Topicus demonstrated its Force Business Lending solution in February at FinovateEurope 2015. The technology is a straight-through business process platform for loan origination for SMEs and corporate businesses.

The idea was to help companies not able to take advantage of more sophisticated BPM solutions such as the self-serve loan origination technology that Topicus demonstrated in its Finovate debut the previous year.

“Our internal processes are not really ready for self-service, yet,” Topicus Managing Director Michiel Schipper said, quoting from queries about his company’s technology. “What’s your solution for that?”

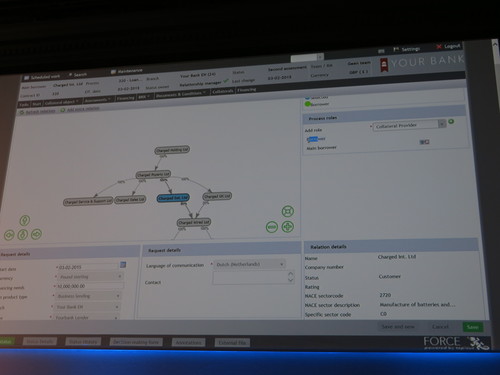

The solution, Force Business Lending, is a financial business process engine built specifically for the needs of lending institutions. The platform “knows” financial products, their structures and pricing, and provides fully automated ratings, dynamic pricing, and the ability to customize policy rules and other lending criteria.

We exchanged e-mails with Schipper earlier this year to find out what Topicus has been working on since its FinovateEurope appearance. We also wanted to know what to expect from the Netherlands-based, cloud-banking software specialist in the second half of 2015.

Finovate: You mentioned at FinovateEurope 2015 that your second appearance at Finovate was largely influenced by comments you received at your first appearance. What was that feedback and how did you take it to heart?

Michiel Schipper: During our first appearance, we showcased a solution where medium-sized enterprises could build their own financing solution from the bank’s assortment. Visitors to our booth told us that they’d love to be able to provide that service, but their mid-office ICT systems and processes would not cope. Therefore, we decided to take a step back and showcase our mid-office solution for loan origination and review that was servicing last year’s portal.

Michiel Schipper: During our first appearance, we showcased a solution where medium-sized enterprises could build their own financing solution from the bank’s assortment. Visitors to our booth told us that they’d love to be able to provide that service, but their mid-office ICT systems and processes would not cope. Therefore, we decided to take a step back and showcase our mid-office solution for loan origination and review that was servicing last year’s portal.

Finovate: Your company’s mission is described as “redesigning the business lending value chain.” Can you tell us a little more about that? What is the problem with business lending right now as you see it?

Schipper: It’s a very in-transparent marketplace for SMEs and mid-corps to be in right now. The traditional role of the banker taking time to challenge the business plans and financial health of his clients is disappearing. And the bank is no longer a one-stop shop for finance. Who is going to help the client find the right solutions for financing growth? Who is monitoring his financial health and acting as a true stakeholder?

New intermediaries, innovative accountants, and smart ICT will need to fill this gap. We believe that the crowd could play a role here as well.

At Topicus, we have been redesigning the value chain by equipping accountants and intermediaries with Basel-II ratings and instruments, software to play “what-if” scenarios for financing solutions, and stacked finance products.

Finovate: This year you demoed the Force Financial Business Process Management (FBPM) solution. How was the reception and how does FBPM differ from other BPM platforms?

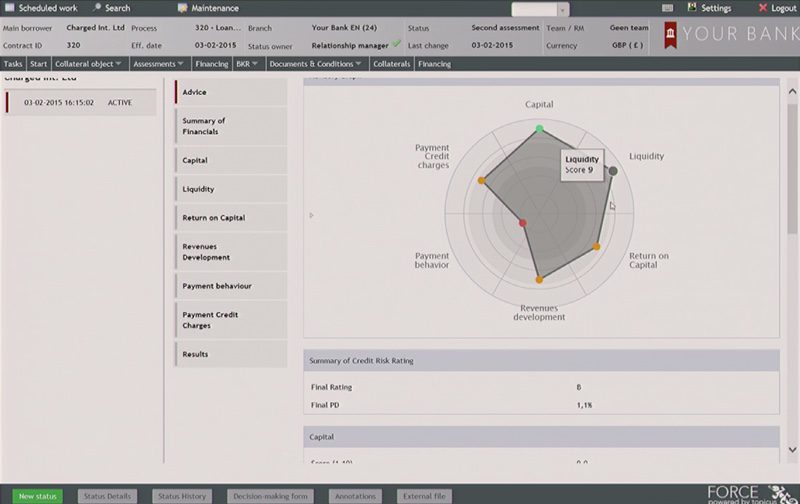

Schipper: The most important discriminator is that traditional BPM platforms with a rule engine lack the product dimension. Our system knows about financial products, acceptance criteria, qualitative and quantitative risk assessment, risk-based pricing, etc. The process will adapt itself depending on which products are part of, say, a potential credit agreement. This results in a shorter time-to-market and a roadmap that has a strong focus on the financial industry.

