Blend, whose name stands for better lending, uses a two-pronged approach that benefits both lenders and borrowers. The San Francisco-based company offers mortgage lenders white-labeled technology to help efficiently originate loans while giving applicants the smoother user experience they’ve come to expect.

In the company’s FinovateSpring 2016 demo, Blend’s Head of Product Pranay Kapadia, speaking about the mortgage-application process, asked, “How do we make this financial, stressful transaction as humanistic as possible, so it’s as though you’re working with a financial adviser?” Kapadia went on to explain that Blend’s mobile-first design walks users through the mortgage-purchase experience by asking questions, offering contextual help, and learning about each applicant’s unique needs.

Company facts:

- Founded in 2012

- 80+ employees

- Helped originate $6 billion in mortgage loans in Q4 2015

- One third of Blend mortgage applications take place on mobile devices

- Almost half of Blend’s applicants fill out mortgage applications outside of customer-support hours

Blend’s Alec Roth, sales, and Pranay Kapadia, head of product, demonstrated at FinovateSpring 2016.

Blend’s Alec Roth, sales, and Pranay Kapadia, head of product, demonstrated at FinovateSpring 2016.

After the company’s FinovateSpring demo, we interviewed Nima Ghamsari, CEO of Blend.

Finovate: What problem does Blend solve?

Ghamsari: There are approximately $1.5 trillion in new mortgages created in the U.S. every year. Getting a mortgage has historically been a slow, document-mired process; however, Blend’s data-driven technology—combined with its elegant design—is working to address pain felt by lenders and borrowers. Here are some key challenges the industry faces today:

- Buying a home is one of the biggest purchases any of us will ever make, yet the process remains difficult and opaque, particularly in light of all of the other things we are now able to do online, and on our mobile devices, such as hailing a ride on Uber, ordering groceries on Instacart, etc.

- While there’s been a boom of data powering other industries, the mortgage industry hasn’t fully adopted the rich-data sources that can drive financial decisions. This means manual paper review and an overall analog process.

- The traditional mortgage process is flooded with paper documents, wet signatures, and fax machines, a process that leaves customers in the dark and makes it impossible for lenders to provide an experience that matches the significance of the transaction.

Finovate: Who are your primary customers?

Ghamsari: Blend is partnering with some of the larger, more innovative banks and lenders in the country. We generally focus on having fewer, but higher-quality, relationships to drive success with our customers.

Finovate: How does Blend solve the problem better?

Ghamsari: Blend enables a best-in-class experience to consumers and data-driven efficiency to lenders:

- A frictionless, end-to-end digital consumer experience, allowing for borrowers to interact with their lender in a modern, mobile- or web-enabled fashion.

- Blend solves for the entire spectrum of consumers by being omnichannel: for a transaction as complicated as a mortgage, consumers can start the process online, take photos on their mobile device, then walk into a branch and have an employee handle some of the complicated questions in Blend, and head back to home to consult with their spouse before signing electronically.

