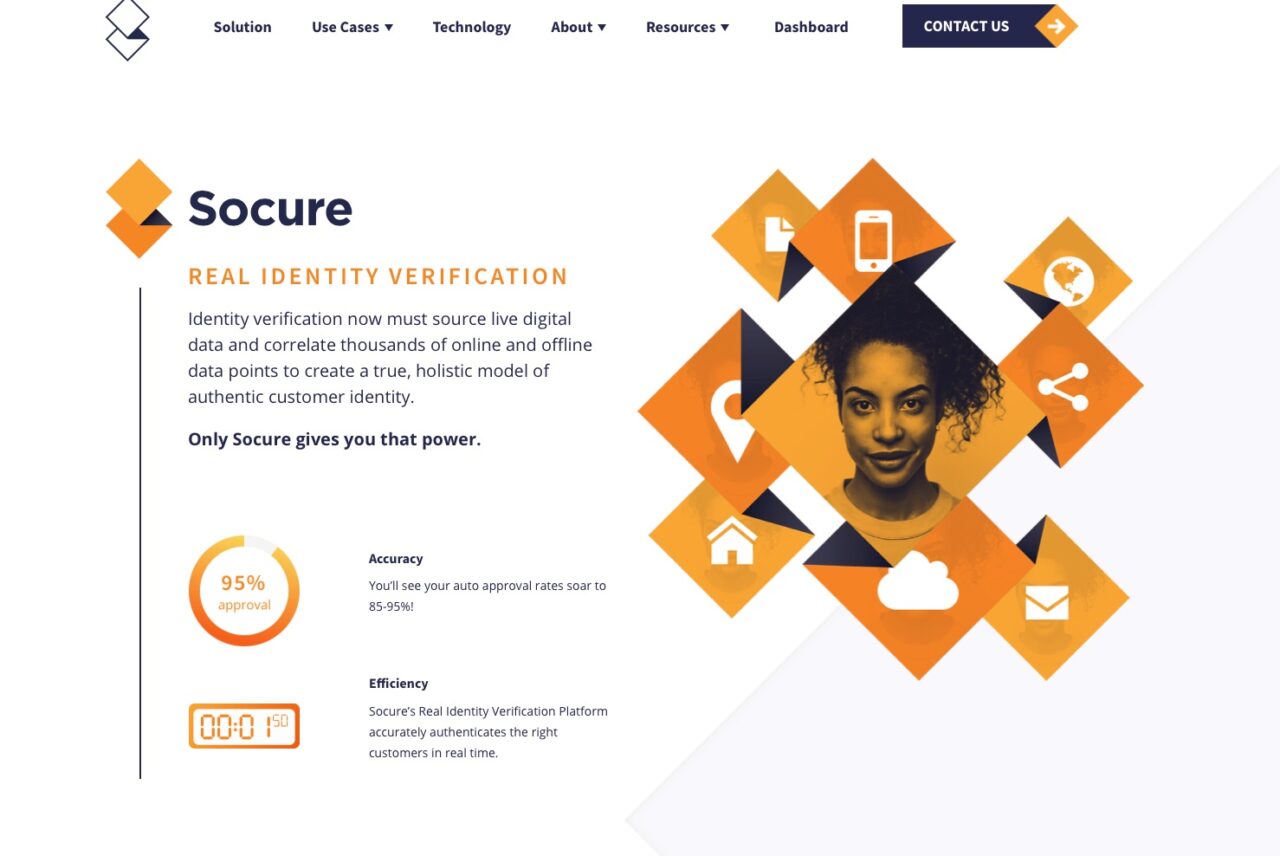

Socure, a New York-based company that provides predictive analytics for digital identity verification, has launched a new solution this week. Aida (Authentic Identity Agent) is a new identity verification bot that can be deployed to validate authenticity in online transactions. Aida is named after the world’s first computer scientist, Ada Lovelace, and leverages AI to process billions of on- and offline datapoints to provide real-time digital identification.

