With winter winds whipping up white caps on the typically mild-mannered Thames, another FinovateEurope is officially in the books.

We could not be more grateful to all those who demonstrated their latest fintech innovations live on stage in front of our record-setting audience here at Old Billingsgate Market Hall. After two days of demos, our attendees have weighed in on which technologies will earn the coveted title of Best of Show.

So with no further ado, let’s take a look at what our 1,500+ fintech fans feel are the innovations that are getting us that much closer to a world of better engagement, friction-free and secure payments and e-commerce, and broader financial opportunities for all.

Here are the Best of Show winners of FinovateEurope 2016 (in alphabetic order):

![]()  Capitali.se for its technology that uses natural language to enable trade automation, turning investment ideas into auto-managed investment portfolios.

Capitali.se for its technology that uses natural language to enable trade automation, turning investment ideas into auto-managed investment portfolios.

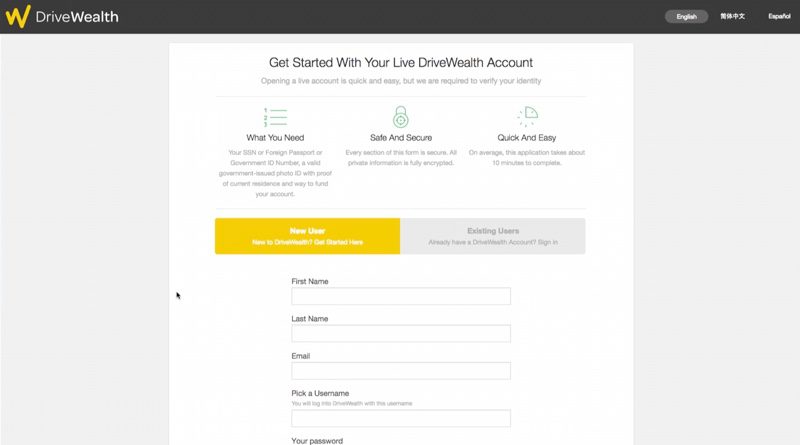

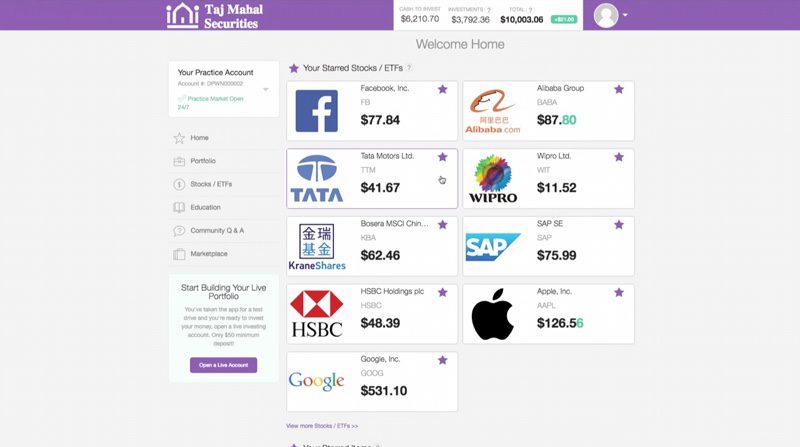

![]()  DriveWealth for its cloud-based/API technologies that enable real-time, fractional share investing and trading in U.S. equities for mass retail investors around the world.

DriveWealth for its cloud-based/API technologies that enable real-time, fractional share investing and trading in U.S. equities for mass retail investors around the world.

![]()  EyeVerify for its biometric authentication, Eyeprint ID technology that turns an ordinary selfie into a key that protects your digital life.

EyeVerify for its biometric authentication, Eyeprint ID technology that turns an ordinary selfie into a key that protects your digital life.

![]()  IDscan Biometrics for its market-leading, digital, onboarding suite with a powerful, state-of-the-art facial  recognition algorithm.

IDscan Biometrics for its market-leading, digital, onboarding suite with a powerful, state-of-the-art facial  recognition algorithm.

![]()  SwipeStox for its mobile social trading app that allows anyone to trade forex, market indicies, and CFDs by copying single trades.

SwipeStox for its mobile social trading app that allows anyone to trade forex, market indicies, and CFDs by copying single trades.

![]()  Valuto for its multi-currency account powered by an open API that enables seamless integration with SaaS accounting, e-invoicing, B2B marketplace, and e-commerce platforms.

Valuto for its multi-currency account powered by an open API that enables seamless integration with SaaS accounting, e-invoicing, B2B marketplace, and e-commerce platforms.

FinovateEurope 2016 was a blast, and we hope you enjoyed the conference as much as we enjoyed hosting it. As always, a thousand thanks to everyone who attended, sponsored, partnered with, and demonstrated their latest fintech innovations at FinovateEurope 2016. We’ll see you next year!

Notes on methodology:

1. Only audience members NOT associated with demoing companies were eligible to vote. Finovate employees did not vote.

2. Attendees were encouraged to note their favorites during each day. At the end of the last demo, they chose their three favorites.

3. The exact written instructions given to attendees: “Please rate (the companies) on the basis of demo quality and potential impact of the innovation demoed.”

4. The six companies appearing on the highest percentage of submitted ballot were named “Best of Show.”

5. Go here for a list of previous Best of Show winners through 2014. Best of Show winners from FinovateEurope 2015 are here. Best of Show winners from FinovateSpring 2015 are here. Best of Show winners from FinovateFall 2015 are here.

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

DriveWealth is most interested in meeting global financial service companies with large customer bases who offer local securities and want access to the U.S. equity markets. The company recently launched with a Chinese partner with more than 100 million customers. And Fitzgerald also mentioned the Indian stock market as a very actively traded market where Indian investors would likely take advantage of access to U.S. stocks. He also notes that global payment providers are also potential partners with DriveWealth. “We’re going for the other 99%, including the mass retail investor,” Fitzgerald explains, “and a lot of them are looking to start with a few thousand dollars rather than $100,000, so low-cost payment-transfers matter.”

Temkin pointed to DriveWealth’s key value to consumers: its focus on education and its ability to bring trading and investment access to popular U.S. stocks. He says the technology “has the potential to change the way in which individuals around the world invest their money.” In return, Robert Cortright, founder and CEO of DriveWealth, pointed to Temkin’s platform-building experience, saying this experience will be key as the company seeks to develop new solutions for its international business partners and their retail clients.

Temkin pointed to DriveWealth’s key value to consumers: its focus on education and its ability to bring trading and investment access to popular U.S. stocks. He says the technology “has the potential to change the way in which individuals around the world invest their money.” In return, Robert Cortright, founder and CEO of DriveWealth, pointed to Temkin’s platform-building experience, saying this experience will be key as the company seeks to develop new solutions for its international business partners and their retail clients.