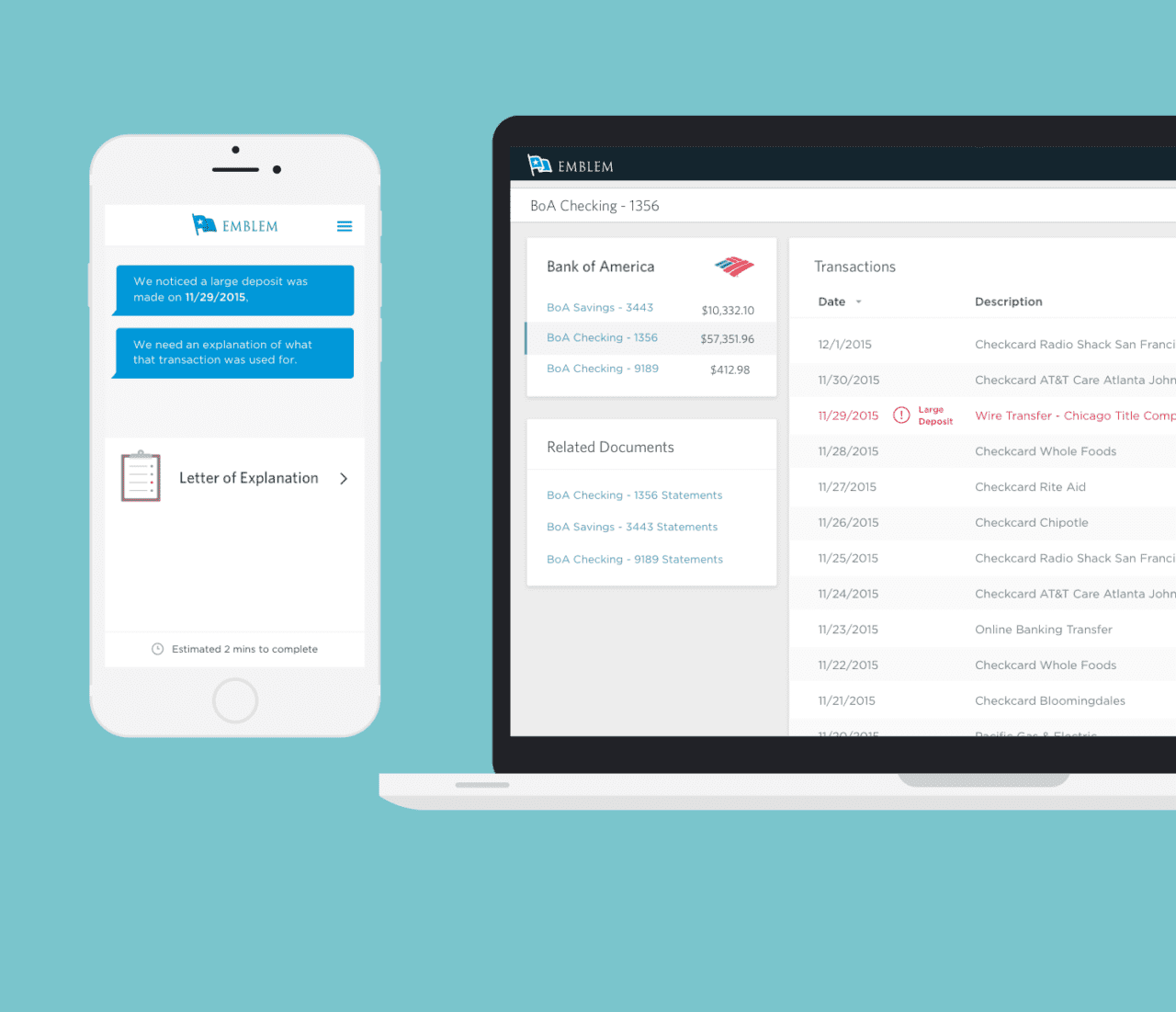

- By allowing the borrower to connect their financial accounts and income information digitally, they no longer have to search for documents to send to submit. Instead, they provide machine-readable information directly from the source, and the lender receives high-fidelity data that they can trust in [making] their credit decision.

- Instead of keying core information into their system, information flows automatically through Blend. When new information is needed from the consumer to finalize the mortgage process, the borrower is immediately notified, giving both the lender and consumer full transparency [as to] where they are in the process.

