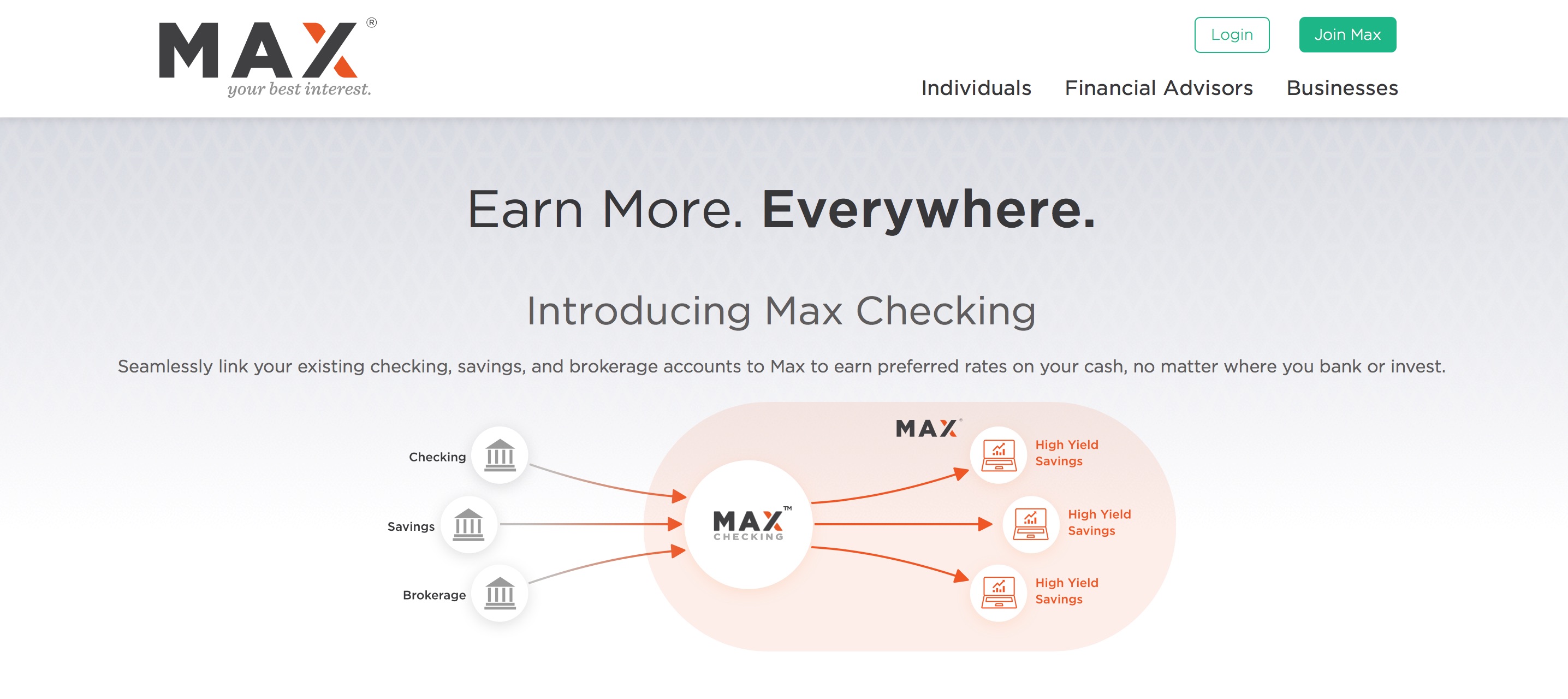

Cash management solution provider MaxMyInterest introduced a new high-yield checking account called Max Checking last week. The latest offering from the New York City-based fintech will help individuals and advisors make more out of their cash holdings. Max Checking offers a 1.00% APY, FDIC-insured account that seamlessly connects the client’s brokerage, checking, and savings accounts to ensure that all of their cash has access to the best rates available.

Max Checking has no fees or minimums, enables free access to ATMs around the world, gives customers the ability to earn rebates on Max membership fees and, via a separate banking app, provides full mobile banking services including mobile check deposit, billpay, and P2P transfers.

In a blog post titled “Why We Launched Max Checking,” MaxMyInterest founder and CEO Gary Zimmerman noted that the reason for introducing the new solution was not to encourage consumers to change banks or checking accounts. Conceding that most people are content with their current banks, Zimmerman wrote that his goal was simply to give checking account users the same access to better cash rates that MaxMyInterest savings account users enjoy.

“Max Checking was designed to deliver on the promise of helping everyone in America earn higher returns on their cash,” he explained, before highlighting new capabilities that were the direct response to client requests. This new functionality ranges from the ability to access a wider number of supported banks to broader management over the technology’s automatic fund-sweeping process.

“Max was originally (created) for households who saw no distinction between checking and savings,” Zimmerman said. “Over the years, we’ve come to know many people who are saving for a specific purpose, and who prefer to allocate a discrete amount of cash to savings to earn more, without touching their checking account. With the launch of Max Checking, you can now earn more on savings without Max sweeping funds in/out of your existing checking account, so you’ll have even more control over your funds.”

The new offering is made possible courtesy of a partnership with Radius Bank, a firm Max has worked with since 2018. “Following our success with Radius Max Savings, we were excited to continue our work together to offer Max members a premium checking account,” Radius Bank President and CEO Mike Butler said. “This extension will allow depositors and their financial advisors to have a unified digital banking experience for both their savings, and now checking, needs in just a few clicks.”

MaxMyInterest demonstrated its automated cash management solution at FinovateFall 2014. The company’s technology offers both individuals and financial advisors the ability to optimize the return on their cash by automatically directing funds to FDIC-insured accounts that offer the highest yields. MaxMyInterest customers currently earn up to 2.28% APY on their savings accounts, significantly higher than the national savings average of 0.10%.

Founded in 2013, MaxMyInterest is operated by Six Trees Capital. More than 750 wealth management firms across the U.S. use the company’s technology to help their clients meet their cash needs.