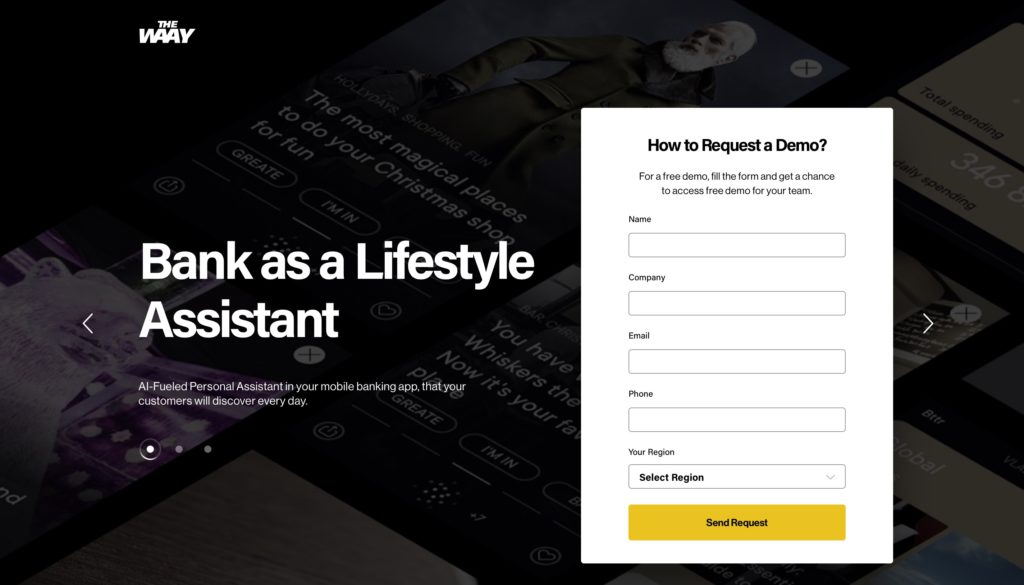

Making banking more compatible with the everyday lives of consumers is one of the top goals of fintechs everywhere. London-based fintech startup, TheWaay, which made its Finovate debut last year in Dubai and followed that appearance with a Best of Show winning return to the Finovate stage a few months later in Singapore, has built a solution designed to do just that.

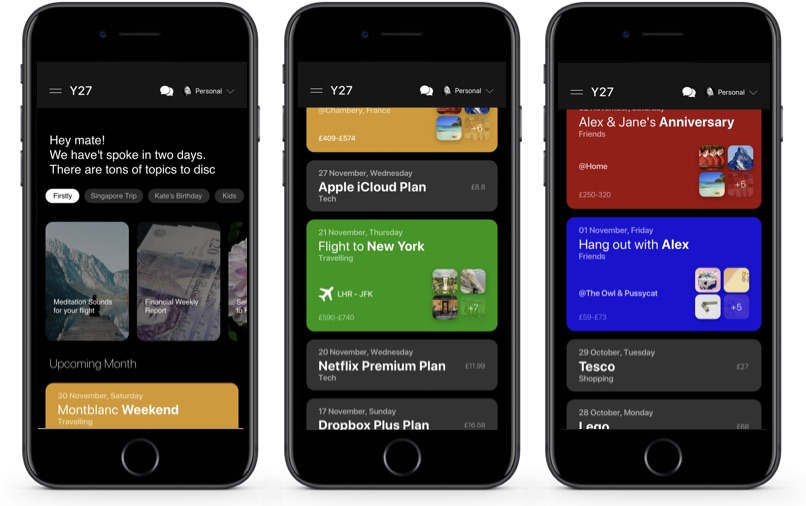

Founded in 2016, TheWaay offers a Lifestyle Banking platform that helps banks and other financial institutions better understand and meet the needs of their customers. The platform’s Lifestyle Assistant leverages deep behavioral profiling to give users personalized lifestyle advice and suggestions on financial services and banking products, as well as travel and e-commerce opportunities that might interest them. The technology helps financial services firms increase customer engagement and transaction volume, as well as grow revenue through increased up-sell activity.

