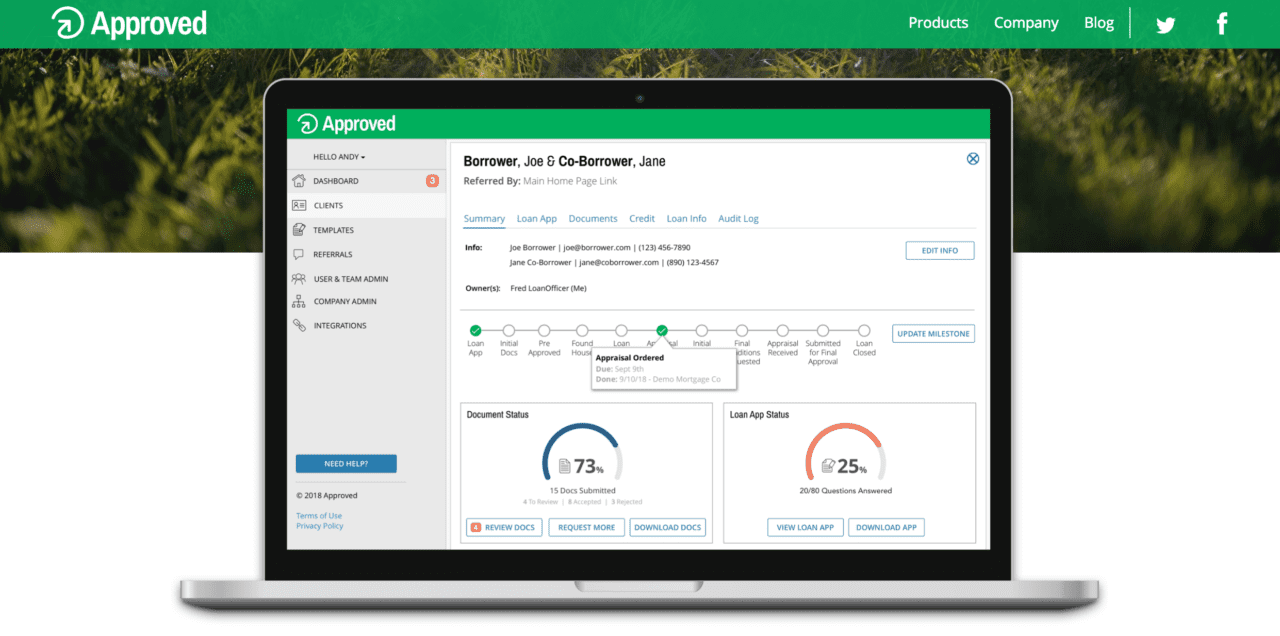

Consumer credit monitoring and financial health company Credit Karma is furthering its reach into the real estate sector this week with the acquisition of mortgagetech startup Approved.

In a blog post yesterday, Approved Founder and CEO Andy Taylor announced that Credit Karma had acquired the three-year-old startup for an undisclosed amount. “Working with Credit Karma gives us the resources and immediate scale to accelerate our mission-driven work, reaching significantly more homebuyers than we could have imagined when we started,” Taylor said.

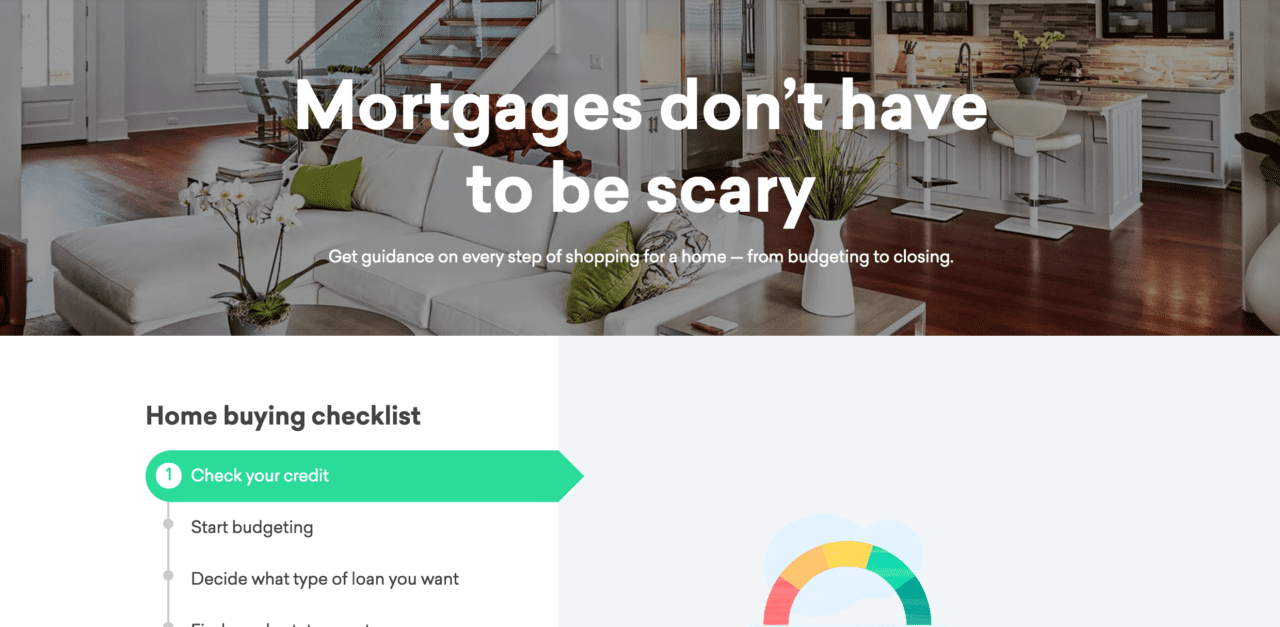

Credit Karma, which previously offered a basic mortgage comparison tool, is bolstering its capabilities with Approved at a time when many Millennials are beginning to purchase their own homes. As the company’s Chief Product Officer Nikhyl Singhal explained in an interview with TechCrunch, “As we’ve expanded, you’ve seen us move from credit cards as a way to help members with that part of their life to first personal loans to auto — meaning auto loans, auto insurance,” he said. “Today, we’re really talking more publicly about mortgage. Mortgage being for many of our members the most important financial decision they’ll make.”

Having facilitated almost $5 billion in loan originations, Approved was launched in 2015 by Taylor and co-founder Navtej Sadhal. The two met while working at RedFin, where they realized a need for disruption in the back-end of the mortgage process, where inefficiencies such as fax machines are still prevalent. Taylor vowed to stay true to Approve’s humble roots, adding, “We can’t wait to reveal what we’re working on next.”

Credit Karma already hosts many financial tools such as credit monitoring, tax filing, and credit card comparisons. By adding a more robust mortgage platform to this list, the company is creating a more sticky ecosystem with which to hook its 80 million users, half of which are Millennials.

At FinovateSpring 2009, Credit Karma CEO Ken Lin demonstrated the company’s platform, which offers free credit reports from Equifax and TransUnion, and seeks to serve as a hub for users to monitor their financial health. The company has facilitated the origination of more than $40 billion in credit products since it was founded in 2007. Earlier this year, the company teamed up with SpyCloud to help users determine if their data is being used on the dark web. Check out our recent interview with Colleen McCreary, Credit Karma’s first Chief People Officer.