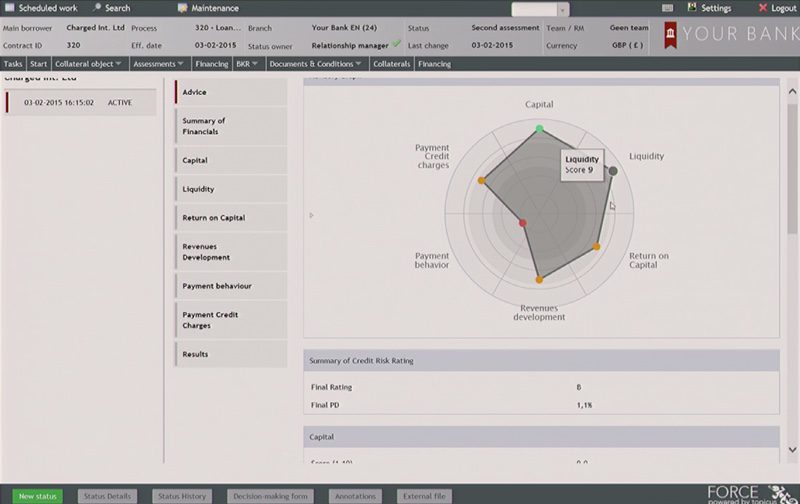

Pictured: Force Business Lending provides a credit risk rating based on the financial data provided, displaying the risk profile in an easy, read-at-a-glance format.

Finovate: What were some of the biggest technical challenges when it came to developing the FBPM solution?

Schipper: The sheer complexity of the business-lending domain. Our aim is to achieve a very high level of automation, or Straight Through Processing. This requires that all aspects of business lending are specified. Most banks still work with paper product sheets, a simple data-entry system for the mid-office, Word templates for the credit proposal, and manual data entry on the back-ends. Harvesting the requirements for Force Business Lending was and is more complex than the mortgage domain.

Finovate: Thinking about user interface and experience for a moment. What does the business user want that is different from what the average individual technology user wants in terms of UI/UX?

Schipper: A professional user wants a lot of information and many buttons on a single screen, because he will quickly learn where to glance to find the info he needs. This results in screens that seem ugly and hard to use at a first glance, but reduce the need to flip back and forward across pages. Casual users need more explanation, canned customer journeys, and something pretty to look at to keep them going. Therefore, casual users and professional users should never have to share screens.

Finovate: More players are getting into the market for developing financial models for SMEs. What is your edge?

Schipper: Our domain is slowly moving from traditional statistical models based on finances to big data and risk assessment. Creating a risk model based on big data and open systems is not very hard any more. The hard part is enabling banks and risk departments to take those steps, as well. Our software embraces the traditional risk models that are still leading today, and allows banks to add qualitative scorecards and external data sources into the equation. The underlying data can be used not only as input for traditional statistical analysis to create a better risk model, but also for correlation discovery methods. We enable change through evolution.

From left: Topicus Head of Business Lending Jamie Burink; Managing Director Michiel Schipper.

Finovate: What fintech innovations are people talking the most about in the Netherlands?

Schipper: That would probably be crowdfunding, with blockchain technology coming in second. We currently have around forty crowdfunding platforms, which seems too much. It is impossible to identify which platforms will survive, so it’s a real immature market.

Finovate: What are your growth goals? Is European expansion a major priority? What about the U.S. or Asia?

Schipper: We are currently working with Gartner to take our next steps in internationalization. The U.S., Middle East, and Northern Europe are the regions we are focusing on. International expansion for our mortgage and business lending propositions is a major priority within the organization. In fact, this receives higher priority than starting new verticals like software for pensions or insurances.

Finovate: What can we expect from Topicus in the second half of 2015?

Schipper: Expect a lot of highlights from Topicus this year. The two most important ones are:

- We are launching our software for crowdfunding, which is based on our fund broker software. It will have all the Force BPM magic built in, as well, so crowdfunding platforms can scale incredibly well with products of all levels of complexity. Crowdfunding a mortgage with automatic execution of all applicable rules and directives can be done against low operational costs, even down to automated arrears processes. We are looking into combining consumer crowdfunding with business crowdfunding to create crowdfunding funds that investors of all sizes can invest in.

- Another highlight is the launch of Force Business Lending as-a-Service, which should enable small funds to reach SMEs through a professional process. These funds now lack a go-to market option, and remain unused. This would really open up the non-banking finance market in the Netherlands and change the business-lending value-chain again.

Learn more about Topicus and its Force Business Lending platform in the company’s demo video from FinovateEurope 2015.

Presenters

Presenters

Michel Brinkhuis, Solution Architect

Michel Brinkhuis, Solution Architect