“This product organically grew from inside our company for one reason,” company CEO Ivan Kochetov said during a demonstration of the company’s Digital Family Office solution at FinovateAsia. “We were sad because everybody was doing neo and digital banking for the mass market, and nobody was doing neo and digital banking for people like you and I, for the affluent market, for the premium market. Is it fair? No.”

For TheWaay, this neo digital banking solution for the affluent market should be about more than changing designs, Kochetov said. Instead, it should be about “new value (and) new promise.” The goal is to provide what Kochetov called “the first digital family office” for the affluent market that works within an institution’s banking app to provide a private banking level of service.

We caught up with Kirill Lisitsyn, Head of Business Development with TheWaay, who facilitated our email conversation with company CEO Ivan Kochetov earlier this year. The transcript of our exchange follows.

Finovate: Congratulations on winning Best of Show at your first Finovate event! What was your experience at FinovateAsia like?

Ivan Kochetov: Thanks a lot! Oh, that was incredible! It was our first step to test the ground in Asia and we surprisingly got the award!

Finovate: For those who are just getting to know your company, what problem does TheWaay solve?

Kochetov: We are a fintech startup aiming to shift current “old school” communications between bank and its customers to a new way of personalized non-banking communications based on customers’ lifestyle and needs. And we believe that this is the right way to support banking industry transformation in the era of the engagement economy.

Finovate: How does TheWaay solve the problem better?

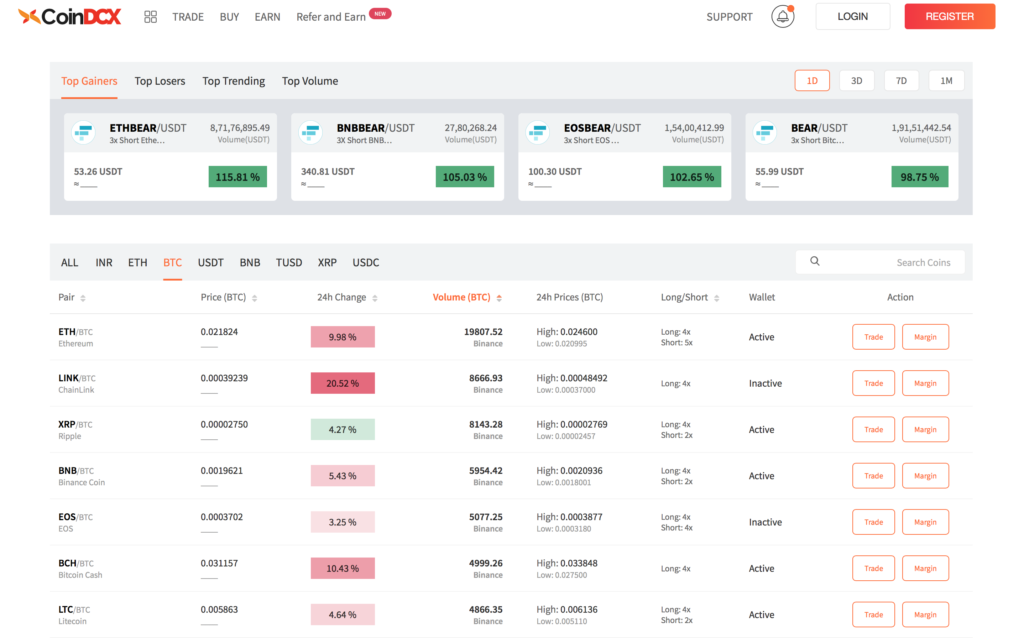

Kochetov: We develop a software that is called Lifestyle Banking Platform. We help banks to understand people and become a Lifestyle Assistant for their customers to boost daily engagement, card transactions and up-sell metrics in their mobile banking app. We use over 500 attributes for each customer and a model trained with over 1 billion in transactions.

