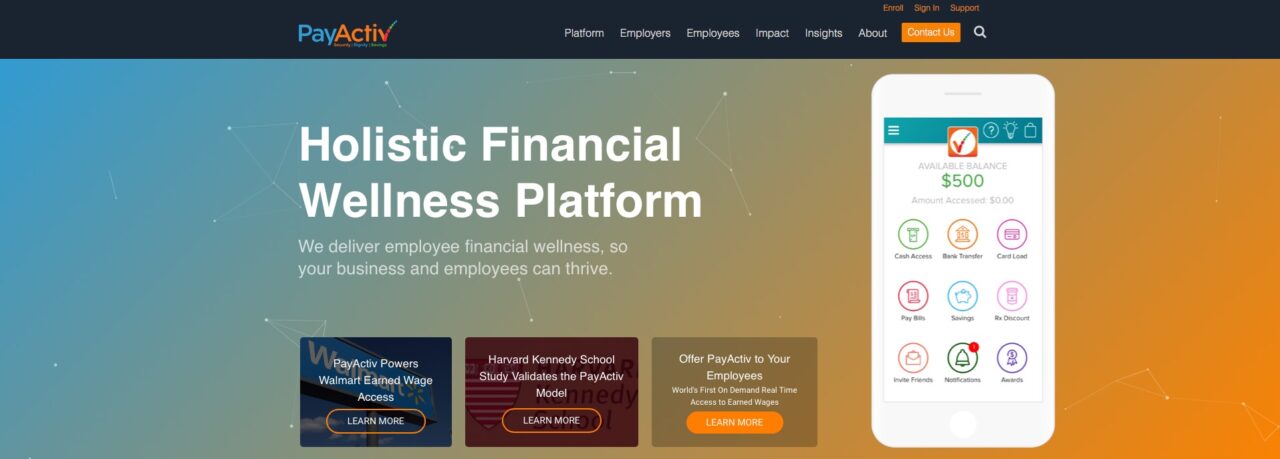

Courtesy of a new partnership, clients of ADP will get access to PayActiv’s Financial Wellness Platform. PayActiv announced last week that the workplace holistic financial wellness services provider will join the ADP Marketplace. This ecosystem of business apps will expose more than 600,000 employers representing 26 million workers to PayActiv’s technology.

“Companies leveraging ADP Marketplace can save as much as $50,000 annually for as few as 100 employees enrolled in PayActiv,” company CEO and founder Safwan Shah said. “Our holistic approach towards financial wellness is a win for both employers and employees.”

PayActiv provides a way for employers to help their employees better manage their financial lives. The company enables workers to get financial relief between paychecks – for example 50% of their already earned income – rather than relying on expensive payday loans or credit cards. PayActiv calls its strategy “timely earned wage access” or EWA and says the platform can be leveraged by both small businesses and larger companies to support not just timely EWA, but intelligent savings and budgeting, financial literacy, and counseling, and more. The platform is voluntary for workers, intuitive, and on-demand.

“Having timely access to earned income alleviates additional debt on already financially stressed individuals,” ADP Marketplace General Manager Craig Cohen said. “By offering PayActiv’s services via the ADP Marketplace, our customers’ employees now have on-demand access to money they’ve earned and can avoid costly alternatives.

PayActiv demonstrated its financial wellness mobile app at FinovateSpring 2016, winning Best of Show. Designed to help the underserved and working poor access quality banking services, PayActiv provides instant cash access, bill pay, bank transfer, savings and budgeting tools, and more.

Headquartered in San Jose, California, PayActiv has raised more than $17 million in funding. The company includes SoftBank Capital, Plug and Play Ventures, and RTA Capital among its investors.

Presenter: Safwan Shah, Founder and CEO

Presenter: Safwan Shah, Founder and CEO