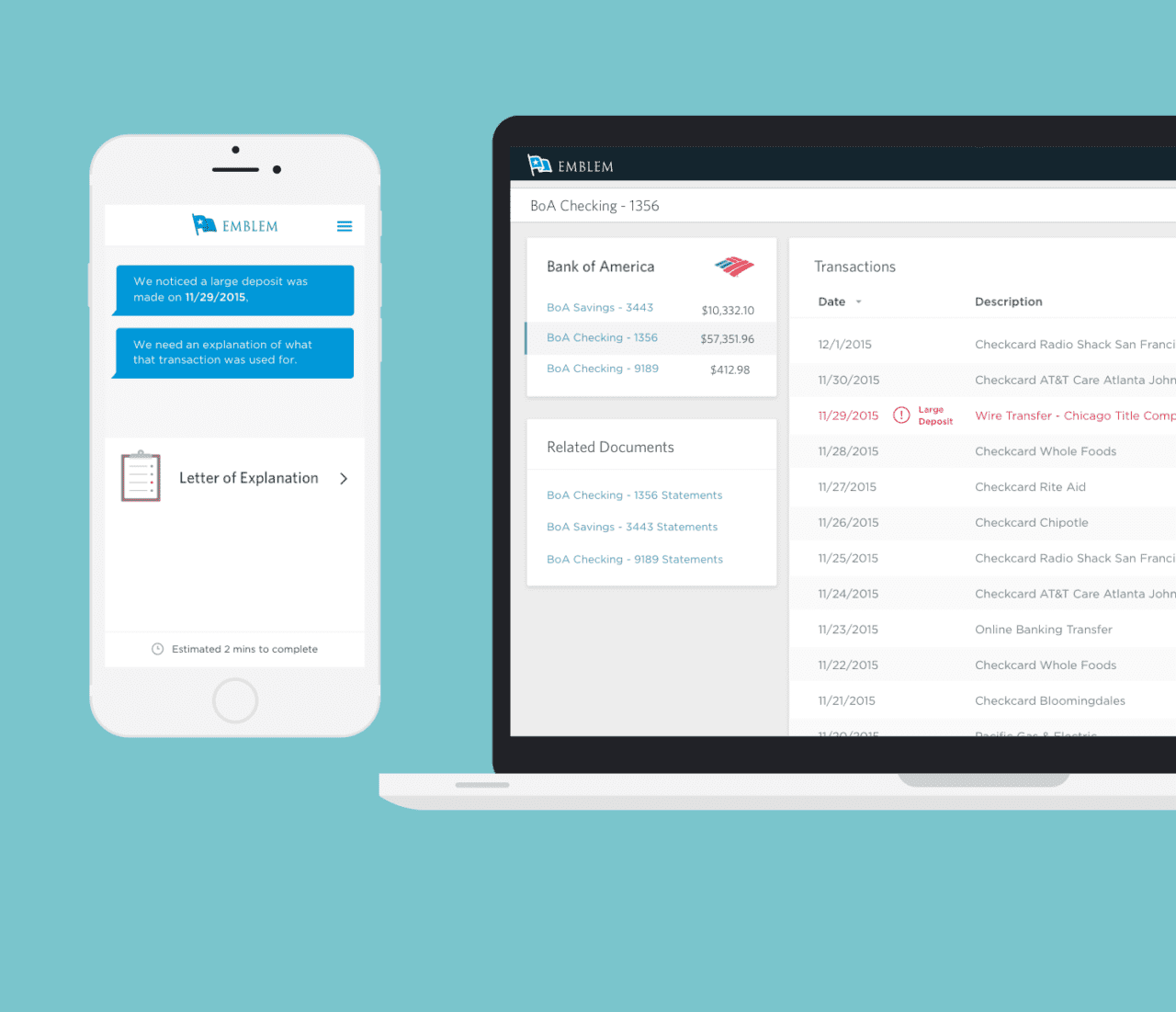

Blend’s co-piloting feature allows lenders and borrowers to fill out the mortgage application together in real-time.

Blend’s co-piloting feature allows lenders and borrowers to fill out the mortgage application together in real-time.

Finovate: Tell us about your favorite implementation of your solution.

Ghamsari: We recently began working with a large mortgage lender on the East Coast. We got their team up-and-running in a matter of a few weeks, and they were taking loans from consumers of all types. One of the things I love about that particular deployment is that a 76-year-old borrower completed the entire mortgage process using Blend, with all of his documentation and information, in just over an hour. Can you imagine that? Prior to using our technology, document collection could have taken a week or longer and would have been almost entirely analog.

Finovate: What in your background gave you the confidence to tackle this challenge?

Ghamsari: At my previous company, we were working with a few of the largest financial services institutions directly after the financial meltdown. The mortgage problem was pitched to us as one of the largest problems in the country, with $10+ trillion at stake. When we arrived, however, what we saw took us by surprise. There were 50-year-old technologies powering largely paper-based processes. People were often spending time on tasks such as manually typing information from a document into a system or scanning and uploading a faxed document. And despite the fact that the data revolution already had happened in a few other industries, there were so many problems with mortgages that data was practically an afterthought.

The ‘eureka’ moment came when we realized the inefficiencies were partially a result of Silicon Valley and the tech industry largely ignoring this major part of the financial sector. I couldn’t name a deep technology company that was focused on solving the infrastructure for home lending, despite it representing a large part of national debt. I also got a sense of [how] the magnitude of the problem—[not only] the delta between where technology could be and where it currently was, [but also] the sheer dollar volume—was lost on many folks in Silicon Valley, and so if we didn’t set out to solve the problem, it likely wouldn’t be addressed at all.

Finovate: What are some upcoming initiatives from Blend that we can look forward to over the next few months?

Ghamsari: In addition to expanding connectivity to high-fidelity data sources for borrowers to prefill mortgage applications in minutes, we are looking forward to rolling out features to further enable airtight digital compliance for our lenders. Moreover, Blend is looking at ways in which intelligence can be used to dramatically compress the time it takes to underwrite a mortgage application, another huge efficiency sink in the mortgage process.

Finovate: Where do you see Blend a year or two from now?

Ghamsari: In the near future, the team at Blend is working to:

- Create the most frictionless, end-to-end digital lending experience for consumers and lenders

- Partner and allow third-party data providers to build connections and further remove friction from the lending process

![]() FinDEVr Silicon Valley was a success! Tickets for upcoming FinDEVr London and FinDEVr New York are at their lowest prices now. Register today for London or New York to save your spot!

FinDEVr Silicon Valley was a success! Tickets for upcoming FinDEVr London and FinDEVr New York are at their lowest prices now. Register today for London or New York to save your spot!

Blend’s Alec Roth, sales, and Pranay Kapadia, head of product, demonstrated at FinovateSpring 2016.

Blend’s Alec Roth, sales, and Pranay Kapadia, head of product, demonstrated at FinovateSpring 2016. Blend’s co-piloting feature allows lenders and borrowers to fill out the mortgage application together in real-time.

Blend’s co-piloting feature allows lenders and borrowers to fill out the mortgage application together in real-time.

Pranay Kapadia, Head of Product Development

Pranay Kapadia, Head of Product Development Alec Roth, Sales

Alec Roth, Sales