“Socure is solving the single most difficult problem in identity verification,” Socure’s founder and chief strategy officer Sunil Madhu said, “validating a person that’s never done business with an organization before.” Criticizing traditional methods of verifying identity in the digital world as “a miserable failure,” Madhu praised both Aida’s speed and accuracy.

“Aida can assess in real-time and with unprecedented levels of reliability, whether a digital identity is authentic, synthetic, or has been stolen by performing beyond-human analysis at machine speed,” he explained. “Aida essentially lives every minute of every day to verify identities and fight fraud.”

Socure founder and Chief Strategy Officer Sunil Madhu demonstrating the Socure ID+ platform at FinovateFall 2017.

Part of the company Socure ID+ identity verification platform, Aida combines AI, unsupervised machine learning, and clustering algorithms to provide a continuous loop of data ingestion, normalization, and evaluation from sources such as credit bureaus, social networks, and email history. Aida automatically builds explainable, transparent machine learning models in hours, and conducts predictive analytics on real-time transactions to determine which should be accepted automatically and which should be flagged for manual review by a human fraud analyst.

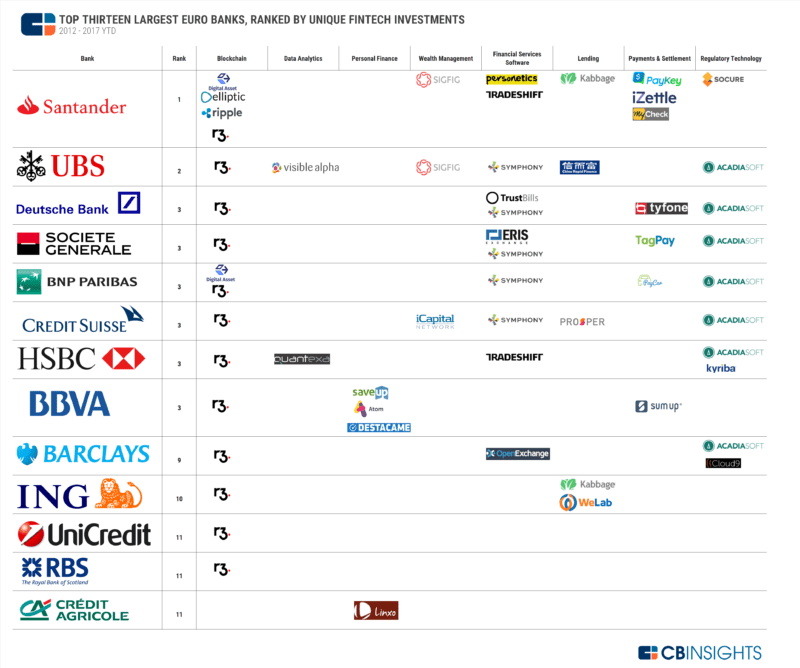

Named to Red Herring’s Top 100 in North America earlier this month, Socure announced in June that two of the top five U.S. banks (and three of the top ten) are using its technology. This spring, the company appointed Tom Thimot as its new CEO, with Socure founder and former CEO Madhu transitioning to the Chief Strategy Officer role.

Founded in 2012, Socure demonstrated its verification platform at FinovateFall 2017 last year. The company has raised nearly $32 million in funding, and includes Commerce Ventures, Flint Capital, and ff Venture Capital among its investors.

Thimot (pictured) comes to Socure from Clarity Insights, a big data consultancy. Before this, Thimot was COO of Kazeon, which was acquired by EMC, CEO of GoRemote (acquired by IPass), an EVP at Netegrity (acquired by Computer Associates) and CEO of CaseCentral (acquired by Guidance Software). He has a BSME in Mechanical Engineering from Marquette University and also attended Harvard Business School.

Thimot (pictured) comes to Socure from Clarity Insights, a big data consultancy. Before this, Thimot was COO of Kazeon, which was acquired by EMC, CEO of GoRemote (acquired by IPass), an EVP at Netegrity (acquired by Computer Associates) and CEO of CaseCentral (acquired by Guidance Software). He has a BSME in Mechanical Engineering from Marquette University and also attended Harvard Business School.