- Klarna and Clover are teaming up to bring Klarna’s BNPL options to over 100,000 in-store merchant locations across the US.

- Shoppers will be able to pay in installments directly at the POS, expanding BNPL from online-only into brick-and-mortar retail.

- The move signals Klarna’s continued momentum in the US market amid a pause in its IPO plans.

Payments innovator Klarna has teamed up with point-of-sale (POS) platform Clover this week. The two have signed an agreement to auto-enable Klarna’s flexible buy now, pay later (BNPL) payment options in brick-and-mortar stores in the US.

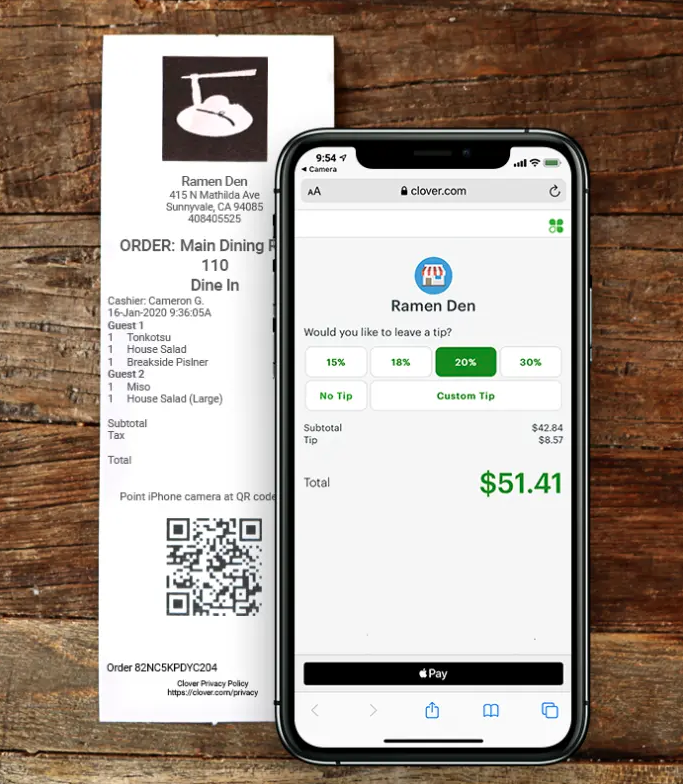

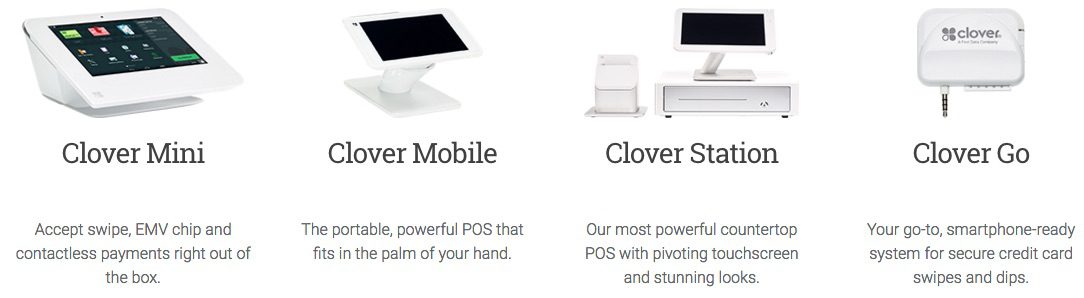

By integrating Klarna into its devices, Clover will offer shoppers the option to use Klarna for in-store purchases. The Klarna logo will appear on the pre-screen of payment terminals, allowing customers to select from a range of flexible payment options, including the ability to pay in four installments or choose interest-free financing plans.

“We’re bringing Klarna to Main Street,” said Klarna Chief Commercial Officer David Sykes. “Klarna started by changing how people pay online—now we’re changing how they pay everywhere. With Clover, we’re meeting shoppers where they are and giving small businesses a powerful new way to grow.”

Clover was founded in 2010 to help small businesses accept payments. Today, the company serves as a one-stop shop for multiple payment needs. In addition to offering a range of payment acceptance terminals, Clover also has software to help businesses with online orders, accounting, loyalty programs, staff management, inventory, and more. Clover was acquired in 2012 by First Data, which was acquired by Fiserv in 2019.

“Clover is excited to join forces with Klarna to leverage our strong presence across US services and retail, to power and engage consumers at key moments—before, during, and after checkout,” said Fiserv Head of Merchant Solutions Jennifer LaClair.

Klarna’s flexible payment options will initially be available at over 100,000 merchant locations through Clover’s point-of-sale devices. A larger rollout is set to begin in early 2026 and will extend to both new and existing Clover merchants across the US. Following the in-store launch, Klarna and Clover plan to expand their partnership into the e-commerce space, offering online merchants the same seamless, flexible payment experiences.

BNPL has historically thrived online, but this move reflects Klarna’s ambition to make BNPL a standard option at the physical point of sale. As major POS providers like Clover embed BNPL directly into in-store checkout experiences, the line between fintech and legacy payments continues to blur. This collaboration not only brings Klarna into more physical retail spaces but also signals a broader shift in consumer expectations, where flexibility, transparency, and choice at checkout are becoming table stakes.

Interestingly, this announcement also comes at a time when Klarna is strategically ramping up its public presence in preparation for going public. While the company postponed its IPO plans just last week, its partnership with Clover signals a continued effort to showcase global momentum and product innovation in the US. Teaming up with a major POS player like Clover allows Klarna to emphasize its omnichannel capabilities and demonstrate strong institutional relationships, both of which are key narratives for attracting investor confidence when it eventually heads back to the public markets.