This post is part of our live coverage of FinovateSpring 2015.

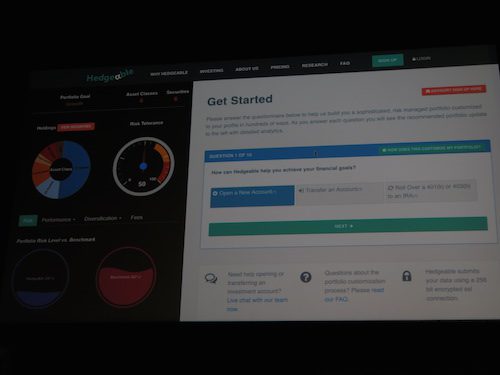

Hedgeable presented its robo-advisor 2.0 platform.

Hedgeable presented its robo-advisor 2.0 platform.

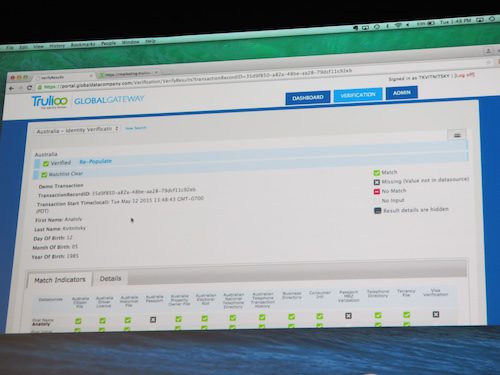

Hedgeable’s robo-advisor 2.0 platform allows any investor with an IRA, rollover, taxable, trust, 401(k), or business account to manage a customized low-cost, risk-managed portfolio with as little as $5,000 in 5 minutes. Hedgeable is hugely disruptive because it brings an ultra-high-net-worth allocation to emerging affluent investors who are traditionally shut out from accessing sophisticated investing solutions.

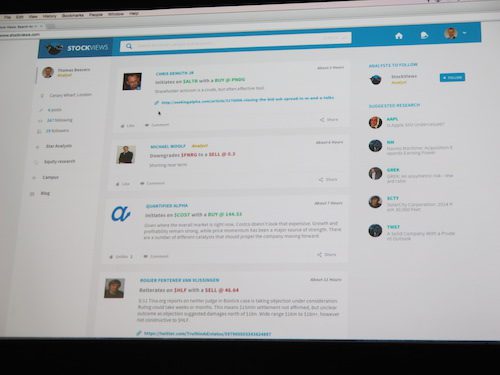

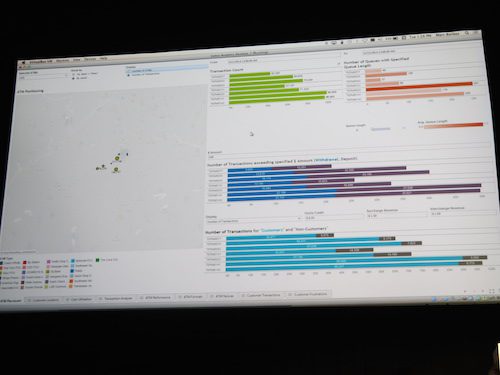

Hedgeable’s platform is not your typical cookie-cutter robo-advisor. It includes dozens of automated stock and ETF portfolios featuring sophisticated features such as downside protection, tactical management, and access to alternative asset classes such as bitcoin, private equity, gold, and real estate. All portfolios are customizable using complex data science and 100+ proprietary investment technology systems created by Hedgeable’s team of world-renowned technologists.

Hedgeable’s investing platform is distributed direct-to-consumer online and also licensed to RIAs, planners, trusts, banks, and other partners around the globe.

Presenting CEO Michael Kane, master sensei, and Matthew Kane, co-founder and chief ninja

Product Launch: May 2015

Metrics: $1.85M raised to date

Product distribution strategy: Direct to Consumer (B2C), through financial institutions, through other fintech companies and platforms, licensed

HQ: New York City, New York

Founded: April 2009

Website: hedgeable.com

Twitter: @hedgeable