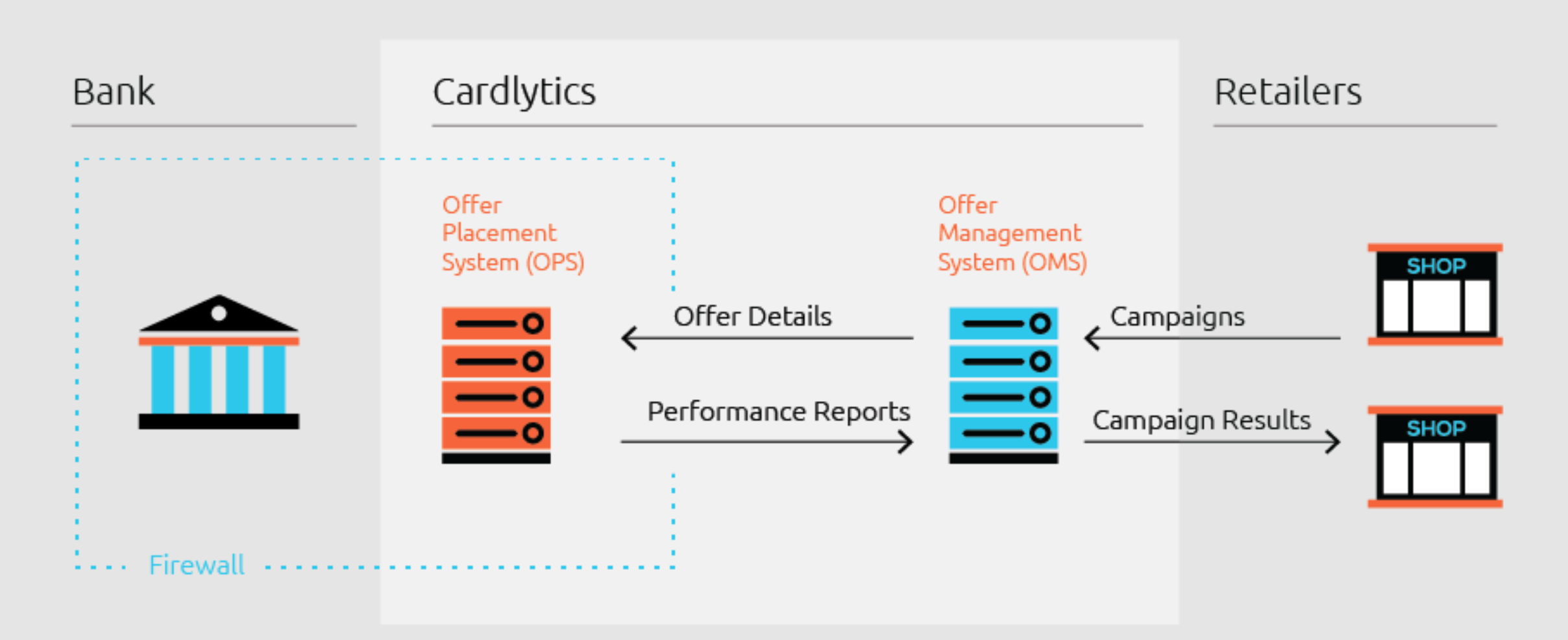

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.

(above) Cardlytics’ Purchase Intelligence platform breaks down customers’ purchase data to offer banks insights.