Finovate: Who are your primary customers?

Kochetov: We are a B2B2C business. Historically we have been building our expertise within banking industry, but now also see the growing interest from telco and retail industries as well. Especially accounting the trend for virtual banking, you do not need huge branches network to become a bank and serve customers. But once you are a digital-only bank you need to engage your customers in your digital channels. And here we could definitely help.

Finovate: What in your background gave you the confidence to tackle this challenge?

Kochetov: The core of our team has a well-balanced mix of background in behavioral psychology, machine learning, product development and in implementing innovative tech and consulting projects for large financial institutions.

Finovate: Tell us about a favorite feature of your platform.

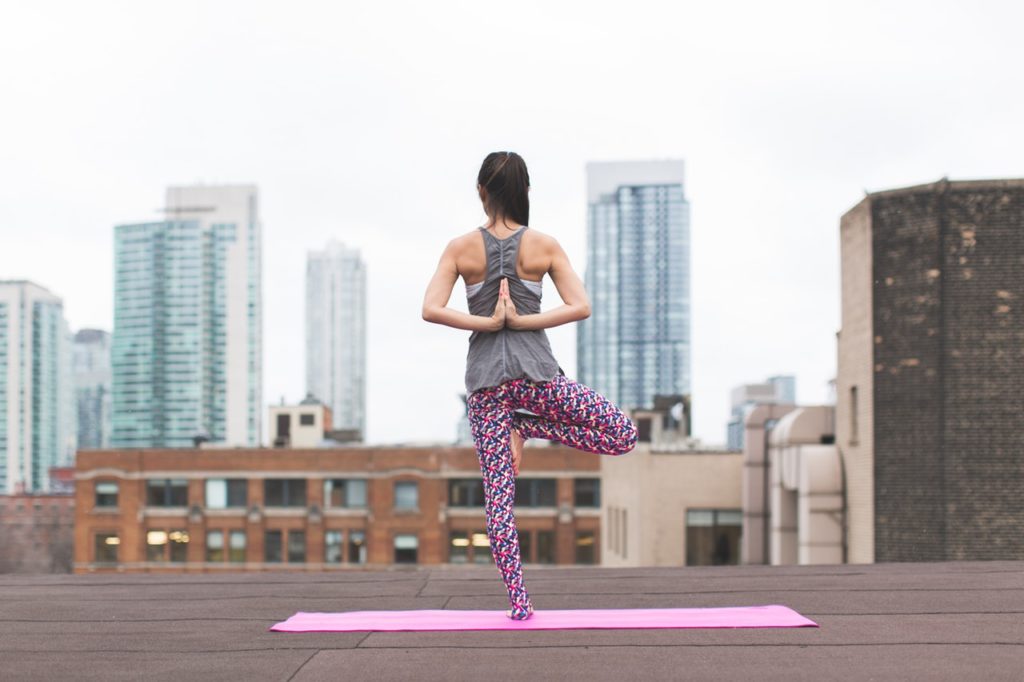

Kochetov: Ha! You know, based on our user surveys and the metrics we track, we figured out that one of the favorite features of our Lifestyle Assistant product is the advice on how to spend one day of a weekend. Users do not have to worry about what to do on their free day; our system will suggest a set of recommendation and ideas coupled with geo-routes, all based on user’s lifestyle, interests, and preferences.

Finovate: What are some upcoming initiatives from TheWaay that we can look forward to over the next few months?

Kochetov: We plan to launch several pilot projects of our Digital Family Office product that we presented on Finovate Asia. We successfully delivered PoC projects, and now very much look forward to scaling that success. Also we have prioritized our international expansion and plan to get few international contracts within next 3-6 months.

Finovate: Where do you see TheWaay a year or two from now?

Kochetov: We plan continue our rapid growth which will be supported by our presence in 3-4 large international markets and focus on 2-3 industries. Also we aim to sign one or two global mutually-beneficial partnerships which could even speed-up our expansion.